- Strategy’s BTC holdings have crossed 500K, now holding 2.4% of all Bitcoin in existence.

- They still have $15B left for debt issuance. Total capital to raise? $39B. No biggie.

Strategy, the company formerly known as MicroStrategy (because who doesn’t love a rebrand?) has just become the first public company to surpass 500K Bitcoin [BTC] holdings. Hold on to your hats, folks, because things are about to get crazy.

On March 24th, the mastermind behind this crypto empire, Michael Saylor, proudly announced that they added a modest 6,911 BTC to their stash, worth a cool $584 million. That’s right—$584 million. You’d need a *lot* of avocado toast to spend that much, but I digress.

With this latest purchase, the firm now owns a staggering 506,137 BTC, a treasure chest worth $43.9 billion. That’s 2.4% of all Bitcoin in circulation, or roughly the amount of coins you could expect to mine between now and March 2028. Yeah, you read that right: Strategy has more Bitcoin than will be mined in the next three years. Let that sink in.

MSTR as a Bitcoin Beta

Since Strategy took the “I’ll buy as much Bitcoin as I can” approach in 2020, their stock, MSTR, has seen gains that would make even the most hardened crypto enthusiast weep tears of joy.

Over the last five years, MSTR has skyrocketed by 2,115%, while Bitcoin itself gained a “measly” 638%. That’s right—MSTR has outperformed Bitcoin by 3.3X. If this were a race, Bitcoin would be that friend who says, “I’m just happy to be here,” while MSTR takes the gold.

In case you missed it, MSTR is still crushing it. In fact, just this month, MSTR shot up nearly 25%, while Bitcoin only managed a limp 1% bounce. Even year-to-date, MSTR is up 12%, while Bitcoin is down 8%. So, if you’ve been betting on Bitcoin for the past few months, you’re probably wondering why your portfolio isn’t doing cartwheels.

Oh, and by the way, the recent Bitcoin acquisition? It was funded by a stock sale. Yes, those stocks you’ve been buying in the hopes that they’ll pay off. So, let’s just call it “circling the drain” until the next big buy.

“The bitcoin purchases (6,911 BTC) were made using proceeds from the Common ATM and the STRK ATM.”

In short, they sold some stock. In case you didn’t know, their “21/21 plan” is all about raising a whopping $42 billion to fund even more Bitcoin purchases. Sounds like a fun little project, right?

According to analyst Ragnar (yes, Ragnar, because why not), the firm still has $15 billion in debt issuance left and $39 billion in capital they need to raise. Not that anyone’s counting, but this could be a *slight* challenge.

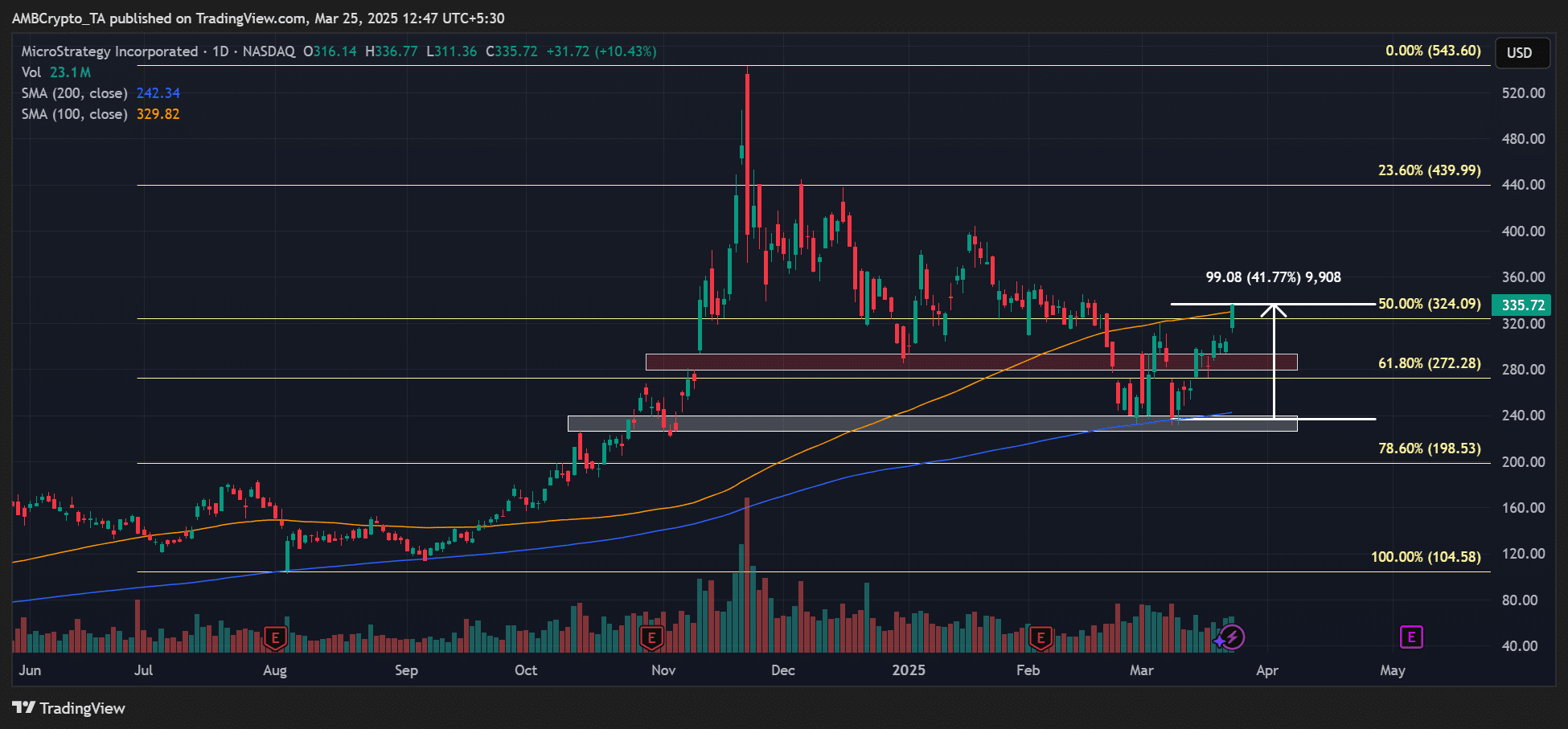

Meanwhile, MSTR’s stock has been playing hopscotch between its 200-day and 100-day moving averages. But hey, with a 41% rally in the last two weeks, who needs to worry about the technicals?

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Mirren Star Legends Tier List [Global Release] (May 2025)

- MrBeast removes controversial AI thumbnail tool after wave of backlash

2025-03-25 15:06