As a seasoned researcher who has closely followed the crypto market for years, I can’t help but feel a sense of deja vu when observing Bitcoin‘s latest price fluctuations. The rollercoaster ride that Bitcoin takes us on is as unpredictable as the stock market in 1929, only with more memes and fewer suspenders.

TL;DR

- Bitcoin dropped below $96,000 after $3.2 billion worth of BTC was sent to exchanges, signaling potential sell-offs and increased price pressure.

- Despite the dip, analysts predict a rebound, with targets ranging from $110K this year to over $320K in 2025.

Heading South Again?

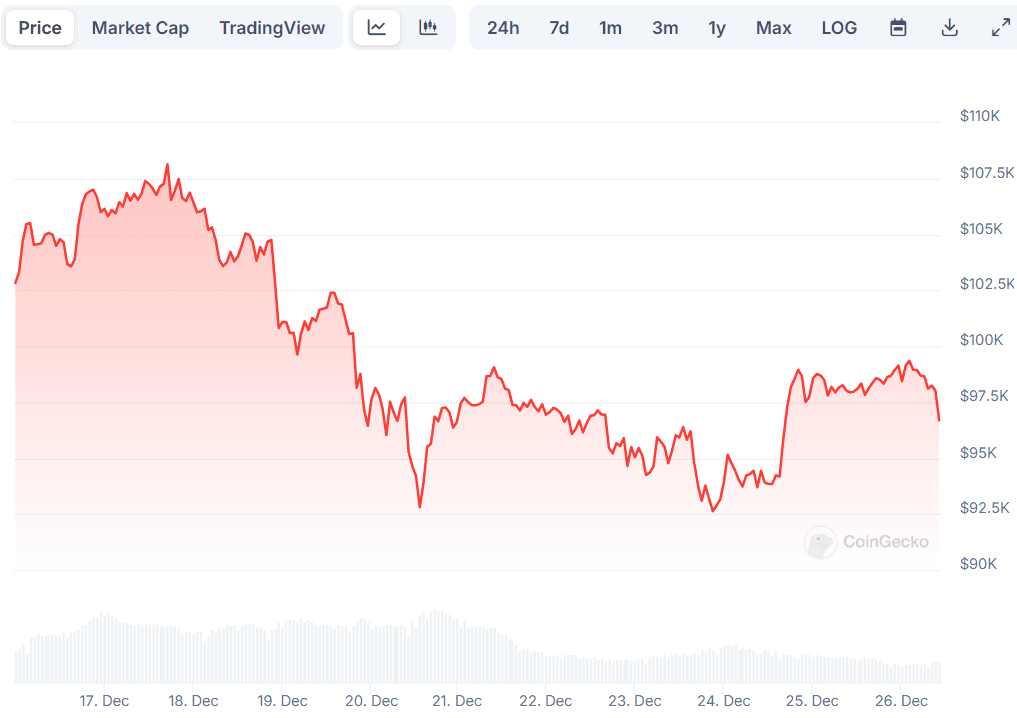

In mid-December, Bitcoin (BTC) garnered widespread attention as its price soared to a record high of over $108,000. However, the Federal Reserve’s latest FOMC meeting and, particularly, remarks made by Jerome Powell, shifted the dynamics in the cryptocurrency market.

In his recent announcement, the Federal Reserve Chairman indicated a further reduction of 0.25% in interest rates. However, he also suggested that potential inflation increases might cause them to reconsider future rate cuts in 2025. Furthermore, Powell clarified that the Fed does not possess the authority to own Bitcoin, thus questioning President Trump’s plan for a strategic Bitcoin reserve.

On December 18th, a significant event took place, causing increased volatility in Bitcoin for the subsequent week. Its price fluctuated between approximately $92,600 and nearly $100,000. Over the past few hours, Bitcoin has dropped by 2% to its current value of $95,600 (as reported by CoinGecko). There is a critical factor suggesting that this decline could deepen in the upcoming days.

Ali Martinez, a widely recognized X user, disclosed that around 33,000 BTC (approximately $3.2 billion) have been transferred to exchanges within the last week. This action might indicate that investors are planning to liquidate their assets, which could lead to substantial sell-offs. Such mass sell-offs would increase the circulating supply, potentially causing a drop in Bitcoin price if demand does not simultaneously rise.

Previously, Martinez identified $97,300 as a crucial support level for the asset because many investors had purchased approximately 1.5 million BTC at this point. Earlier, it was noted that the price indeed fell beneath this critical level.

The Opposite Scenario

In contrast to the previous assumption, numerous analysts continue to be hopeful that the asset’s value will surge past $100,000 once more. User Captain Faibik predicts a rise towards approximately $110K by the end of the year, while Crypto Rover thinks BTC is on the verge of experiencing a parabolic growth spike next year.

Jelle and Mags are included in the group of bullish investors. The first one foresees a new All-Time High (ATH) once Bitcoin surpasses $102,000, whereas the second believes we’re still quite a ways from the peak of the bull market. Mags has projected a significant increase to over $320,000 around 2025, after which bears could potentially regain control.

As a researcher, delving into Bitcoin’s price trends, I invite you to explore our dedicated video below. It offers valuable insights that may help you decide if this could be the right moment for your investment in Bitcoin.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2024-12-26 11:57