As a seasoned researcher with years of experience navigating the cryptocurrency markets, I have witnessed numerous ups and downs, rejections, and resurgences. The current Ethereum rally is an exciting development that has caught my attention, particularly its approach to the $4K resistance once again.

Following a setback at the significant $4,000 barrier and a subsequent drop to the $3,500 safety net, Ethereum experienced a surge in purchasing enthusiasm, sparking yet another powerful upswing.

Once more, the cost is close to the $4,000 barrier, which, if broken, might trigger a short-squeeze, pushing Ethereum upwards.

Technical Analysis

By Shayan

The Daily Chart

Lately, Ethereum encountered a refusal at the crucial $4,000 barrier, leading to a drop towards the vital $3,500 support area. This region has shown itself to be an essential zone of interest, drawing substantial buying activity. Consequently, the market experienced a robust recovery, pushing the price back towards the $4,000 resistance level once more.

At present, investors are working diligently to overcome this psychological and structural hurdle, paving the way for a prolonged surge towards the asset’s record peak. If ETH manages to breach the $4K barrier in the near future, it might initiate a short-covering situation, compelling those with short positions to liquidate and propelling the price upward.

Yet, the $4,000 mark is a significant area of supply, and if Ethereum can’t push beyond this point, it might encounter another reversal. Under these circumstances, Ethereum may continue to trade within the $3,500-$4,000 band in the near future as both buyers and sellers fight for dominance.

The 4-Hour Chart

On a 4-hour scale, Ethereum has been following an upward price trajectory within a rising channel. After hitting resistance at the upper edge of the channel close to the $4K region, the value plunged significantly, dipping below the channel’s midpoint and probing the lower trendline around the $3.5K support area.

At this crucial point, increased purchasing caused a robust surge, which led to an upward trend bringing Ethereum close to the midpoint of its channel around $4,000. The price at $4,000 now presents substantial obstacles for further growth, as it coincides with the upper boundary of the channel.

If buyers manage to break above this resistance and decisively sustain the momentum, Ethereum could embark on a fresh bullish rally, targeting its ATH. However, in the event of another rejection, the price may remain confined within the ascending channel, with the $3.5K support acting as a key cushion.

Onchain Analysis

By Shayan

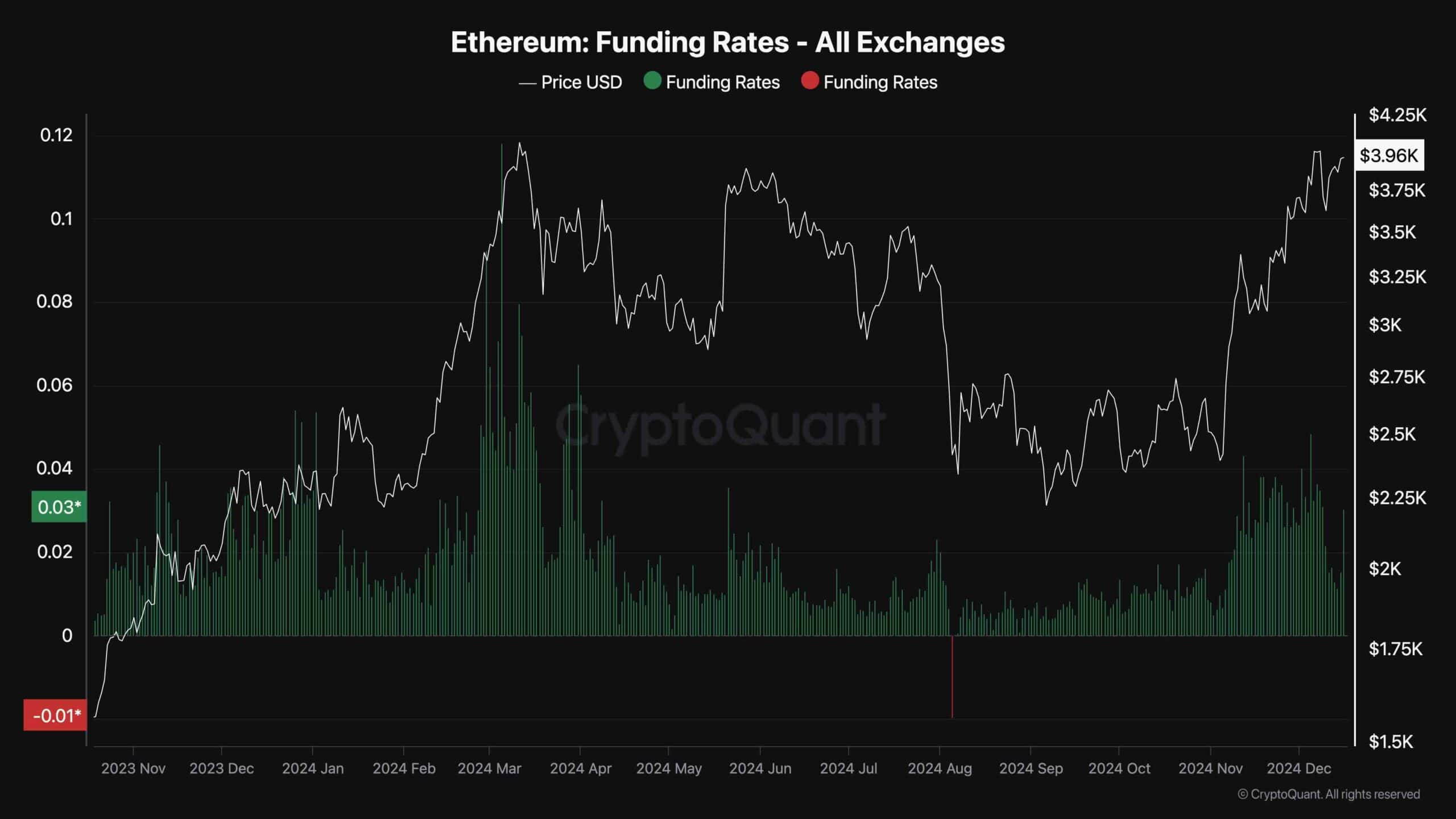

In simpler terms, the futures market significantly impacts price fluctuations and turbulence. One of its important signs is funding rates, which give useful information about the overall market’s attitude. As illustrated in the graph, the recent surge in Ethereum, following the $3.5K support level, was accompanied by a substantial increase in funding rates, signaling that traders are increasingly keen on holding long positions for Ethereum, indicating growing optimism in the market.

This surge in funding rates highlights the increasing buying pressure and prevailing bullish sentiment, with market participants anticipating further gains in the mid-term. If the upward trend in funding rates continues, a breakout above the $4K resistance will become increasingly likely.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-16 17:27