Ethereum’s price is finally showing signs of bullish continuation after reclaiming a key level.

However, there is still work to do for the market to pave its way toward a new all-time high.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the day-to-day graph, the price has bounced back from the $3,200 support point and surpassed $3,500. If the asset maintains its position above this zone, a quick rise towards the $4,000 mark might ensue.

When the Relative Strength Index (RSI) exceeds 50%, it suggests a bullish momentum, thereby increasing the likelihood of the current situation unfolding.

The 4-Hour Chart

On the 4-hour timeframe, the price trend becomes clearer, but it also raises a potential concern. Although the market has broken the $3,500 mark with strength, the discrepancy between the recent peak prices and the RSI indicator (Relative Strength Index) suggests a bearish divergence that is worth noting.

This bearish divergence could lead to at least a pullback and retest of the $3,500 level before any continuation higher in the coming days.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

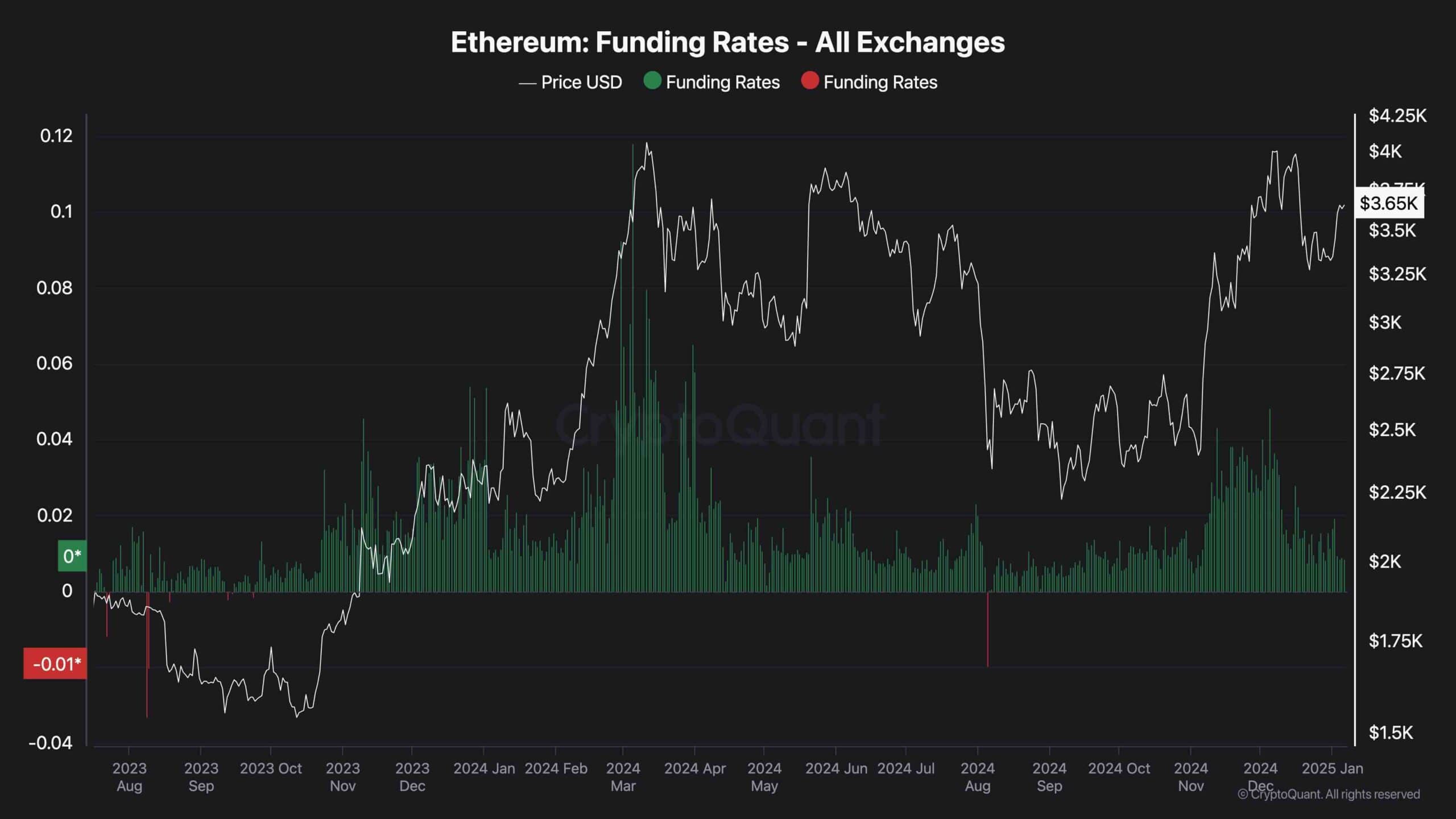

Ethereum Funding Rates

Over the last several months, Ethereum’s value has consistently stayed above $3,000, leading many investors to anticipate a new record high in the market. Yet, this widespread optimism has also triggered a corrective phase, temporarily halting Ethereum’s upward trajectory.

This graph demonstrates the Ethereum funding rate indicator, which signifies whether traders in the futures market are placing their orders more actively – either buying or selling. As the chart indicates, the funding rates reached exceptionally high levels when the price neared $4,000 initially. However, subsequent long liquidation events have prompted a correction and consolidation in the market.

Meanwhile, funding rates have decreased over the last few weeks, indicating that the futures market sentiment has cooled significantly. This could result in a sustainable rally in the coming weeks if sufficient demand is present in the spot market.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Tekken Fans Get Creative with Photo Requests for ‘Scientific Research’

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- WLD PREDICTION. WLD cryptocurrency

- Granblue Fantasy: Players Crave More Content, Hope for a Sequel

2025-01-06 18:23