Hedera (HBAR) has managed to tickle the market’s fancy with a nearly 5% rise in the past 24 hours, aiming to breach the $0.20 mark for the first time in two weeks. The recent price rally is like a fleeting smile on a cloudy day, hinting at a potential shift in trend.

Yet, despite this brief flirtation with recovery, HBAR is still grappling with key resistance levels and a distinctly bearish backdrop that has been the relentless suitor in recent weeks.

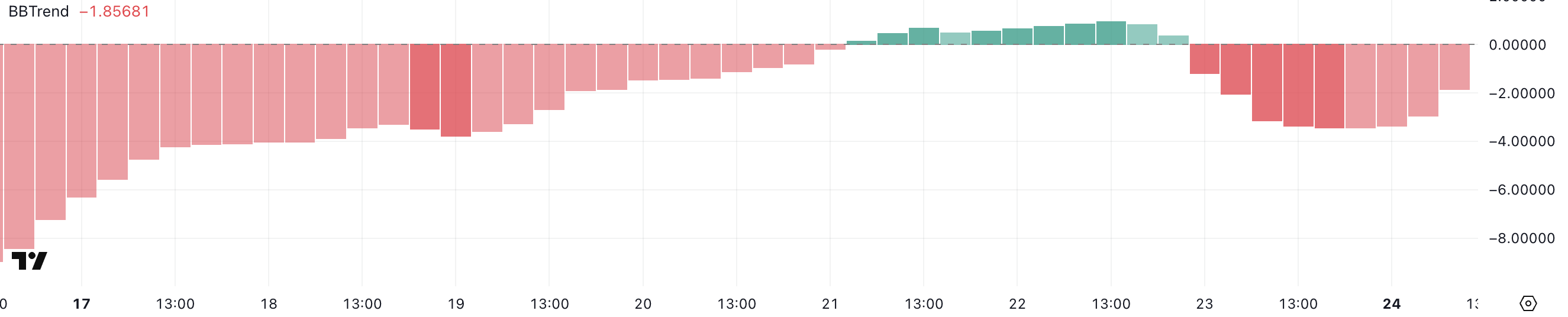

Hedera BBTrend Is Recovering, But Still Negative

Hedera’s BBTrend is currently perched at -1.85, a slight recovery from the dramatic -3.44 it clung to yesterday. It was as high as 0.96 two days ago, a fleeting moment of hope, like a particularly stubborn daisy resisting the autumn frost.

This recent movement suggests some short-term improvement in price momentum after the relentless downside pressure. However, the overall trend still leans negative, as Hedera continues to struggle to sustain any lasting bullish signals. It’s like trying to start a fire with wet matches—despite the efforts, the spark is just not catching.

The indicator highlights how the token is attempting to recover but remains stuck in a broader pattern of weak momentum. It’s a bit like attempting to row upstream in a leaky boat—progress is slow and often frustrating.

The BBTrend (Bollinger Band Trend) indicator measures how far price action deviates from the center of the Bollinger Bands, helping to assess trend strength and direction. Typically, values above 0 suggest bullish conditions, while values below 0 point to bearish momentum. With Hedera’s BBTrend currently at -1.85, it suggests bearish pressure is still present, despite the recent bounce. It’s like a stubborn pendulum, swinging back to its bearish position with a heavy thud.

More importantly, Hedera has shown difficulty sustaining strong positive levels for an extended period. The last time BBTrend crossed above 10 was on March 6, a blink in the eye of market time, highlighting how fleeting bullish momentum has been in recent weeks.

HBAR Ichimoku Cloud Shows The Trend Could Be Shifting, But There Are Challenges Ahead

Hedera’s Ichimoku Cloud chart is showing some early signs of recovery, as the price has broken above the blue Tenkan-sen line and is now testing the bottom of the red Kumo (cloud). It’s like a metaphorical breaking of the surface, but the water is still cold and unwelcoming.

The price action has moved into the cloud after trading below it for an extended period, which can be seen as a shift from bearish to more neutral conditions. While the price attempting to climb into the cloud suggests that selling pressure is weakening, it still faces resistance from the thicker part of the Kumo just above current levels. It’s like trying to climb a greased pole—every step forward is a challenge.

The cloud’s bearish (red) coloration indicates that the broader trend remains under pressure, despite the recent upside move. It’s a bit like being on the Titanic after it hits the iceberg—there’s a brief calm, but the overall situation is still dire.

The Ichimoku Cloud, or Kumo, is a multi-component indicator that highlights support, resistance, trend direction, and momentum all in one glance. When prices are below the cloud, it suggests bearish conditions, while prices above the cloud signal bullish sentiment. Trading inside the cloud typically indicates a consolidation phase or market indecision. In Hedera’s case, the token’s current positioning within the cloud signals that it is attempting to neutralize the recent bearish momentum but has not yet shifted into a clear bullish trend. Until HBAR can firmly break above the upper edge of the cloud, upside potential may remain capped by resistance. It’s like a forsk rope in a tug-of-war, taut and tense, but not yet pulled to victory.

Will A Golden Cross Make Hedera Surge?

Hedera’s EMA lines are still showing a bearish setup overall as long-term EMAs continue to trend downward. However, short-term EMAs are beginning to slope upwards and could soon cross above the longer-term averages, potentially forming a golden cross. If this bullish crossover occurs, it may trigger a stronger upward move, with the first resistance level sitting at $0.199. A break above this level could open the path for further gains toward $0.215, and if the bullish momentum accelerates, Hedera price could even aim for $0.258 in the coming sessions. It’s like a reluctant actor finally getting their cue to enter the stage.

Alternatively, if the short-term upside momentum fades and the golden cross fails to materialize, bearish pressure could resume. In this scenario, HBAR may revisit key support levels at $0.184 and $0.178. A decisive break below these levels could lead the token back under $0.17, reinforcing the bearish structure. It’s like a game of chess where the knight is in a precarious position, and any wrong move could lead to checkmate.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-03-25 04:27