Markets

What to know:

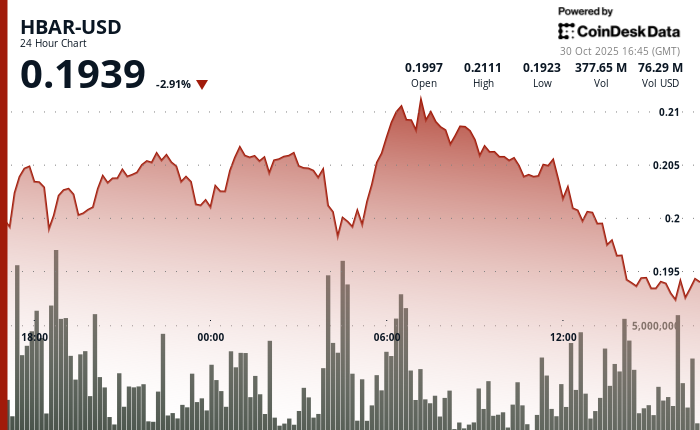

- HBAR fell 3.25% to $0.1925 despite the debut of Canary Capital’s spot HBAR ETF on Nasdaq, highlighting a disconnect between institutional milestones and short-term price action. 🤷♂️

- Trading volume jumped 19% above the 30-day average, suggesting increased institutional activity and profit-taking after an initial 25% post-announcement rally. Because nothing says “institutional” like a 19% spike. 📈

- Technical weakness dominated fundamentals, with key support breaks confirming a bearish shift and signaling potential short-term downside despite long-term adoption momentum. Fundamentals? Who needs them when you’ve got a chart? 📉

Hedera’s native token, HBAR, fell 3.25% to $0.1925 over the 24-hour period ending October 30, despite the launch of its first U.S.-listed exchange-traded fund. Because what’s a token without a little drama? 💸

The selloff followed Canary Capital’s spot HBAR ETF debut on the Nasdaq, a milestone for non-Bitcoin digital assets. A milestone! Because nothing says “progress” like a token that’s already down 4%. 🎉

The token initially rallied more than 25% after the announcement, but enthusiasm quickly faded as profit-taking set in. Enthusiasm? What enthusiasm? It was like a party where everyone left before the cake arrived. 🍰

The ETF, trading under the ticker HBR, recorded about $8 million in first-day volume, underscoring solid institutional interest despite short-term price weakness. Solid institutional interest? Or just a bunch of people checking their watches? ⏰

While the ETF marked a regulatory and institutional breakthrough for Hedera, technical factors overshadowed fundamentals. Technical factors? Oh, right, because fundamentals are just a suggestion. 🧠

Market data suggests the decline was part of a broader pattern of controlled selling across digital assets. Controlled selling? More like controlled chaos. But who’s counting? 🌀

Key Technical Levels Signal Continued Pressure for HBAR

Support/Resistance

- Critical support at $0.2040 broke during the 24-hour period. Oh no, the support broke. How dramatic. 🎭

- New resistance formed in the $0.2070-$0.2080 zone after multiple rejections. Rejections? Like a bad date. 💔

Volume Analysis

- Strong selling pressure with 261.2M tokens traded, 87% above the 24-hour average. Strong selling pressure? Or just a lot of people checking their phones. 📱

- Most significant volume activity occurred on 30 October at 04:00 as price broke key technical levels. 4 AM? That’s when the real selling happens. 🕒

Chart Patterns

- Bearish trend established with successive lower highs from the $0.2114 peak. Lower highs? Because nothing says “trend” like a downward spiral. 🌀

- Total range of $0.0203 (9.9%); price collapsed from $0.194 to $0.192 amid massive volume spikes. Collapsed? Or just taking a nap. 🛌

Targets & Risk/Reward

- 60-minute analysis indicates further downside toward $0.190. Further downside? What’s next, a trip to the moon? No, wait, that’s already been done. 🌙

- Momentum indicators show severely oversold conditions, confirming accelerated institutional selling. Oversold? Or just exhausted from all the drama. 🥵

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Gold Rate Forecast

- Brent Oil Forecast

- He Had One Night to Write the Music for Shane and Ilya’s First Time

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2025-10-30 21:37