As someone who has spent years navigating the complex world of cryptocurrencies and blockchain technology, I must say that the saga of Hawk’s token ($HAWK) is a tale that resonates deeply with my experiences. The merging of celebrity influence with the nascent and often unregulated crypto market is indeed an alluring prospect, but as the article aptly points out, it’s also a recipe for disaster if not handled with utmost transparency and accountability.

As an analyst, I would rephrase the given text as follows:

That was until the 22-year-old launched her memecoin, $HAWK. Now Hawk Tuah isn’t flying so high.

The cryptocurrency known as HAWK made its debut on the Solana blockchain with quite a spectacle, quickly soaring to a market capitalization of approximately $491 million. However, this rapid ascent proved temporary, as the coin’s value plunged dramatically, dropping to around $20 million based on DEX Screener’s data.

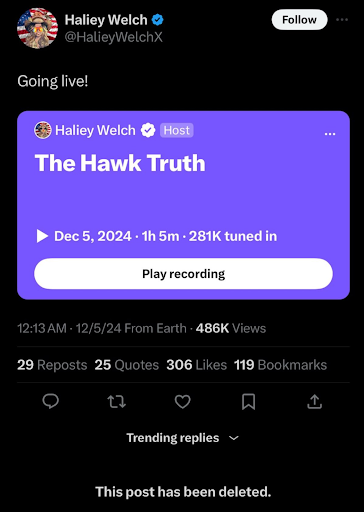

The swift fall suggests doubts about the authenticity of the project and the intentions guiding its administration. A previously erased conversation on Twitter Spaces has deepened these concerns, fueling numerous accusations that HAWK is merely a “celebrity exit scam.

As a crypto investor, delving into the events surrounding the launch of $HAWK, I found it crucial to dissect its underlying framework and the decision-making mechanisms that appeared to drive its inception.

Starting a meme coin may appear effortless, given the ease of doing so through platforms like Pump.fun. However, achieving success involves more than just a casual stroll. It necessitates capital, marketing acumen, technical skills, and most importantly, an initial concept that is valuable. Collaboration is crucial. I speak from experience as a founder who’s been in Web3 since 2013, has secured tens of millions of dollars in venture capital for my own projects, and currently serve as a venture capitalist at the large venture fund, Foresight Ventures. For further insights on launching a meme coin, refer to my recent article on CoinDesk here. According to investigator Coffeezilla, $HAWK seems to have been developed by three separate teams.

- Welch’s Web2 team, responsible for her “traditional” brand

- Memetic Labs, led by founder Doc Hollywood, managing blockchain-related activities and holding the pen on all Web3 related decisions

- and overHere, a new technical service provider specifically brought in to facilitate a novel token claim process designed to onboard Welch’s Web2 audience.

At first, OverHere entered into conversations with me, explaining its function, and expressed its willingness to share additional information openly and transparently.

In a now-removed broadcast on X Spaces, Welch signed off around 1:00am EST, informing the audience she was going to bed. The discussion was primarily led by Doc Hollywood, with Memetics Labs, his firm, playing a significant role in key areas of the token release. This included aspects like token economics, creation and distribution, marketing (including communication via primary channels like X), establishment of liquidity pools, and setting trading fees.

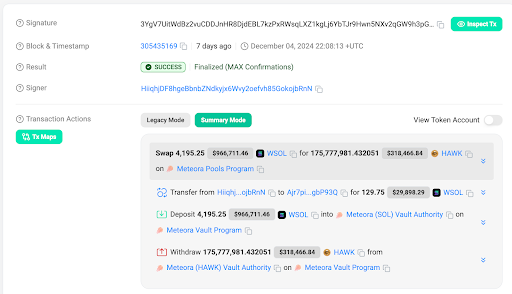

As a researcher, I recently posed a question concerning the high trading fees on Meteora, a decentralized exchange platform where users can trade cryptocurrencies directly without intermediaries. In response to my query, Doc Hollywood explained that a significant portion of these expenses stemmed from costs related to our team and the establishment of the foundation in the Cayman Islands. However, Meteora has disputed this claim, asserting that they developed the technology on a pro bono basis.

Based on reports from multiple industry experts who learned about the product’s recent creation, the technology for social tokens developed by OverHere features a novel business model. This model involves tokenizing the likeness and intellectual property associated with Web2 fans, which is an innovative approach that hasn’t been seen in previous meme coin launches or any other crypto projects before.

According to reports, team Welch may have been advised by Memetic Labs, their Web3 advisor, to establish high pool fees of 15% on Meteora. This move, made on or around December 4, attracted criticism due to its potential to prioritize short-term profits over the trust of both their existing Web2 audience and the Web3 community they aimed to engage with this launch. High trading fees can potentially damage the project’s reputation for credibility.

A contentious issue arises from the fact that investors from the initial sale were able to sell vast numbers of tokens following the launch, despite having unlimited access to vest their tokens. This mass selling activity had a negative impact on the token’s worth, leading to concerns about potential insider trading manipulation.

OverHere emphasized that their participation in Meteora lacked any financial benefits, neither earning profits from Meteora or the pre-sale, nor receiving free tokens. Instead, they positioned $HAWK as a trailblazing example for utilizing intellectual property during token launches. Unfortunately, the course of the project was adversely affected by issues arising from decisions made by Welch’s Web3 team, which led to mismanagement and mistakes that hindered this goal.

In the story of $HAWK, the main issue that surfaced was a lack of openness or transparency. Before launching, there was no published tokenomics or distribution plan, leading to suspicions that the team might have been dealing unfairly with insider information. The opposition, using BubbleMaps – an auditing tool for DeFI and NFTs – claimed that nearly all tokens (96%) were assigned to the “team.” However, later on, it was disclosed that only 10% of the tokens were actually meant for the team, including portions set aside for the community fund, reserves, and strategic purposes.

Based on overHere’s interpretation, the Web3 team, who had exclusive control of the deployer wallet, have stated they did not sell these tokens. However, it seems that this selling pressure stemmed from some pre-sale investors whose presence was not previously disclosed to the public before the launch. This initial misunderstanding highlights a lack of communication and transparency from the start.

Initially, there were some delays in implementing lock and vesting features due to technical glitches within the vesting system. These discussions about the token’s lockup and release schedules were handled by Welch’s Web3 team in conjunction with Magna, the service provider responsible for these mechanisms. It is important to note that OverHere deliberately chose not to take part in decision-making processes, focusing instead on its role as a technical service provider rather than an operational team. However, it has shown readiness to offer detailed explanations regarding its role and responsibilities to provide clarity.

According to experts like Jarry Xiao from Ellipsis, it didn’t seem that Welch’s team(s) intended harm (they were not aiming for an undesirable outcome). However, without proof suggesting otherwise, their actions appear to be a grasping for cash without regard for the potential negative impacts on retail.

The story is a stark reminder of the perils inherent in merging celebrity influence with the nascent and often unregulated cryptocurrency market. The promise of decentralized finance funding media empires without traditional equity sales is alluring, yet $HAWK exposes the fragile foundation upon which such ventures are built. The lack of transparency, accountability, and ethical oversight can swiftly transform a promising project into a cautionary tale.

$HAWK serves as a stark reminder about the importance of strong governance structures and openness in Web3 ventures. As the team works towards rebuilding trust and clarifying $HAWK’s mission, it is crucial for our crypto community to learn from this instance: without clear responsibility and open dialogue, even the most promising initiatives could crumble. It is essential that transparency and accountability become foundational elements in every Web3 project, especially those led by high-profile figures who may be targets of exploitation.

The opinions presented within this article belong solely to the writer and may not align with the views of CoinDesk, Inc., its stakeholders, or their associates.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-13 01:19