What to know:

- BONK, the token that’s been bonking around like a kangaroo, leaped 12% from $0.0000250 to $0.0000281, before settling back down to $0.0000265 (+6.2%).

- Grayscale Investments, the big cheese in the crypto world, added BONK to its institutional monitoring list, which is like getting a gold star from your teacher—everyone’s suddenly paying attention.

- Volume hit a whopping 2.6 trillion tokens during the rally, with support forming at $0.0000261–$0.0000264, like a solid foundation for a house of cards.

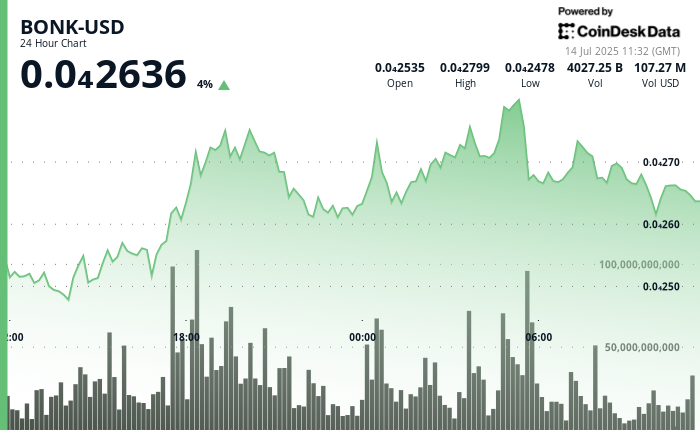

BONK, the Solana-based meme token that’s been the talk of the town, posted a sharp 12% intraday gain during the last 24 hours, climbing from $0.0000250 to $0.0000281 before settling at $0.0000265, up 6.2%. It’s like a rollercoaster ride, but with more zeros and less screaming.

The surge came after Grayscale Investments, the crypto giant that’s been known to turn a blind eye to a good meme, included BONK in its expanded institutional monitoring framework. This move has sparked a flurry of interest from asset managers, who are now eyeing BONK like a cat eyeing a mouse. 🐁💰

Trading momentum intensified around 15:00 UTC on July 13, culminating in a high-volume breakout by 05:00 UTC on July 14. BONK recorded 2.6 trillion tokens in trading volume at its peak, more than double the typical daily activity. It’s like a firework show, but with numbers instead of sparks. 🎇

Technical levels confirmed resistance at $0.0000281, where price action encountered sell-side pressure. However, support was established at $0.0000264, with institutional traders seen re-entering positions during pullbacks, potentially setting up for a future breakout, particularly if BONK can maintain momentum above $0.0000260. It’s like a game of tug-of-war, but with a lot more zeros and a bit less rope. 🤹♂️

BONK also experienced a 3% swing during the final 60-minute session between 09:37 and 10:36 UTC, ranging from $0.0000260 to $0.0000268. While brief profit-taking drove prices to session lows around $0.0000260, renewed buying interest quickly stabilized the market. It’s like a seesaw, but with a lot more volatility and a bit less playground. 🎠

Technical Analysis Highlights

- Trading range: $0.0000247–$0.0000281, representing 14% volatility during the institutional breakout window. It’s like a wild ride on a rollercoaster, but with more zeros and less screaming. 🎢

- Peak volume: 2.6T tokens traded at 05:00 UTC, reflecting high conviction interest from large buyers. It’s like a stampede, but with a lot more zeros and a bit less dust. 🏃♂️💨

- Resistance zone: $0.0000281 confirmed by rejection pattern; next test could signal breakout continuation. It’s like a brick wall, but with a lot more zeros and a bit less bricks. 🧱

- Support zone: $0.0000264 identified as institutional accumulation band; firmed by multiple bounces. It’s like a safety net, but with a lot more zeros and a bit less net. 🕸️

- Intraday dip: Brief move to $0.0000260 met with heavy buying; volume exceeded 75B tokens in late-session activity. It’s like a quick dip in the pool, but with a lot more zeros and a bit less water. 🏊♂️

- Recovery zone: Market stabilized around $0.0000266 as selling pressure eased, forming bullish continuation structure. It’s like a calm after the storm, but with a lot more zeros and a bit less rain. ☁️🌈

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- Come and See

2025-07-14 16:28