In the grand theater of financial markets, where fortunes are made and lost with the flick of a wrist, we find ourselves observing a curious spectacle: the noble gold, that glimmering relic of human aspiration, has taken flight, soaring ever higher, while the once-mighty Bitcoin languishes in the shadows, as if caught in a dream from which it cannot awaken.

Indeed, the yellow metal, that which has adorned the crowns of kings and the dreams of the common man alike, is on the verge of breaching the hallowed threshold of $3,000 per ounce. Meanwhile, our dear Bitcoin, the darling of the digital age, finds itself shackled below the $100,000 mark, as if it were a bird with clipped wings, fluttering helplessly in the winds of February.

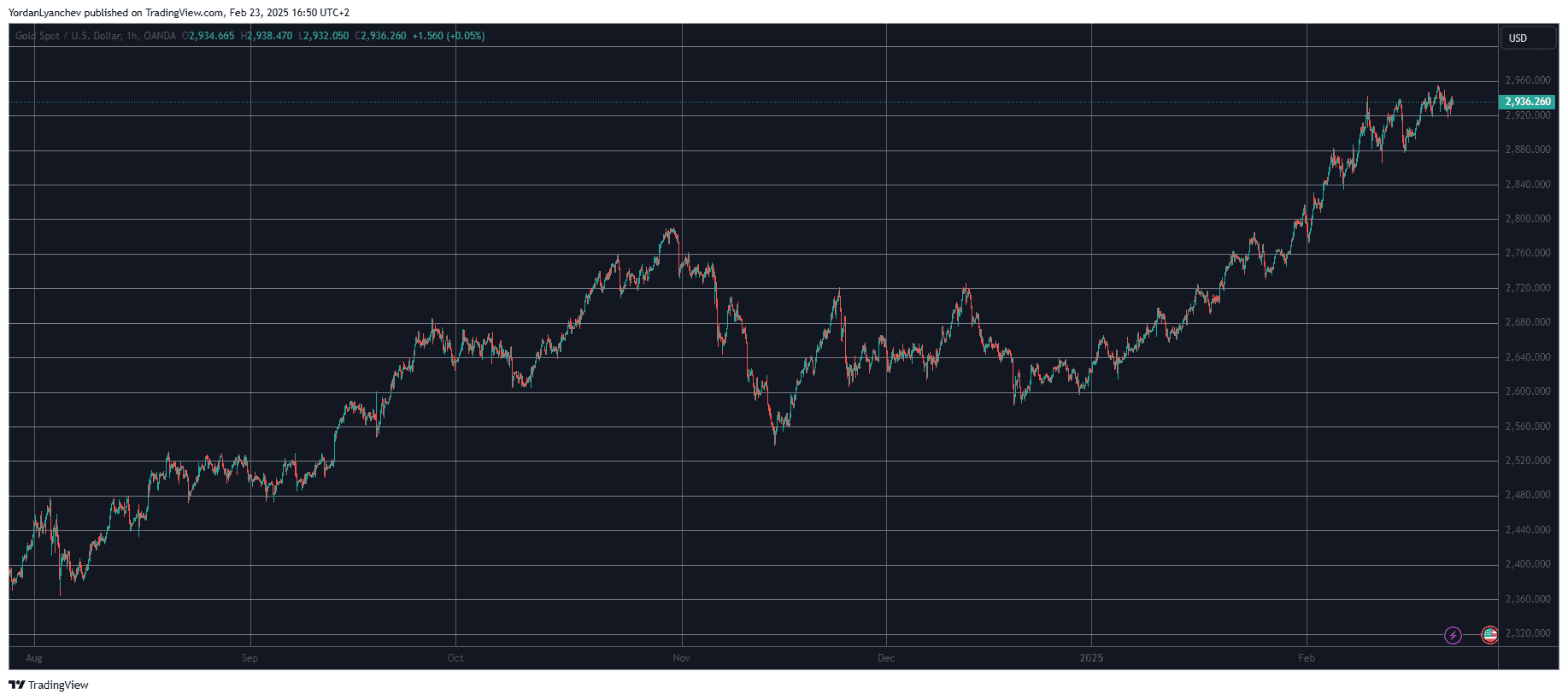

Gold’s Unbridled Ascent

Ah, the experts, those self-proclaimed sages of the financial realm, have proffered a multitude of explanations for gold’s meteoric rise in this year of our Lord, 2025. Chief among them is the specter of inflation, creeping like a thief in the night across the United States and beyond, coupled with the global uncertainty that has arisen from the tempestuous actions of President Trump, who, since his return to power, has stirred the pot of chaos with a vigor that would make even the most seasoned politician blush.

In these times of turmoil, investors and central banks have flocked to gold as if it were a life raft in a stormy sea, reminiscent of the early days of the COVID-19 crisis, when panic reigned supreme. Financial gurus, those erstwhile skeptics of the yellow metal, now sing its praises, declaring that the $3,000 price point is but a stepping stone to even greater heights. Whether this prophecy will come to pass remains a mystery, but one cannot deny that gold has solidified its dominance over the financial landscape.

With a market capitalization nearing $20 trillion, gold stands unchallenged, a titan among mere mortals, dwarfing the combined worth of the next seven financial assets, Bitcoin included. Truly, it is a sight to behold!

Bitcoin’s Dismal Doldrums

In stark contrast, the price chart of Bitcoin tells a tale of woe. Following Trump’s electoral victory in November 2024, gold stumbled, while Bitcoin, in a fit of exuberance, soared to dizzying heights. Yet, as the dust settled, it became clear that Bitcoin’s ascent was but a fleeting moment of glory, as it now finds itself nearly 15% adrift from its all-time high.

As gold solidifies its gains, marking new heights with each passing day, one must ponder: do these divergent paths spell doom for Bitcoin? The experts, with their crystal balls, seem convinced that gold will continue its relentless climb, leaving Bitcoin to wallow in obscurity.

Yet, the truth is far more complex. Demand for Bitcoin has waned, particularly in the United States, as evidenced by the declining Coinbase Premium and the lackluster performance of local ETFs. However, the financial markets are a realm of irrationality, where logic often takes a backseat to whimsy. Bitcoin, that capricious creature, has a penchant for defying expectations. So, dear reader, do not be surprised if it suddenly reverses course, soaring to new heights, leaving gold to ponder its own fate.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-02-23 19:17