Gold, that delightfully obstinate chunk of elemental mischief, had been having a rather splendid first quarter in 2025—until, on April 7, it decided to take a whimsical dip below the magical $3,000 per ounce mark. One might blame an unwieldy trade war or perhaps a Vogon recitation of market forecasts. 🤖

Even the Galaxy Questions Gold’s Celestial Status: A Nearly 3% Plunge, Seriously?

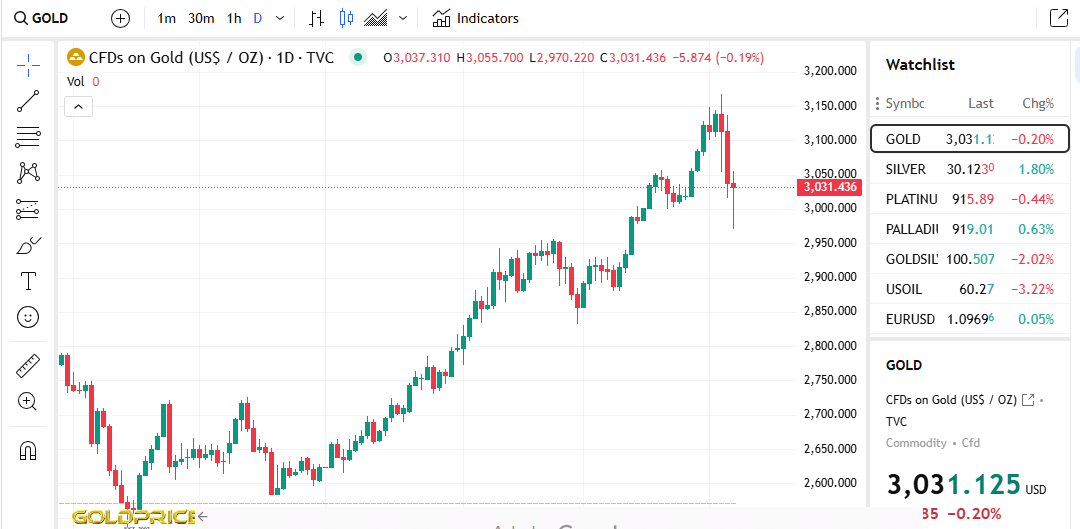

After a rally that made even the most optimistic intergalactic hitchhiker blink in wonder, Gold soared to heights that almost defied reason. But as fate (and a particularly absurd trade war) would have it, the precious metal tumbled below the fabled $3,000 line for the first time since March 18—hovering momentarily near a quaint $2,969 before gathering its wits and staging a recovery.

Meanwhile, the market backdrop was as unpredictable as a Pan Galactic Gargle Blaster-induced dream. Gold pranced upward from a humble $2,500 at the dawn of 2025 to a peak of over $3,165 on April 3. With a year-to-date leap of more than 25%, it had become the asset of choice for anyone who fancied a bit of insurance against the absurdity of uncertainty.

So persuasive was this newfound adoration that even the mighty Goldman Sachs—those high priests of financial prophecy—revised their year-end projection to a modest figure of more than $2,600 per ounce. This celestial tug-of-war with bitcoin (which was feeling particularly blue, down 17% since January 1) sparked yet another debate on which cosmic traveler really deserved the title of ultimate safe haven.

Alas, as if orchestrated by the universe’s cheekiest comic, a near $100 nosedive on the infamous Black Monday morning again called into question Gold’s sanctuary status. This precipitous tumble, arriving mere hours before U.S. markets were due to stir, served as a stern reminder that cosmic absurdity—in the form of trade war jitters (courtesy of Trump’s bewildering policies)—is ever at play. 😏

TopMob, our intrepid chronicler of interstellar events, reported that the escalation—sparked by Trump’s so-called “Liberation Day” tariff announcement—left Asian markets reeling on April 7. In Hong Kong, the main stock market index plummeted by more than 13% (its worst tumble in over two decades) until China’s sovereign wealth fund gallantly intervened, trimming the losses down to a more palatable 7%. 🎭

But fear not, cosmic traveler! At the time of this report (April 7, 6:45 a.m. EST), Gold had dusted off its existential crisis and made a triumphant recovery, trading robustly above the $3,000 mark—as if to whisper, “I told you so.” 🚀

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Every House Available In Tainted Grail: The Fall Of Avalon

- Tainted Grail The Fall of Avalon: See No Evil Quest Guide

2025-04-07 17:29