As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find myself both intrigued and slightly concerned by the latest report from the Financial Stability Oversight Council. On one hand, it’s reassuring to see that authorities are acknowledging the potential risks associated with stablecoins and the crypto market as a whole. However, their call for Congress to pass legislation has become an annual tradition at this point, and I can’t help but wonder if we’re dancing around the same issues year after year without any tangible progress.

On a Friday, the Financial Stability Oversight Council released its 2024 annual report, discussing potential threats and areas needing attention in both the U.S. and international financial markets. Similar to previous years, this year’s report emphasized the impact of stablecoins and the digital assets market as a whole; however, it did not propose any immediate actions by the FSOC to mitigate these issues.

You’ve found yourself delving into State of Crypto, our newsletter exploring the connection between cryptocurrencies and government entities. If you’d like to stay updated on future editions, simply click here to subscribe.

‘Emerging risks’

The narrative

Once again this year, the Financial Stability Oversight Council, made up of leaders from various American financial agencies, has issued a warning in their annual report about the potential risks associated with the unregulated expansion of stablecoins to both the U.S. and global financial markets.

Why it matters

The Financial Stability Oversight Council has been assigned the responsibility of maintaining financial security within the United States, and it has repeatedly appealed to Congress over the years to enact laws pertaining to the cryptocurrency market. This appeal is echoed in their 2024 report as they continue to express these concerns.

Breaking it down

Over the past few years, I’ve been closely monitoring the landscape of stablecoins, observing that they operate beyond any federal regulatory purview. The cumulative size of these digital assets has raised concerns about their potential impact on financial stability. In our most recent report, we’ve reiterated this risk and called upon Congress to enact legislation specifically designed for stablecoins and the broader market structure. This recommendation aligns with the guidance provided in our earlier reports.

The report states that stablecoins might pose a threat to financial stability since they can easily be affected by bank runs unless proper risk control measures are in place. This danger is further increased by problems with market concentration and transparency.

One concern that regulators might want to keep an eye on is the fact that Tether’s USDT makes up approximately 70% of the overall global market for stablecoins.

The absence of a federal regulatory structure continues to be a significant issue, as per the report. While some states have established guidelines for stablecoins, these are not comprehensive enough to address the concerns raised by the Financial Stability Oversight Council (FSOC).

The report stated that while some entities are under constant state monitoring and must regularly submit reports, a significant number offer only minimal and unverified details regarding their assets and strategies for managing reserves.

For some time now, the Financial Stability Oversight Council (FSOC) has hinted at taking necessary steps if legislation from Congress doesn’t materialize. However, it remains uncertain as to how effectively or even if FSOC can execute such actions. With fresh regulators joining FSOC in the upcoming months, their potential impact on this matter is yet to be determined.

In simpler terms, the report stated that many companies dealing with digital currencies, also known as crypto-assets, operate outside or in violation of U.S. financial regulations. This could lead to a high level of fraud and manipulation within these markets. The Council suggests that Congress should pass a law that grants federal financial regulators the power to create rules specifically for the non-security digital currency trading market.

In a prepared statement, Treasury Secretary Janet Yellen acknowledged addressing newly arising threats from rapid technological advancements, particularly digital assets and AI. While these technologies offer potential advantages like efficiency, they also introduce financial risks, cyber threats, and dangers associated with third-party service providers. The council advocates for legislation that constructs a unified federal regulatory structure for stablecoin issuers and legislation on cryptocurrencies that addresses the identified risks.

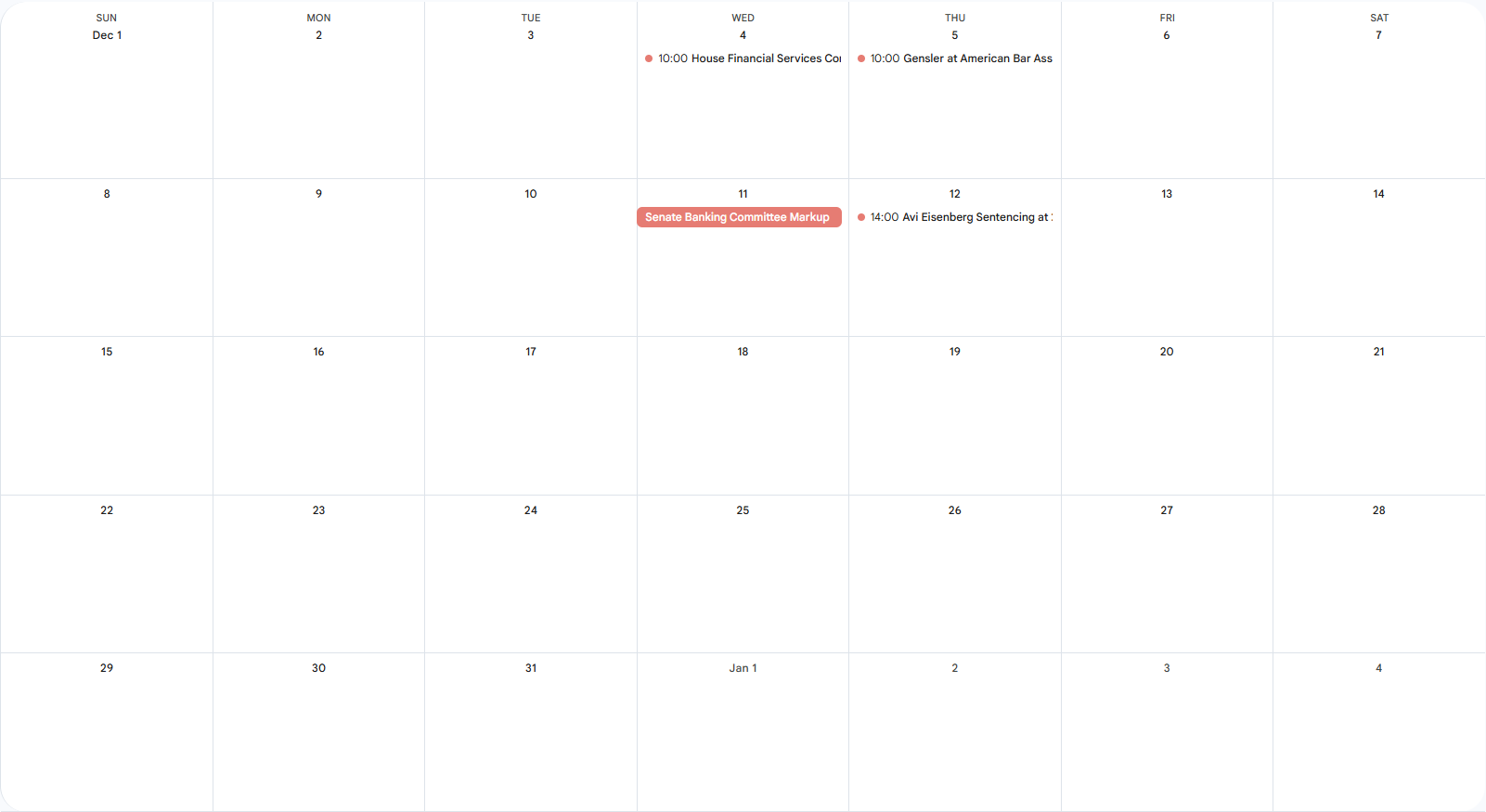

This week

Wednesday

- 15:00 UTC (10:00 a.m. ET) The House Financial Services Committee held a hearing about technology and finance, serving as a sort of swan song for outgoing committee Chair Patrick McHenry (R-N.C.).

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-07 08:12