As a seasoned researcher with years of experience in the ever-evolving world of cryptocurrencies, I must say that the recent performance of XRP has been quite intriguing. The asset’s rapid surge following the US elections and subsequent correction is reminiscent of a rollercoaster ride – exhilarating yet nerve-wracking!

Looking at the technical analysis, it appears that XRP is still struggling to break through the significant resistance level of $2.73. If history repeats itself, we might see another dip towards $2.05 before a potential breakout. However, I can’t help but recall the words of the wise market sage, Warren Buffet, who once said, “Be fearful when others are greedy and greedy when others are fearful.” In this context, a temporary decline could potentially pave the way for XRP to reach new heights.

The idea that XRP might soar as high as $11 sounds ambitious, especially considering its current market cap. However, if we consider the potential of Ripple‘s technology and the ongoing adoption of its cross-border solutions, such a price tag is not entirely implausible in the long term.

Of course, it’s essential to remember that the crypto market is as unpredictable as a game of roulette. So, while I find the $11 prediction intriguing, I wouldn’t bet my house on it quite yet!

And now, for a bit of humor to lighten the mood: If XRP does indeed reach $11, I’ll be the first in line to buy a yacht… or perhaps a small island, who knows? After all, as Mark Twain once said, “Buy land – they’re not making it anymore!”

TL:DR;

- XRP rebounded from its most recent price slip below $2, but the asset might not be out of the woods yet.

- However, a popular crypto analyst suggested that a potential decline toward that level again could be beneficial for XRP’s long-term price movements.

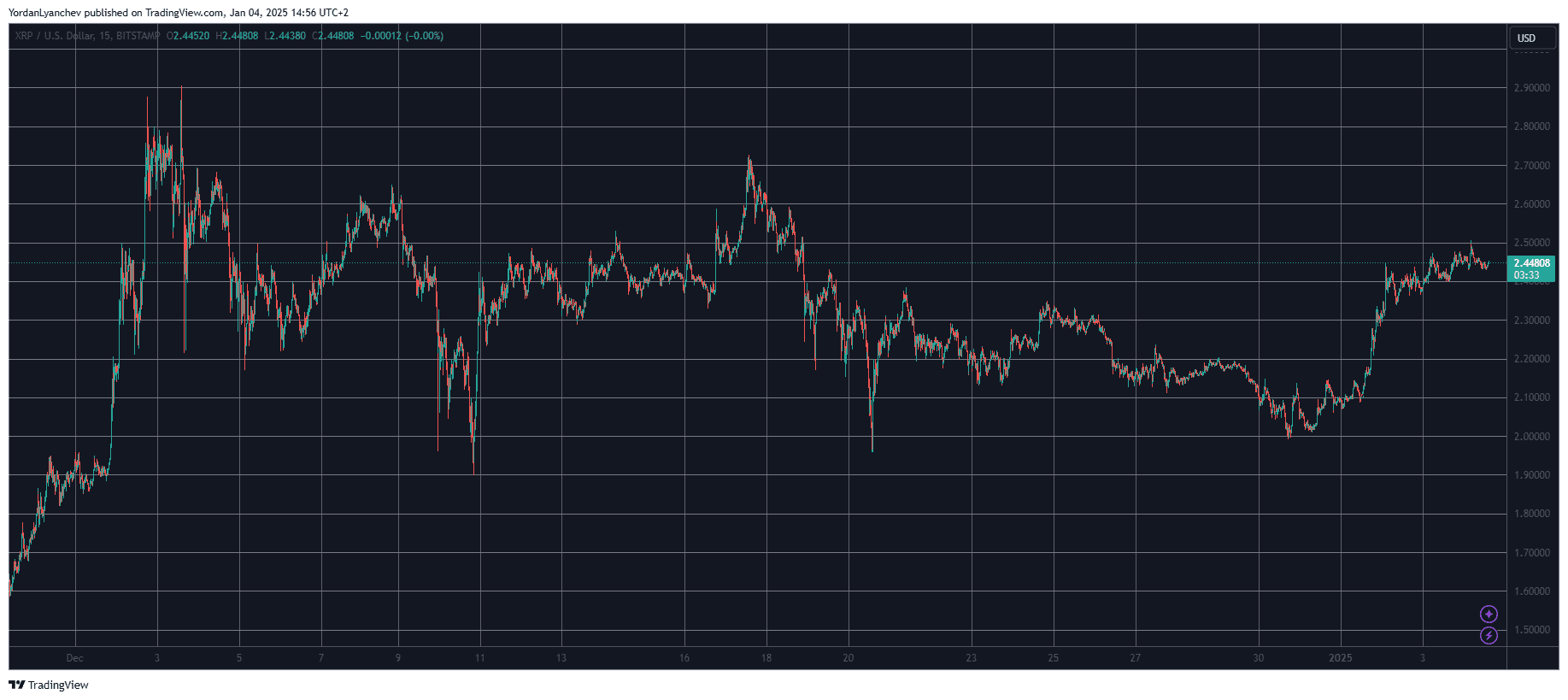

As a researcher, I observed an extraordinary surge in the value of Ripple’s cross-border token following the US elections. At one point, it soared by triple digits and nearly reached $3. This incredible growth occurred within a matter of weeks. However, the asset’s momentum started to wane at the beginning of December.

Over the subsequent weeks, it experienced numerous severe falls, culminating in a drop below $2 last Monday, specifically on December 30th. This occurrence happened amidst the latest market-wide downturn.

Nevertheless, the widely used cryptocurrency experienced a positive response to the drop and soared more than 20% since then, currently valued at approximately $2.45. As a result, XRP has reclaimed its position as the third-largest digital currency by market capitalization, surpassing Tether’s USDT.

As a seasoned analyst with over a decade of experience in the crypto market, I have witnessed numerous instances where resistance levels have halted the upward momentum of digital assets like XRP. Based on my analysis, XRP is currently facing a significant resistance level at $2.73, which has previously hindered its price rise during this rally. If this asset fails to break through it soon, I fear we could see a potential drop back down to $2.05. I always advise caution when investing in the volatile crypto market and encourage investors to do their due diligence before making any investment decisions.

As an analyst, I find myself sharing Martinez’s perspective that the current situation could serve as a catalyst for XRP. If this holds true, we might witness XRP surging past its previous record high of $3.4 (as per CoinGecko data) and potentially reaching an astounding new peak of $11.

Currently, Ripple (XRP) continues to gather strength inside a large, upward-sloping pennant formation. As long as the $2.73 barrier persists, a temporary reversal back towards $2.05 could occur before we may witness an explosive breakout reaching up to $11!

— Ali (@ali_charts) January 4, 2025

It can be reasonably assumed that $11 for XRP is quite remarkable. If such a value were achieved, XRP’s market capitalization would exceed $600 billion, surpassing Ethereum in this aspect. However, even though it seems possible under a more favorable Trump administration, reaching this price point remains distant and falls into the category of overly optimistic price forecasts.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Tekken Fans Get Creative with Photo Requests for ‘Scientific Research’

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- WLD PREDICTION. WLD cryptocurrency

- Granblue Fantasy: Players Crave More Content, Hope for a Sequel

2025-01-04 16:12