As a seasoned researcher with over two decades of experience navigating financial markets, I find myself intrigued by the current outlook on Wall Street and the Federal Reserve’s rate cut decision. Having witnessed multiple market cycles and recessions, I can confidently say that this time feels different – but not in the way some might think.

Wall Street’s rate cut outlook is overly pessimistic.

This week brings an important update for investors everywhere. The Federal Reserve will update its interest rate policy on Wednesday Dec. 18. The consensus expectation is for a 25 basis point cut, lowering the effective rate to 4.4% from the current level of 4.7%.

As a crypto investor, I’m keenly interested in understanding the anticipated direction of interest rates for the upcoming year. The question on everyone’s mind is whether policymakers will continue with their plan to reduce interest rates by another 100 basis points, as they suggested in September, or if their stance has shifted towards a more cautious approach (meaning less likely to lower the rates).

Initially in September, there was strong confidence that four rate reductions would occur before the end of 2025 on Wall Street. However, currently, financial managers and traders are less convinced about this prediction. As per the FedWatch tool from the Chicago Mercantile Exchange, it appears that our central bank might only reduce interest rates by half a percentage point in the upcoming year, according to market speculators betting on bonds.

I concur with parts of your evaluation. It’s anticipated that the Federal Reserve might lower its projected interest rates for next year. The latest employment and inflation data suggest that the economy is approaching pre-pandemic growth rates. Despite earlier fears, economic output hasn’t plummeted as drastically as predicted this year. This leads me to believe that the Federal Reserve is successfully meeting its objectives of full employment and price stability. As a result, I predict that it will suggest 75 basis points worth of rate cuts in 2025, which is more than the Wall Street forecast of just 50 basis points.

For us risk-asset investors, this development is significant since it implies that the expense of obtaining loans will persistently decrease. With funds becoming increasingly affordable, more individuals will opt to borrow money. Hedge funds will increase their leverage. Consequently, there’ll be an influx of capital within the financial system, ready for investment.

But don’t take my word for it, let’s look at what the data’s telling us.

If you’re new to this, let me clarify: The Federal Reserve gathers only eight times a year to formulate policy. Usually, these sessions occur in the first and last month of each quarter. However, the second meeting of each quarter carries extra importance because it’s during these meetings that we receive the Summary of Economic Projections (SEP) from the policymakers.

At these meetings, members of the Board of Governors and regional Federal Reserve banks are inquired about their forecasts regarding economic expansion, inflation, joblessness, and interest rates for the upcoming years. The gathered data is analyzed to determine the middle point of opinion for each category. Although these findings don’t ensure that monetary policy will move in the same direction, they provide us with a sense of its potential trajectory.

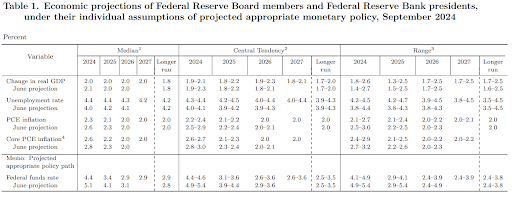

Here’s what the September SEP forecast looked like:

The part of the tables we care about most are the median projections on the left. By surveying those numbers, we get an idea of policymakers’ outlook for growth, inflation, unemployment, and interest rates for this year through 2027. As you can see, Fed officials predicted gross domestic product (“GDP”) growth ending this year around 2%, an unemployment rate of 4.4%, inflation at 2.3%, and borrowing costs at 4.4%. Then, in the out years, the group expects each measure to stabilize, with interest rates settling at 2.9%.

It appears that we won’t be wrapping up the year as initially projected in September. Economists now expect a 2.2% increase in GDP during the last quarter, which would bring the overall annual economic growth rate to approximately 2.4%. This is higher than our previous prediction.

For other key indicators, the scenario is much the same. As revealed by November’s employment data, the unemployment rate stands at 4.2%, mirroring October’s personal consumption expenditure figures which show an inflation growth of 2.3% compared to last year. These numbers generally align with previous projections, lending credence to a 0.25 percentage point reduction in interest rates this week.

However, the decision on interest rate cuts will depend on the trajectory of employment and inflation rates, and fortunately, both seem to be moving in a positive direction.

Initially, let’s examine the rate at which nonfarm jobs are being created. As per November data, the economy has been adding an average of approximately 180,000 jobs per month in 2024. This is a significant increase compared to the 177,300 monthly average from 2017-2019. This indicates to policymakers that the labor market is finding stability after years of rapid expansion, and is gradually returning to its usual pace.

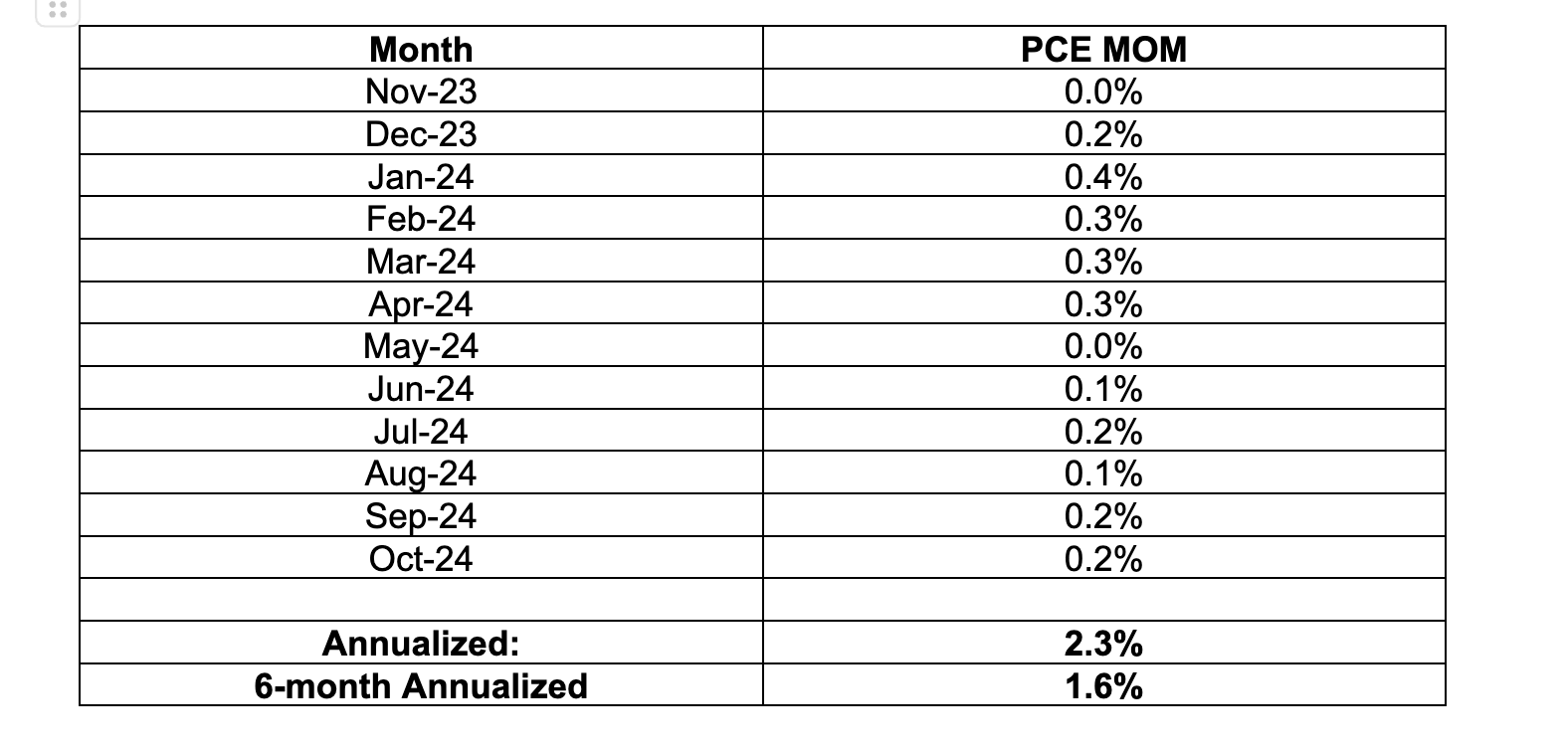

The story isn’t much different with inflation. Take a look at the trend in personal consumption expenditures:

The table provided illustrates monthly growth of Personal Consumption Expenditures (PCE) over the past year. As I’ve been pointing out, price pressures seem to be higher than expected, primarily due to elevated figures from the beginning of this year. From January to April, these four months account for approximately 1.3% of November’s annualized growth rate of 2.3%. However, if we examine the past six months, it shows that the pace of inflation growth in the future has decelerated to an annualized rate of 1.6%. This figure is significantly lower than the Federal Reserve’s target of 2%, indicating that interest rates continue to have a dampening effect on prices.

Ever since the Federal Reserve initiated rate hikes in March 2022, its primary objectives have been achieving full employment and maintaining price stability. However, up until recently, it hasn’t observed tangible indications of these goals being realized. But, upon examining the latest data, it appears that the job market has stabilized, and inflationary pressures are once again aligning with their target levels.

Between the years 2000 and 2020, the average real interest rate, which is calculated as the effective federal funds rate minus inflation (PCE), was approximately -0.05%. At present, this rate stands at 2.6%. If our central bank aims to bring this number back to a neutral level (neither stimulating nor restricting the economy), significant monetary easing is likely to be implemented in the future.

By the close of the day, it’s evident that our economy is on a stable trajectory. Consequently, this situation allows the Federal Reserve some leeway in not being overly aggressive with its rate cut suggestions going forward. In truth, this is their desired scenario: an economy that’s thriving and providing them the luxury of time to make considered decisions. We aim to avoid a central bank swiftly lowering rates due to an economic downturn, as output plummets.

To clarify what I mentioned earlier, it appears that the Federal Reserve might adjust their forecast for borrowing costs to around 3.7% by the end of 2025, lower than their previous estimation of 3.4%. This is below the current Wall Street projection of 3.9%, thereby alleviating concerns about a potential downturn. This shift could potentially bolster a sustained, long-term growth trend for risk assets such as bitcoin and ether.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-17 23:10