What to know:

- The Federal Reserve kept its benchmark fed funds rate range steady at 4.25%-4.50%, because why fix what’s already broken? 🤷♂️

- In its accompanying policy statement, the central bank said inflation remains “somewhat elevated,” which is like saying a hurricane is “somewhat breezy.” 🌪️

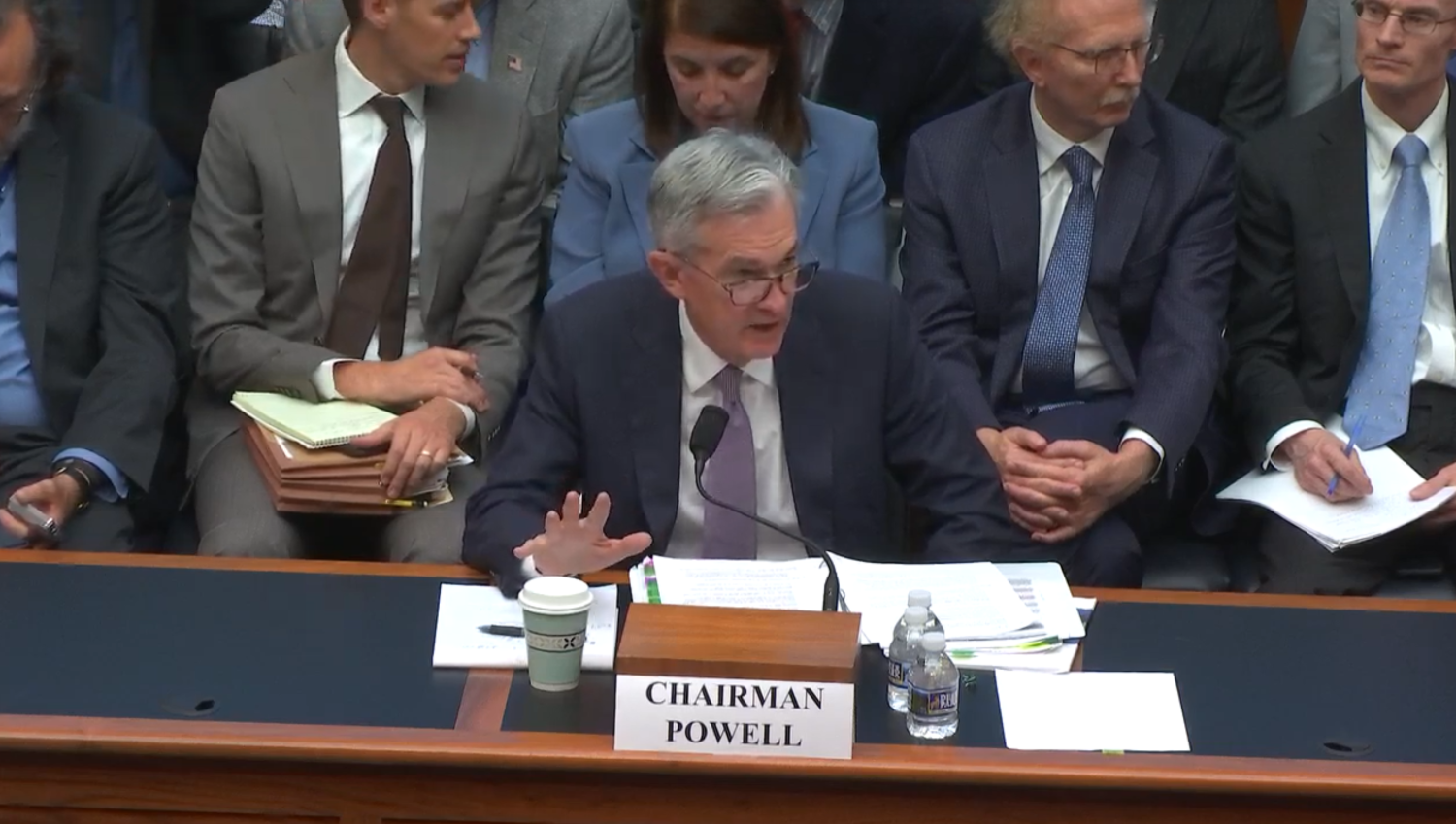

- Fed Chair Jerome Powell’s post-meeting press conference begins shortly, where he’ll likely say a lot of words that mean absolutely nothing. 🎤

As expected, the U.S. Federal Reserve has decided to keep its benchmark fed funds range rate steady at 4.25%-4.50%, marking the first pause since the central bank started easing policy last September. It’s like they’re taking a coffee break while the economy burns. ☕🔥

The accompanying policy statement noted that the unemployment rate had stabilized at a “low level” and inflation remained “somewhat elevated.” The wording is hawkish, as it removed any reference to “progress” in inflation moving toward its 2% target. Progress? Who needs progress when you can just pretend everything’s fine? 🦅

Under pressure for most of this week, the price of bitcoin (BTC) dipped to $101,800 shortly following the news. Because nothing says “stable economy” like a cryptocurrency rollercoaster. 🎢

Since the Fed’s first September rate cut, the fed funds rate has been slashed by 100 basis points. The U.S. 10-year Treasury yield, however, has gone in the opposite direction, rising to 4.6% from 3.6% — a divergence between short-term and long-term rates that rarely has been seen. It’s like watching a couple argue in public; you know it’s bad, but you can’t look away. 👀

That divergence, as well as a series of stronger-than-expected reports on the economy and inflation, has not been lost on the Fed. Following the bank’s December meeting, Chair Jerome Powell made it clear that any further rate cuts — at least for the moment — were on hold. Because why make a decision today when you can procrastinate until tomorrow? 🕰️

Powell’s post-meeting press conference begins shortly, at which market participants will look for further guidance about future policy. Spoiler alert: it’s going to be a lot of words that mean absolutely nothing. 🎭

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-29 22:12