- Pray attend: Bitcoin has settled itself upon a most pivotal support, which may herald a brisk elevation in value.

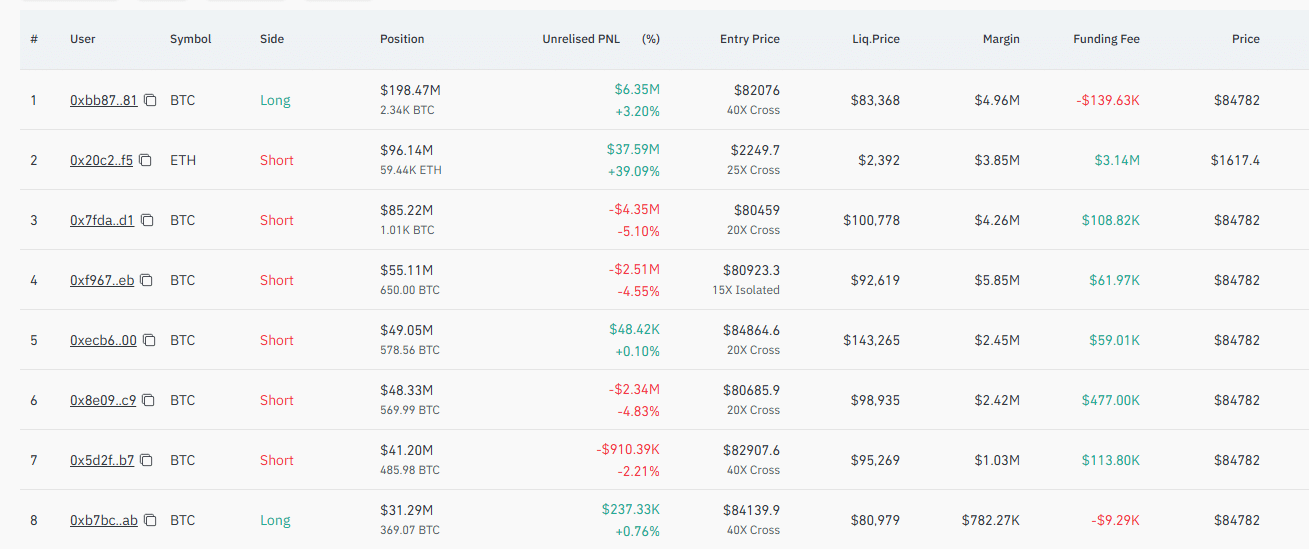

- A formidable whale hath ventured a $198.11 million triumph, yet short-sellers remain the most obstinate suitors, pushing firmly against the price.

Our dear Bitcoin’s progress has been rather languid, notwithstanding this momentous support and the whale’s grand display of confidence. Alas, even with such valiance, the price has ascended but a modest 1.42% in the last day. 😌

Yet, there is mirth to be found: while the bulls present themselves in a most resolute manner, a chorus of negativities hums in the background, threatening to vex the advancement of our heroic asset. 😏

A Most Historic Supply and Hopes of a Bounce

Throughout this month, Bitcoin has graced an exceedingly important support area, renowned in the annals of its history for inspiring splendid climbs.

Indeed, this charted realm hath on several occasions signaled propitious surges. Should Bitcoin prove steadfast once again, one might hope the asset shall reach $150,000 or further—how delightfully grandiose! 🤭

The bullish sentiment grows in enthusiasm, particularly in light of the whale’s $198.11 million commitment, suggesting a remarkable hope for lofty gains.

Monday’s graceful climb delivered $5.99 million in unrealized profit, though a funding fee of $142,110 doth remind us that naught is gained without cost. 😅

The broader derivatives realm likewise proclaims optimism, embellishing the possibility of a most distinguished rally. Buyers now outnumber sellers, which could propel Bitcoin’s fortunes still higher. 🤞

Pray, How Doth Traders Direct Their Liquidity?

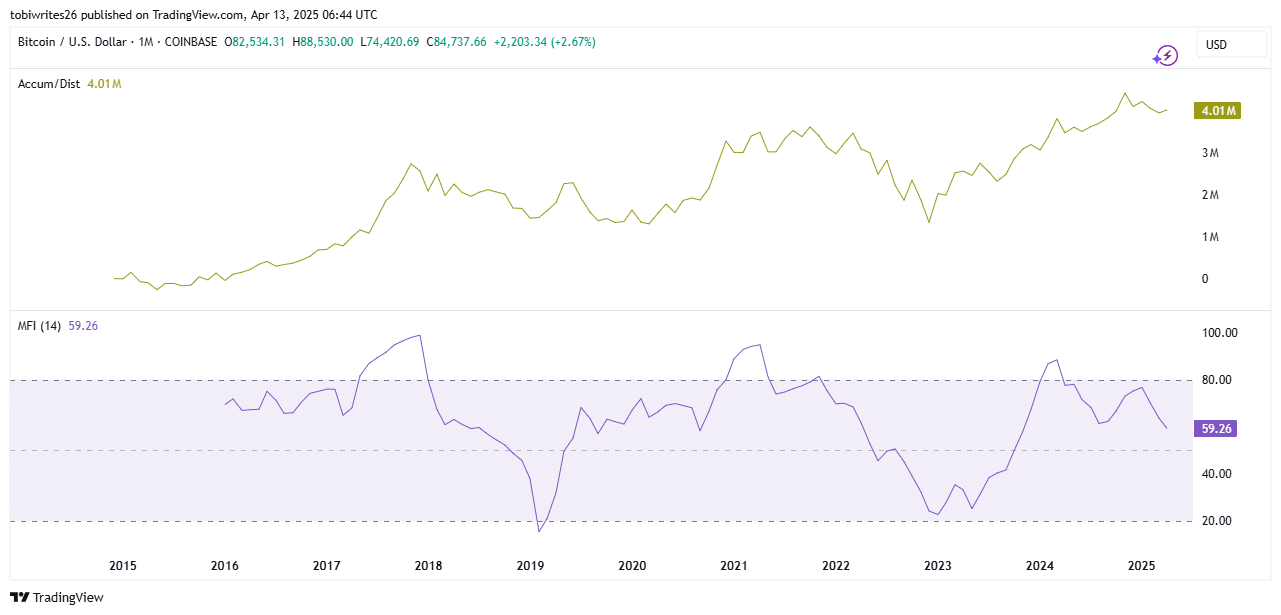

In contemplating the depth of these market machinations, we observe that traders engage in a measured accumulation of Bitcoin, indicating a gentle confidence in future bliss.

The Accumulation/Distribution indicator reveals that a tidy $4 million worth of Bitcoin hath been so gathered.

Though overall liquidity has seen a modest retreat, the Money Flow Index, perched at 59.26, suggests a pleasing tide of optimism. Should liquidity resume its steady flow, we might witness further ascension in Bitcoin’s worth. 😌

Short Traders Face a Most Inconvenient Predicament

Whilst Bitcoin’s modest ascent may be pleasing to the owners of long positions, it has been downright vexing for those who toy with short contracts. 😈

At present, $56.41 million in short positions have been forcibly closed, set beside a mere $13.25 million in long contracts—clearly, the short-sellers find their dance steps most ungainly. 😏

The Funding Rate, at a positive 0.0098%, further confirms the advantage of those betting upon Bitcoin’s upward progress.

Thus, Bitcoin appears poised ever so delicately for a prosperous rally, if—and only if—the broader marketplace consents to such a delightful venture. Emoji-laden fans, do cross your fingers. 😉

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-04-13 15:08