Ethereum is at a fork in the road, my friend, with a tough resistance region ahead, including the 200-day moving average and the lower boundary of a descending wedge.

As our tale unfolds, a rejection here could mean a sad slide to $2.5K. But, fear not, a break above could squeeze the heck out of those shorts, pushing ETH to $3K!

The Techy Stuff

By Shayan

A Glimpse at the Daily Chart

After a bounce from $2.5K, Ethereum has seen some buying love, giving it a little nudge. But, alas, a formidable resistance zone awaits, with the 200-day moving average and the crucial $2.9K level.

If the price gets rejected here, it could be another tumble to $2.5K. But, should it break free, a short squeeze might just send it skyward to $3K!

A Peek at the 4-Hour Chart

On the smaller timeframe, ETH has been cooped up in a low-volatility cage after dropping below the descending wedge. Traders are just itching for a breakout!

ETH now dances near a crucial resistance zone, with the 0.5-0.618 Fibonacci retracement levels. If the selling pressure rises, the price could stumble. But, should the bulls muster up some strength and break through, it could spark a whole new surge!

Onchain Analysis

By Shayan

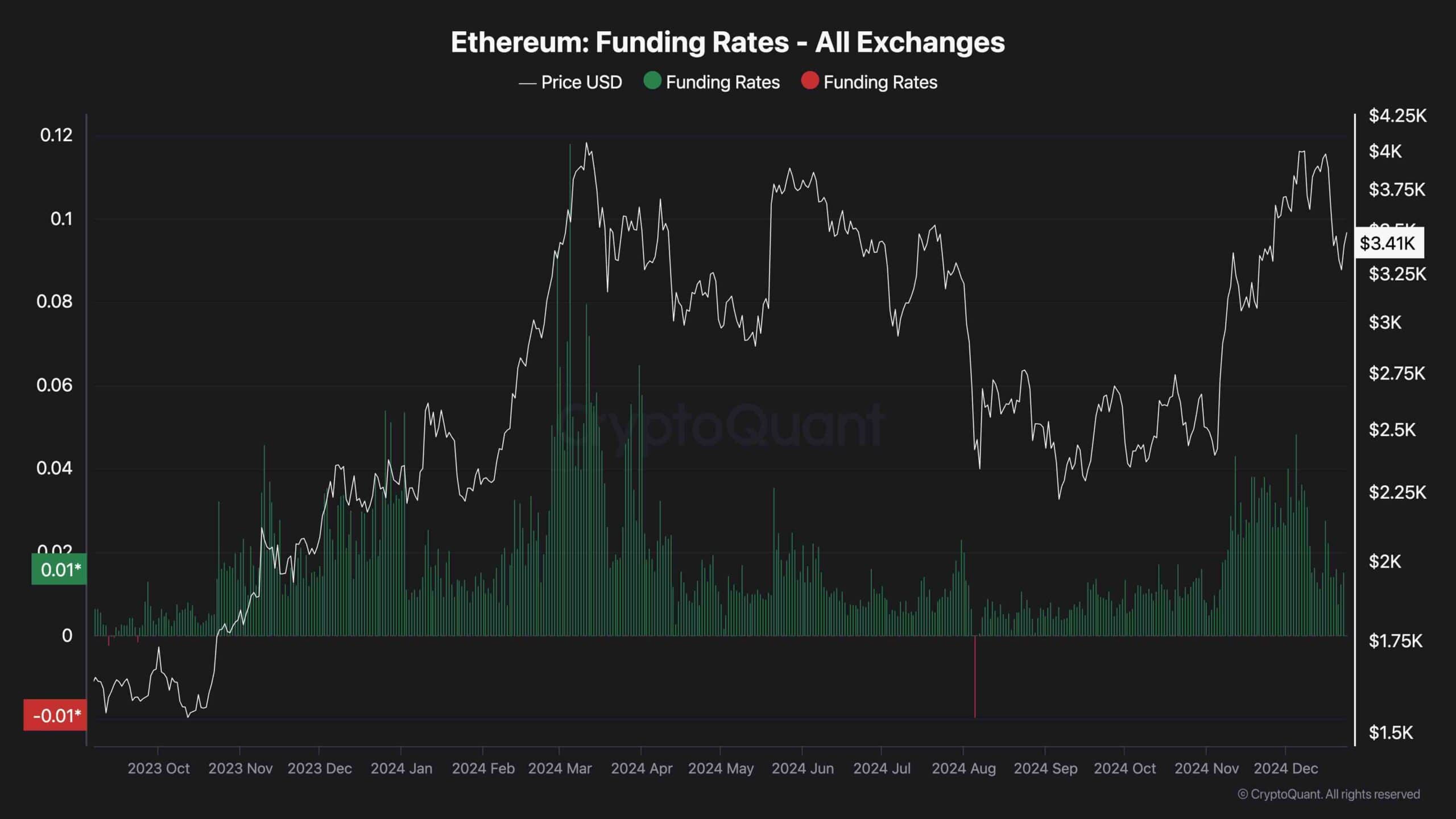

The futures market, a key player in Ethereum’s price shenanigans, has a sentiment indicator called the funding rate. This sneaky little thing shows how eager buyers or sellers are to make their moves.

Lately, funding rates have been going down, down, down with the market’s recent turmoil. This drop means less action in the futures market, and that’s not good for a strong, bullish push. If this keeps up, especially with selling pressure around $3K, the market might just keep on sinking, with sellers eyeing $2.5K as their next target.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-02-21 16:55