What to know:

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market of 2018, I can’t help but feel a mix of excitement and trepidation when I see the soaring leverage ratios in the ether futures market. Having learned my lessons the hard way, I’ve come to appreciate the importance of understanding market dynamics and managing risk.

The escalating leverage ratio for ETH is a clear sign that traders are increasingly betting big on the Ethereum network. While it’s tempting to jump on the bandwagon, I remember all too well the volatility that comes with such high levels of leverage.

It’s not just about the potential profits; it’s also about the potential losses. And in the crypto world, those can be as sudden and sharp as a South Korean regulatory announcement. So, while ether might indeed experience twice the price volatility of bitcoin in the near future, I prefer to keep my own volatility to a minimum.

On a lighter note, they say the market doesn’t care about your personal life, but I can’t help but wonder if it’s trying to teach me a lesson: “If you can’t handle the heat, get out of the Ethereum kitchen!” After all, who needs a burnt wallet when you can have a good laugh over a bad call?

Although Bitcoin (BTC) often captures the attention of institutional investors, Ethereum’s ether (ETH) emerges as a preferred choice among traders seeking to amplify their returns with leveraged trading opportunities.

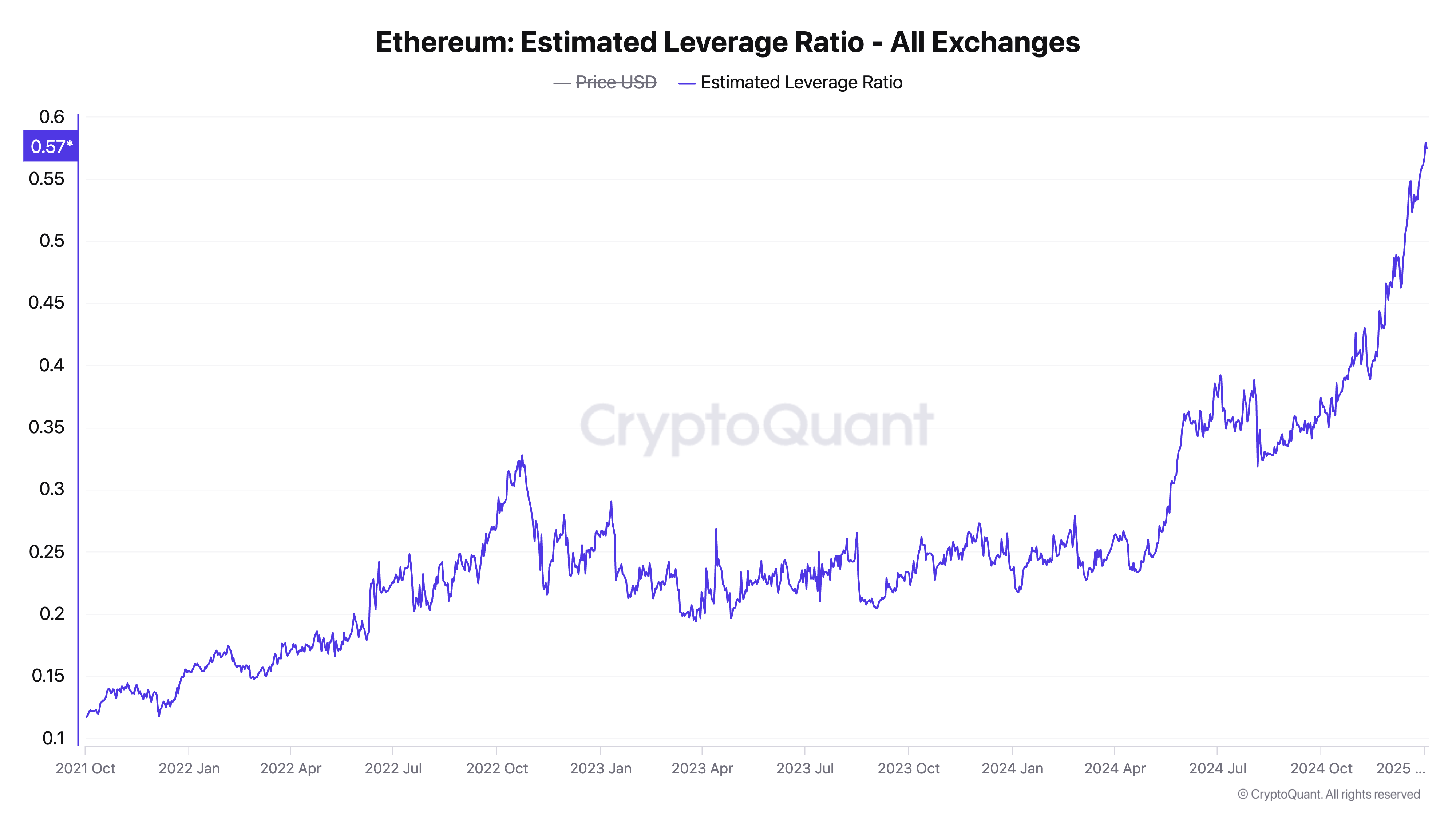

On Wednesday, Ether’s calculated leverage ratio – a gauge indicating the level of borrowing among traders – reached an unprecedented peak of 0.57. This is a considerable jump from its initial reading of 0.37 at the onset of Q4 2024, as recorded by analytics provider CryptoQuant.

The ratio is determined by splitting the global total of accumulated open interests for both traditional and perpetual Ethereum future contracts, into the overall count of Ethereum held in wallets linked to exchanges that support futures trading.

An increasing trend in the ratio implies that traders are progressively employing more leverage, which points towards an escalation in market risk and speculation. With leverage, traders can manage larger market positions using a comparatively smaller amount of funds.

To put it simply, if a trading platform provides a 10:1 leverage, this means you can manage investments worth $10,000 using only a $1,000 deposit as collateral. This amplifies both potential gains and losses, making the risk of having your positions closed involuntarily (liquidation) higher, especially when market conditions work against leveraged positions. This situation often leads to greater volatility in the market.

In other words, when Ether’s leverage ratio exceeds 0.5, it indicates that there is a high level of trading using borrowed funds in the futures market compared to the quantity of Ether actually held in the exchange’s coin reserves.

A leverage ratio above 0.5 for Ether suggests that there is a significant level of margin trading taking place within the futures market, compared to the quantity of Ether held in the exchange’s coin reserves.

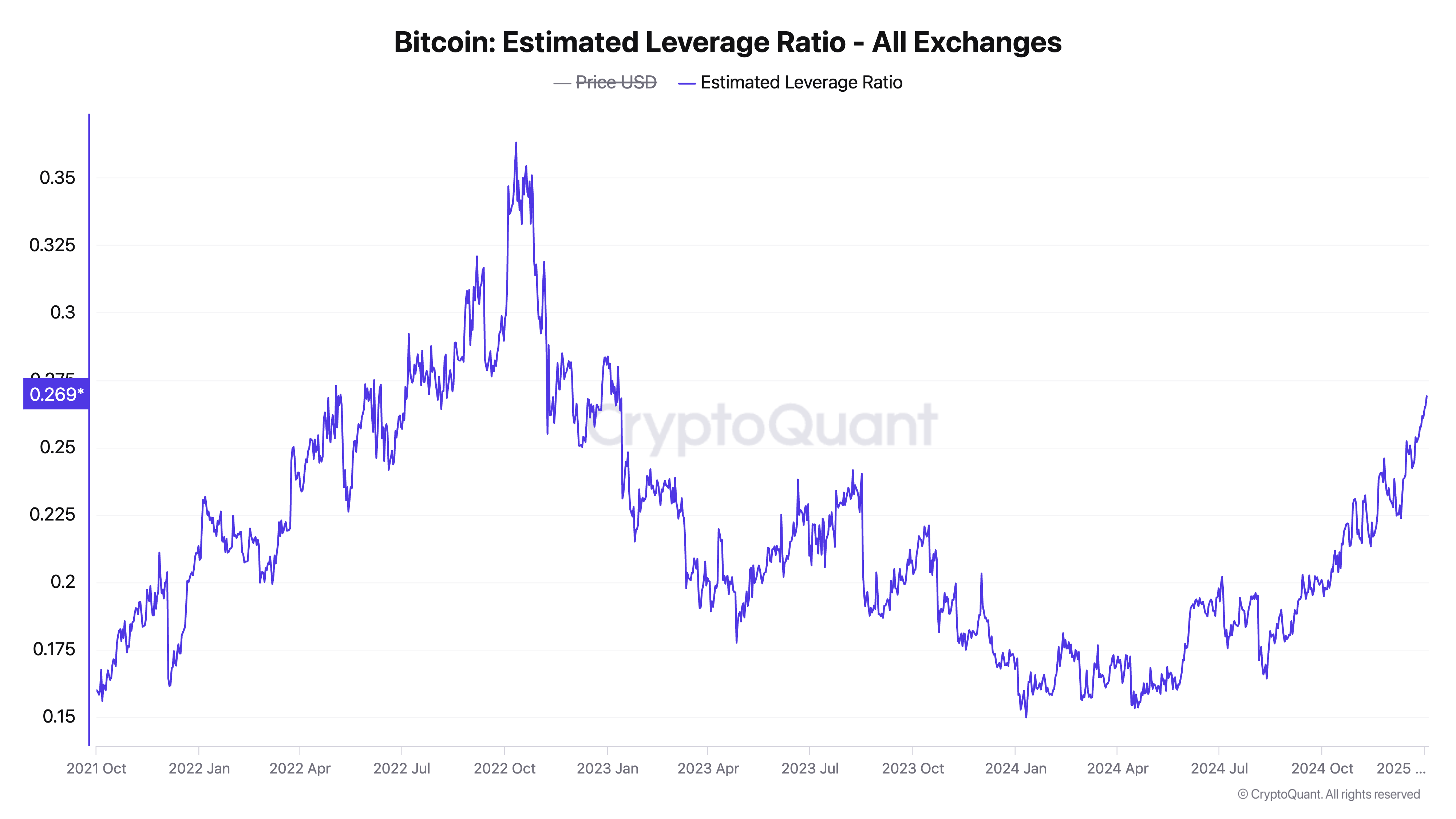

Compared to Bitcoin, this level of leverage is significantly greater. At the moment of writing, Bitcoin’s estimated leverage ratio stands at approximately 0.269, a figure not surpassed since early 2023, though it remains considerably lower than its all-time high of 0.36 reached in October 2022.

In the upcoming period, it’s possible that ether could exhibit price fluctuations that are approximately double those of Bitcoin.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- DAG PREDICTION. DAG cryptocurrency

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-03 14:26