Ah, Ethereum! The elusive creature of the crypto jungle, flitting about in a tight little range, like a cat caught in a cardboard box. It finds itself wedged between the 100-day moving average at a cozy $3.2K and the formidable resistance at $3.5K, as if it were deciding whether to leap into the unknown or take a nap. 🐱

This phase of consolidation, akin to a suspenseful novel where the hero is about to make a life-altering decision, is accompanied by a delightful increase in volatility. One can almost hear the market whispering, “A breakout is nigh!”—a proclamation that could herald a new trend, or perhaps just a new chapter in this ongoing saga.

Technical Analysis

By Shayan, the oracle of the charts

The Daily Chart

Currently, our dear ETH is caught in a narrow range, defined by the 100-day moving average at $3.2K and the critical resistance zone at $3.5K. This latter figure is not just a number; it’s the upper boundary of a bullish flag formation, a veritable fortress of supply! Should ETH manage to breach this bastion, we might just witness a sustained bullish rally, aiming for the lofty heights of $4K. 🚀

But beware! Should it fail to conquer this level, we may find ourselves in the depths of a bearish downturn, with a potential plunge below the 100-day MA leading to a cascade of long-liquidation events. As the market dances in this range, the heightened volatility suggests that a decisive breakout is looming, ready to dictate Ethereum’s next grand adventure.

The 4-Hour Chart

In the shorter timeframe, Ethereum is consolidating within a descending wedge pattern, like a drama unfolding in slow motion. The price recently found support at the wedge’s lower boundary near $3K, prompting a bounce toward the upper boundary, much like a rubber ball that just can’t stay down.

However, the surge met resistance at $3.5K, leading to a delightful increase in volatility and a pullback. Now, Ethereum oscillates between the 0.5 Fibonacci retracement level at $3.2K and the wedge’s upper boundary, reflecting a market caught in a state of indecision, like a child torn between two ice cream flavors. 🍦

This equilibrium between buyers and sellers underscores the urgent need for a breakout from the wedge and the current range. A bullish breakout seems to be the most probable outcome in the mid-term, contingent on buyer momentum and the whims of market conditions.

Onchain Analysis

By Shayan, the seer of on-chain mysteries

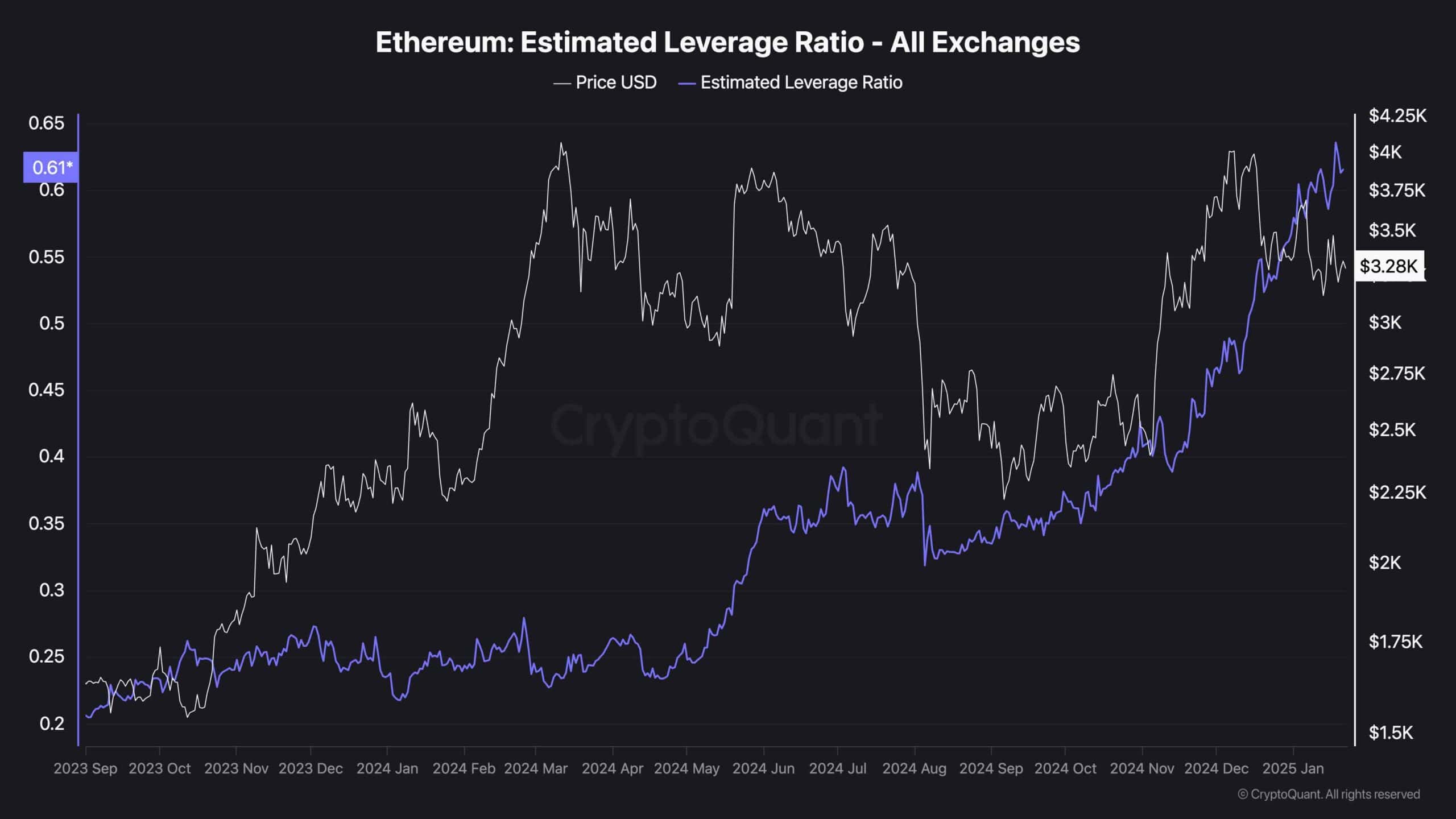

The Estimated Leverage Ratio metric, which tracks the average leverage employed by futures market participants, reveals crucial insights into ETH’s market dynamics. It’s like peering into a crystal ball, but with more numbers and fewer sparkles.

Ethereum’s Estimated Leverage Ratio has been steadily climbing over recent months, reflecting a growing appetite for high-leverage positions in the derivatives market. This trend coincides with the cryptocurrency’s recent bullish price movements, indicating an overheated market. The current elevated levels of leverage heighten the risk of a short or long-squeeze event, which could result in sharp price swings—like a rollercoaster ride without the safety bar! 🎢

Our dear asset remains trapped between the $3.2K support and the $3.5K resistance zone, a range that has defined Ethereum’s consolidation phase. The impending breakout from this range, driven by the high-leverage environment, is expected to trigger a significant and impulsive price move, much like a surprise party gone awry.

Given the prevailing market sentiment, a bullish breakout appears more probable. However, traders should keep a watchful eye on the leverage ratio, as any abrupt change could lead to unexpected volatility and liquidations, turning the market into a circus of chaos! 🎪

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-22 16:06