Well, well, well! Ethereum has decided to take a nosedive today, and not just any nosedive—a spectacular 25% plunge that has left investors clutching their pearls and wondering if they should start knitting sweaters for the impending bear market. 🐻

So, what’s the deal? Are we witnessing the dawn of a new era of doom and gloom, or is this just a temporary hiccup in the grand scheme of crypto chaos? Only time will tell, but let’s dive into the numbers, shall we?

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

According to the daily chart, Ethereum has plummeted back to the $2,100 level, which is about as comforting as a cold shower on a winter morning. The $3,000 mark and the 200-day moving average—those trusty old indicators—have been shattered like a glass vase in a toddler’s playroom. If Ethereum doesn’t manage to claw its way back above that moving average soon, we might be in for a longer, more painful correction. Yikes!

The 4-Hour Chart

Now, let’s take a peek at the 4-hour chart, where Ethereum attempted to break free from a large falling wedge pattern. Spoiler alert: it was a fake-out! 🎭 This bull trap has sent prices tumbling, and the $2,800 level has vanished faster than your motivation to hit the gym after a long day. If a quick recovery doesn’t happen, we might be stuck in a consolidation zone between $2,800 and $2,400 for weeks. Grab your popcorn, folks!

Sentiment Analysis

By Edris Derakhshi (TradingRage)

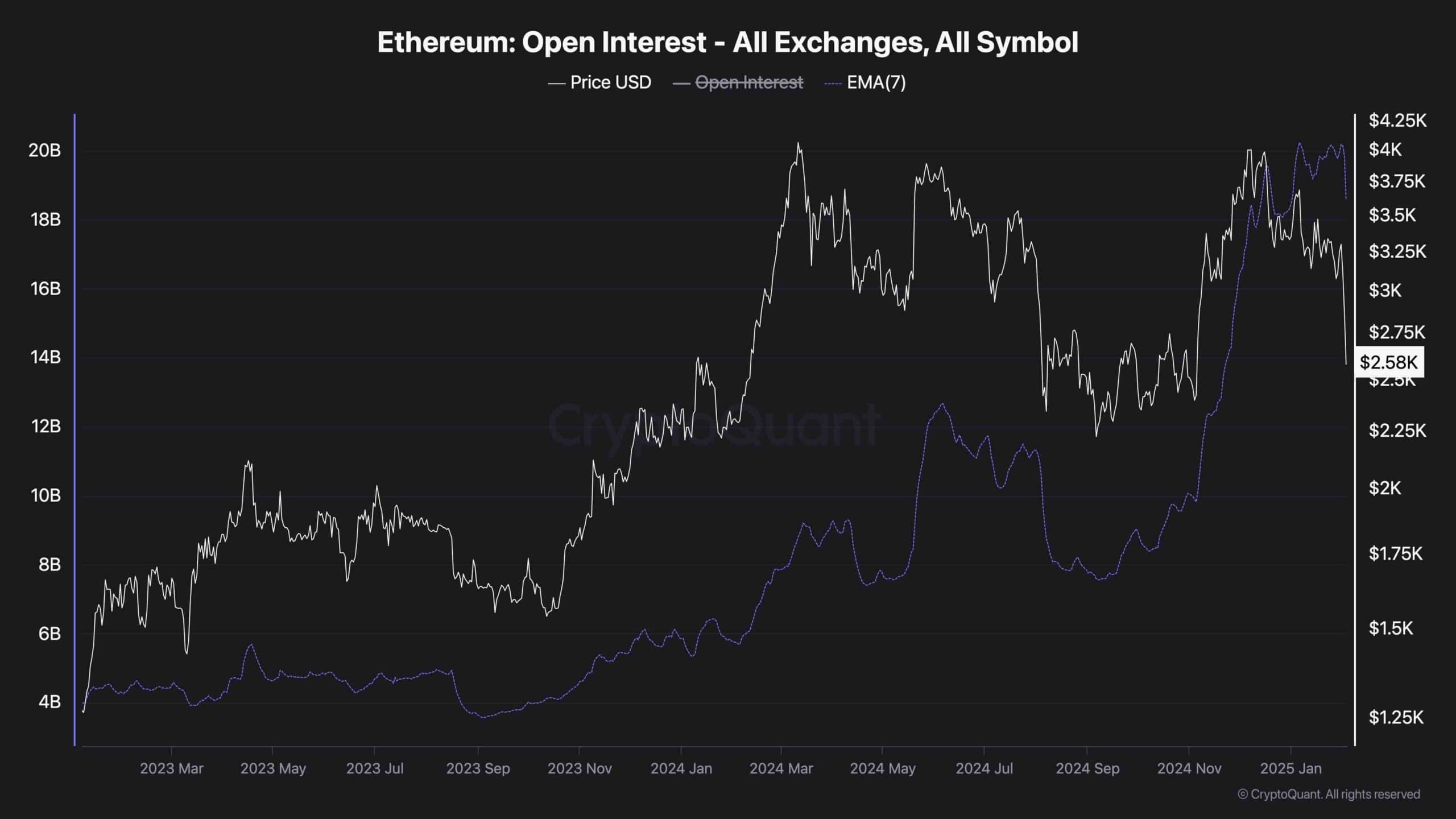

Ethereum Open Interest

While Ethereum’s price action has been a rollercoaster of emotions, we need to dig deeper into the market dynamics. The futures market metrics are like the secret sauce that could reveal what’s really cooking in the crypto kitchen. 🍳

Take a look at this chart, which shows the ETH price alongside the 7-day exponential moving average of open interest. It’s like a soap opera—lots of drama, but the open interest isn’t showing any signs of a significant decline. If this crash is indeed a liquidation cascade, the futures market is still buzzing like a beehive, and we might see more liquidations and drops if the selling pressure keeps up. Buckle up!

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-02-03 15:39