- Ethereum’s OI and whale inflows have soared, as if the City’s finest were suddenly besotted with digital tokens instead of port.

- ETH liquidations and technicals hint at a breakout above $2,714—shorts, do mind the gap as you’re squeezed out like toothpaste in a boarding school dormitory.

Ethereum’s [ETH] Futures market has lately exhibited the sort of vigour one might expect from a debutante at her first ball—nervous, excitable, and altogether too eager to impress.

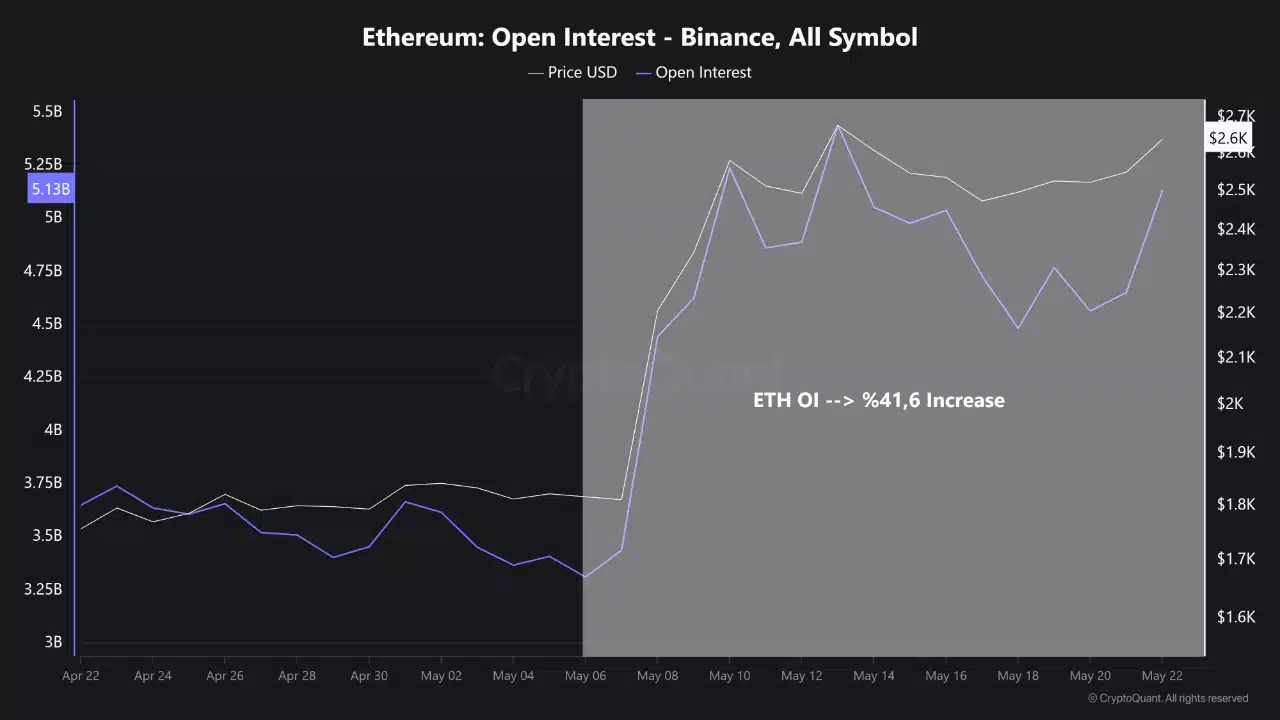

Open Interest (OI) on Binance leapt from $3.6B to $5.1B—a 41.6% rise that would make even the most seasoned bookmaker blush—while total ETH OI across all exchanges now hovers near $17B, like a dowager counting her pearls.

This uptick is less the fevered speculation of the nouveau riche and more the calculated conviction of institutions who, having tired of polo, now dabble in crypto.

And lest you think this is mere froth, consider: ETH’s price has risen nearly 65%, from $1,600 to $2,663.72—a rally with more backbone than a prep school headmaster.

Thus, Ethereum’s recent ascent appears less a fleeting fancy and more a structurally sound affair, underpinned by robust derivatives participation and the sort of enthusiasm usually reserved for foxhunts and scandal.

Whale Inflows accelerate

In just seven days, Ethereum’s Large Holders Netflow rose 22.8%, extending a 30-day increase of 1057.08% and a 90-day leap of 392.80%. One imagines the whales themselves must be feeling rather bloated by now.

This surge suggests that institutional entities and long-term holders are accumulating ETH with the sort of persistence usually reserved for collecting rare stamps or embarrassing anecdotes about one’s rivals.

The timing of these inflows coincides with Ethereum’s breakout above $2,600—proof that those with deep pockets are not merely spectators but enthusiastic participants in this digital farce.

While accumulation continues apace, ETH Exchange Reserves have increased by 3.93%, totalling $51.17B. Ordinarily, such an influx would presage a sell-off, but in this topsy-turvy world it may simply mean traders are hedging their bets—or perhaps just showing off.

traders depositing ETH for derivatives exposure or to hedge positions, much as one might hedge one’s reputation at a country house weekend.

ETH faces major hurdle at $2,714

Ethereum currently trades around $2,663, tantalisingly close to a resistance band between $2,714 and $2,741. The Stochastic RSI sits above 79—overbought territory—while Bollinger Bands suggest volatility has taken a brief holiday in the south of France.

A decisive close above $2,741 could open the floodgates to a rally toward $3,000. Should ETH fail to breach this zone, however, expect a short-term retreat to $2,581—like a guest quietly slipping away from an awkward dinner party.

In sum, ETH stands at a technical crossroads that could determine not only its own fate but that of the entire altcoin set—no pressure at all.

Shorts get squeezed

Derivatives data reveals increasing bear capitulation—one can almost hear the lamentations from Mayfair to Manhattan.

On the 23rd of May, ETH liquidations saw short positions worth $17.88M wiped out across exchanges; Binance and Bitfinex led the rout, while long positions accounted for a mere $12.56M.

This ongoing squeeze has only added fuel to ETH’s rally, as Open Interest and Whale Netflows both cheer from the sidelines like overzealous uncles at a regatta.

Can ETH break $2,714 and trigger the next altcoin wave?

Ethereum seems poised to vault above the $2,714 resistance, buoyed by strong on-chain and derivatives metrics—one might say it’s ready for its close-up.

The sharp rise in Whale Inflows, continued short liquidations, and a 41.6% surge in OI confirm bullish momentum worthy of a West End opening night. While reserves have ticked up slightly, they have yet to dampen the prevailing optimism.

A successful breakout above $2,714 could well herald the next great altcoin rally—with Ethereum leading the charge like an impeccably dressed master of ceremonies. 🎩

Would you like me to explain or break down any part of this code?

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-05-23 15:17