Ah, Ethereum! The cryptocurrency that seems to be playing a game of limbo with its key support at $2.5K. It’s like watching a cat decide whether to jump onto a windowsill—lots of indecision and a fair bit of low-energy trading activity. 🐱👤

This sideways shuffle is a classic case of market equilibrium, where buyers and sellers are staring each other down, waiting for someone to make the first move. It’s like a standoff in a spaghetti western, but with fewer tumbleweeds and more digital wallets.

Technical Analysis

By Shayan

The Daily Chart

After a valiant rebound above the $2.5K support, ETH has been as lively as a sloth on a Sunday afternoon. The trading activity is so low, it could be mistaken for a meditation retreat. 🧘♂️

Now, the $2.5K level is not just a number; it’s a psychological support, like that friend who always says, “I’m fine” when they’re clearly not. A bullish rebound is expected, aiming for the 200-day moving average at $3K. But let’s not get too excited—Ethereum is still stuck in the $2.5K-$3K limbo, and a breakout is essential to avoid a nosedive into the abyss.

The 4-Hour Chart

On the shorter timeframe, Ethereum is consolidating like a teenager trying to decide what to wear to prom. After breaking below the descending wedge’s lower boundary, it’s been as volatile as a soap opera plot twist. 📺

Currently, it’s hovering below the key resistance of the 0.5-0.618 Fibonacci range, which could lead to a rejection if sellers decide to throw a party. But if buyers crash the party, we might just see a breakout that could trigger a fresh rally. The short-term outlook? As uncertain as a cat in a room full of rocking chairs.

Onchain Analysis

By Shayan

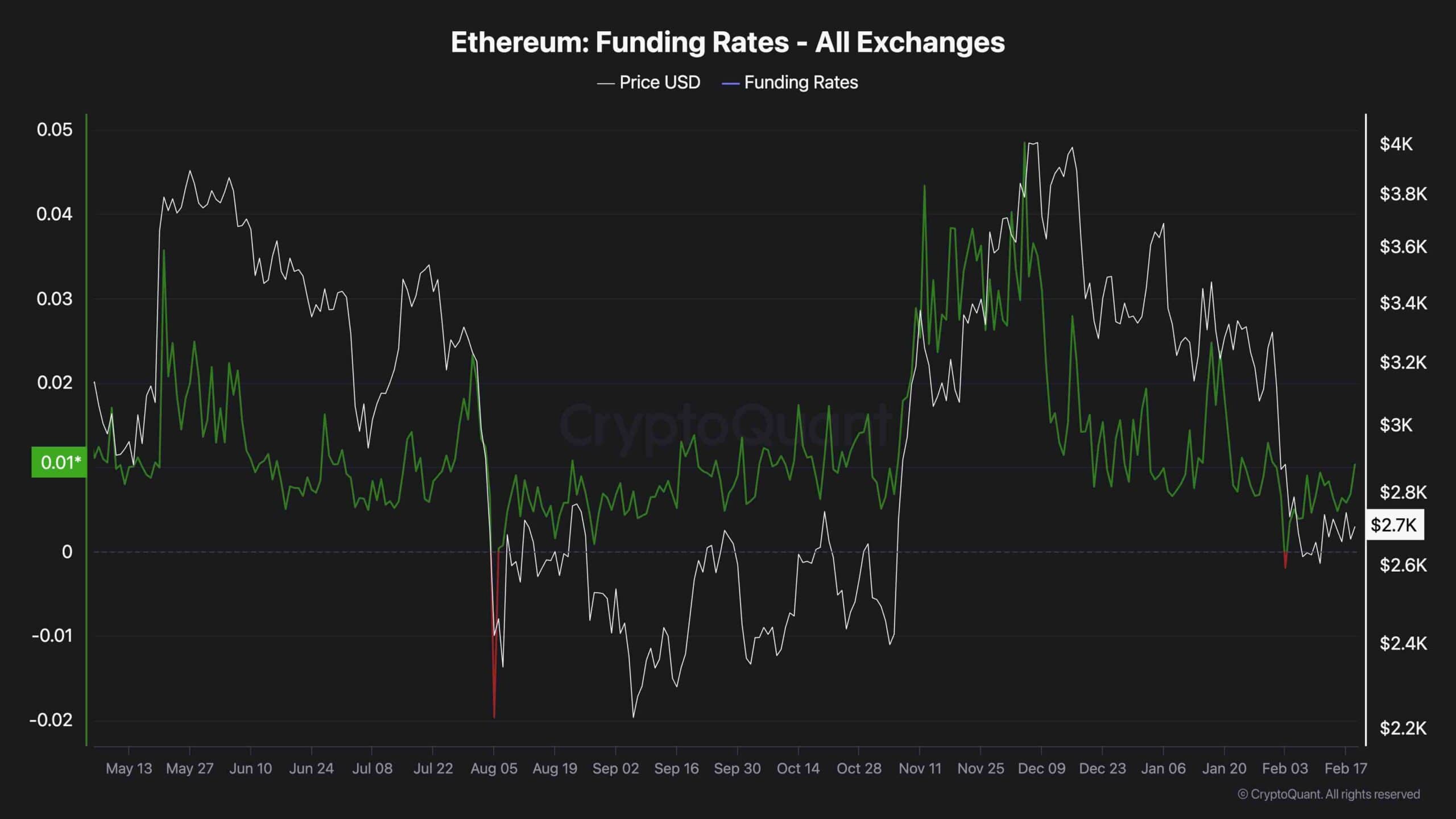

Historically, the futures market has been the puppet master of Ethereum’s price action. The funding rates metric is like the mood ring of the futures market, indicating whether buyers or sellers are feeling particularly frisky. 💃

As shown in the chart, funding rates have seen a slight uptick during this recent market consolidation. This suggests that the futures market is gearing up for a potential influx of buyers, much like a crowd anticipating a surprise concert. If this trend continues alongside sufficient spot demand, we might just witness a quick recovery and a renewed attempt to reclaim the elusive $3K threshold. 🎉

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

2025-02-19 14:36