Ethereum, it seems, has taken it upon itself to thumb its nose at the global economic chaos. While the rest of the crypto market has been more volatile than your uncle’s hairline, ETH has remained a beacon of hope—at least for those with a penchant for digital assets. Since its rather dramatic dip in April, the price of Ethereum has done something rather extraordinary—it doubled. Yes, doubled! That’s more than 100%. A veritable rags-to-riches tale in the world of finance. No signs of slowing down, either. Quite the resilient fellow, wouldn’t you agree? Meanwhile, other assets are practically wailing as market volatility makes them shake in their boots.

Enter Carl Runefelt, the top analyst who’s been observing Ethereum’s daily chart with all the enthusiasm of a puppy in a treat shop. According to Runefelt, if Bitcoin so much as sneezes sideways, Ethereum could break free from its little consolidation triangle and lead the charge in the next altseason. Not just the second-largest cryptocurrency, mind you, but potentially the captain of this market rally ship. Runefelt thinks Ethereum’s about to flex its muscles. And honestly, who wouldn’t want to bet on that?

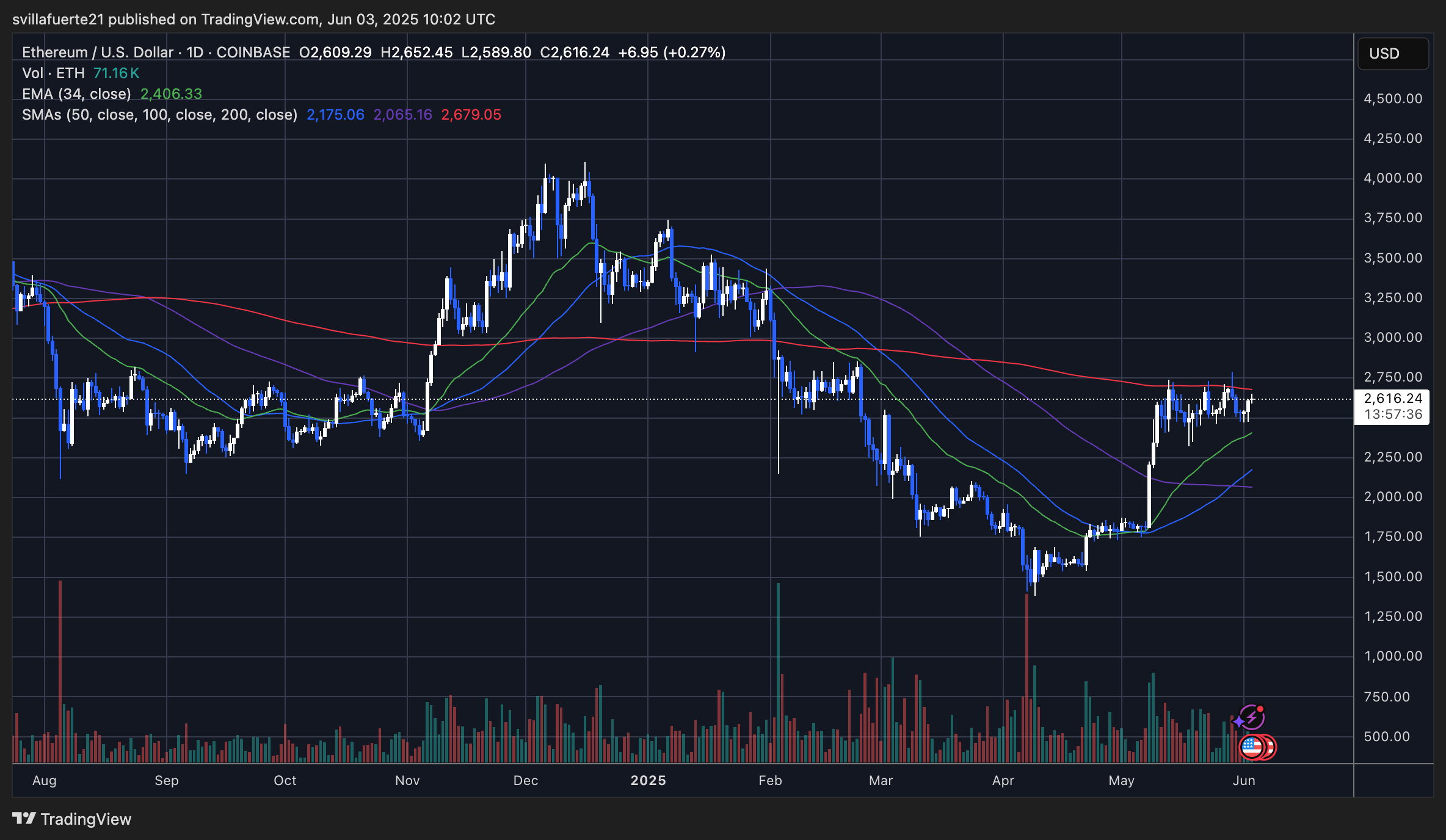

At the moment, ETH is lounging comfortably above $2,600, eyeing some heavy-duty resistance zones. The market’s watching this closely. Why? Because if it bursts through that resistance like a kid at Christmas, you could be looking at a pretty wild altcoin rally. Ethereum might be just what the doctor ordered to get this market back on its feet. It’s practically the foundation of this whole digital asset circus.

Ethereum’s Tightrope Act: Bulls Line Up for the Big Breakout

Ethereum, bless its heart, is holding on to a rather snug consolidation range, and investors are practically on the edge of their seats, waiting for its next move. This isn’t just a random dip—no, no. After a rather impressive rally since April, ETH is now face-to-face with resistance levels around $2,650–$2,700. In a market full of geopolitical tension and rising US Treasury yields, Ethereum’s making a rather compelling case for strength. The bulls are holding steady. It’s almost like watching a tense standoff in a Western, except with more numbers and less dusty streets.

Runefelt, ever the optimist, has pointed out that Ethereum is basically refusing to “dump” on the daily timeframe. This is the kind of bullish resilience one could only dream of. He seems to believe that if Bitcoin simply treads water for a while, Ethereum could bust out of its consolidation and lead the charge for the next altseason. It’s like waiting for a slow-motion train crash—except, in this case, we’re hoping for the best.

Technically speaking, Ethereum’s consolidation is practically a masterpiece. Higher lows since April? Check. Strong base around the $2,300 level? Check. It’s perched right above all the major moving averages. And if ETH manages to push through resistance? Well, then you can almost hear the crowd cheering as it shoots for $3,100. It’s all about timing. The kind of timing you’d expect from a Swiss watch… or a well-rehearsed opera.

Runefelt’s analysis covers both sides of the coin—$3,100 to the upside, and $2,300 to the downside. It’s a pivotal range, and the stakes couldn’t be higher. If Ethereum pulls off a breakout, don’t be surprised if it ignites broader confidence across the altcoin market. This could be the start of something… explosive.

The Daily Grind: ETH Price Analysis – Not Quite There Yet

So, where does Ethereum stand now, you ask? Well, ETH is sitting pretty at $2,616, just beneath the 200-day simple moving average (SMA) of $2,679. It’s been knocking on that door for weeks, but as of yet, hasn’t managed to waltz through. There have been some rather impressive intraday moves above $2,650, but it’s still holding out on us. Is it shy? Or just playing the long game?

Looking at the broader picture, Ethereum’s trading range between $2,480 and $2,700 is as tight as a drum. After its stunning rally from April’s lows near $1,800, ETH’s recent behavior is more like a waiting game. The 34-day EMA at $2,406 is trending upwards, suggesting that bulls are still calling the shots for the moment. However, trading volume? Well, it’s been a bit “meh”—not enough conviction to set the world on fire, but enough to keep things interesting.

If ETH breaks above $2,700, we might just see a sprint towards $3,000. But if it falters and drops below $2,480? We could see a retracement, possibly testing the 100-day SMA near $2,065. It’s like a thrilling game of chess, except with digital coins and a lot more caffeine.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lottery apologizes after thousands mistakenly told they won millions

2025-06-04 05:13