In the grand theater of the cryptocurrency market, where fortunes are made and lost with the flick of a digital coin, Ethereum, that capricious darling of the blockchain, has decided to grace us with a 5% increase in its value. Ah, the sweet scent of optimism wafts through the air, as ETH now stands at a princely $1,845. One might wonder, is this a genuine resurgence or merely a fleeting whim of the market? 🤔

Ethereum Price Rallies Before Options Expiry

As the clock ticks towards the fateful day of May 30, when a staggering $42.4 billion in options will expire, the Ethereum options trading volume has surged by 18.95%, crossing the $1 billion threshold. It seems the bulls are in a frenzy, attempting to push ETH past the elusive $2,700 mark for the first time in three months. Will they succeed, or will they be left lamenting their lost dreams? 🐂💔

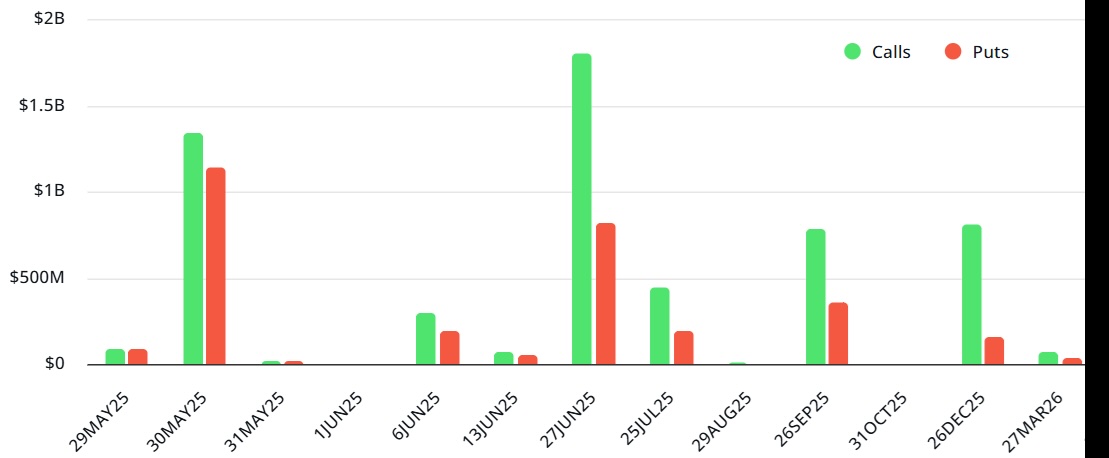

Ethereum Options Open Interest – Source: Leavitas

With the bulls determined to keep ETH above $2,600, the pressure mounts on the bears, who are clutching their $1.1 billion in put options like a drowning man clings to a life raft. Alas, if ETH remains above this threshold by 8:00 am UTC on May 30, 97% of those contracts will meet their untimely demise. Such is the cruel nature of the market! 😅

Moreover, the put-call ratio has plummeted to 0.53, indicating that the bulls are once again in the driver’s seat. The max pain point for ETH options is currently at $2,300, but the calls are dominating the puts across all price ranges, as illustrated below:

ETH price at $2,300–$2,500: $420 million in calls vs. $220 million in puts, a net advantage of $200 million for the calls.

ETH price at $2,500–$2,600: $500 million in calls vs. $130 million in puts, favoring calls by $370 million.

ETH price at $2,600–$2,700: $590 million in calls vs. $35 million in puts, resulting in a $555 million call advantage.

ETH price at $2,700–$2,900: $780 million in calls vs. $10 million in puts, creating a dominant $770 million edge for calls.

Ethereum ETF Inflows on Rise

In a delightful twist, inflows into spot Ethereum ETFs have been gathering momentum, with a total of $84.6 million flowing in on Wednesday alone. BlackRock’s iShares Ethereum Trust (ETHA) has been particularly gluttonous, devouring $52.7 million, while Fidelity’s FETH has managed to snag $25.7 million. It appears that institutional interest is not waning, much to the delight of the crypto enthusiasts! 💰

ETHEREUM IS TRYING TO BREAKOUT NOW!

— Merlijn The Trader (@MerlijnTrader) May 29, 2025

On the technical chart, Ethereum is poised for a breakout from the flag-and-pole pattern. If the bulls can maintain their fervor, we might just witness a meteoric rise to $3,300. But then again, in the world of crypto, anything is possible—except perhaps a dull moment! 🚀

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- You Won’t Believe Denzel Washington Starred in a Forgotten ‘Die Hard’ Sequel

2025-05-29 16:37