So, Ethereum decided to make some noise. Apparently, big wigs like Abraxas Capital, with its Heka Funds (don’t ask, it’s fancy), have been gobbling up ETH like it’s the last bag of chips at a party. This, my dear audience, could mean that ETH’s price is gearing up to do a ridiculous leap. Maybe even a moonwalk, but we’ll get to that later. 🚀

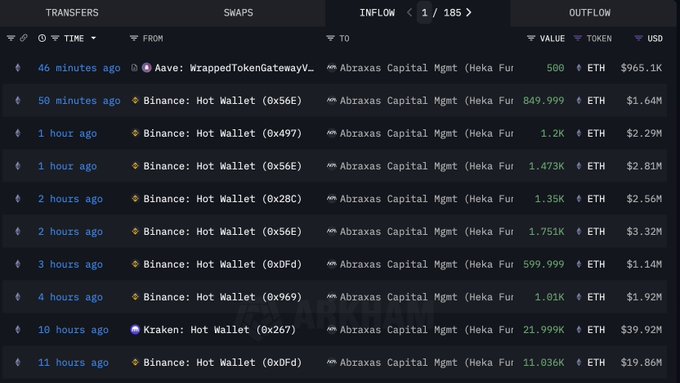

Lookonchain (yes, another name that sounds suspiciously like a techy spy agency) revealed that Abraxas swiped 74,304 ETH from Binance and Kraken. That’s a cool $135.46 million if you’re counting. Because, why not? When you’ve got that kind of money, who needs sleep, right?

Coincidentally, Ethereum decided to throw a party and broke out of a six-month downtrend. It’s like that friend who just got their life together after a string of bad decisions. They’re feeling good and are ready to conquer the world (or at least make you wonder if you should be buying ETH too). 🎉

In early April, ETH broke past $1,600 as the world collectively sighed in relief, and the market went a little haywire (in a good way). Fast forward to $2,000 – now traders are eyeing the big magical $3,000. Think of it like the end of a really long Netflix series. You’re invested and wondering if the next episode will be worth it. Spoiler alert: it might be. 📈

Momentum indicators are all flashing green, like a well-fed traffic light. The Relative Strength Index (RSI) skyrocketed from 56 to 66 in a mere 24 hours, which is like watching a sloth run a marathon and suddenly decide to sprint. The 50-day Simple Moving Average (SMA) has found a comfy spot at $1,775, and the 200-day SMA is somewhere in the $2,500–$2,800 zone, kind of like that stretch of road that’s always under construction. But who’s counting?

On the fundamental side, Ethereum is having a glow-up. Its Total Value Locked (TVL) is up by 41%, now sitting at a whopping $52.8 billion. And because the blockchain has a mind of its own, daily transactions have spiked 22%. It’s like Ethereum is the cool kid on the block, and everyone wants to be friends. Even BlackRock BUIDL and Ether.fi have come to the party, looking to make their own financial apps. Cute, right?

Sure, ETH’s burn rate has slowed a tad because, you know, lower fees and all that jazz. But in the grand scheme of things, Ethereum is cruising. With institutional giants jumping on the bandwagon, technical indicators flashing green, and usage climbing, Ethereum’s ready to break the $3,000 barrier. So, buckle up. It’s going to be a wild ride. 🤑

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Mirren Star Legends Tier List [Global Release] (May 2025)

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Jump Stars Assemble Meta Unit Tier List & Reroll Guide

- 28 Years Later Fans Go Wild Over Giant Zombie Dongs But The Director’s Comments Will Shock Them

- Basketball Zero Boombox & Music ID Codes – Roblox

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Nintendo Switch 2 System Update Out Now, Here Are The Patch Notes

2025-05-08 18:43