Ethereum’s Hidden Crisis: Why Bulls Might Need a Strong Coffee ☕️🚨

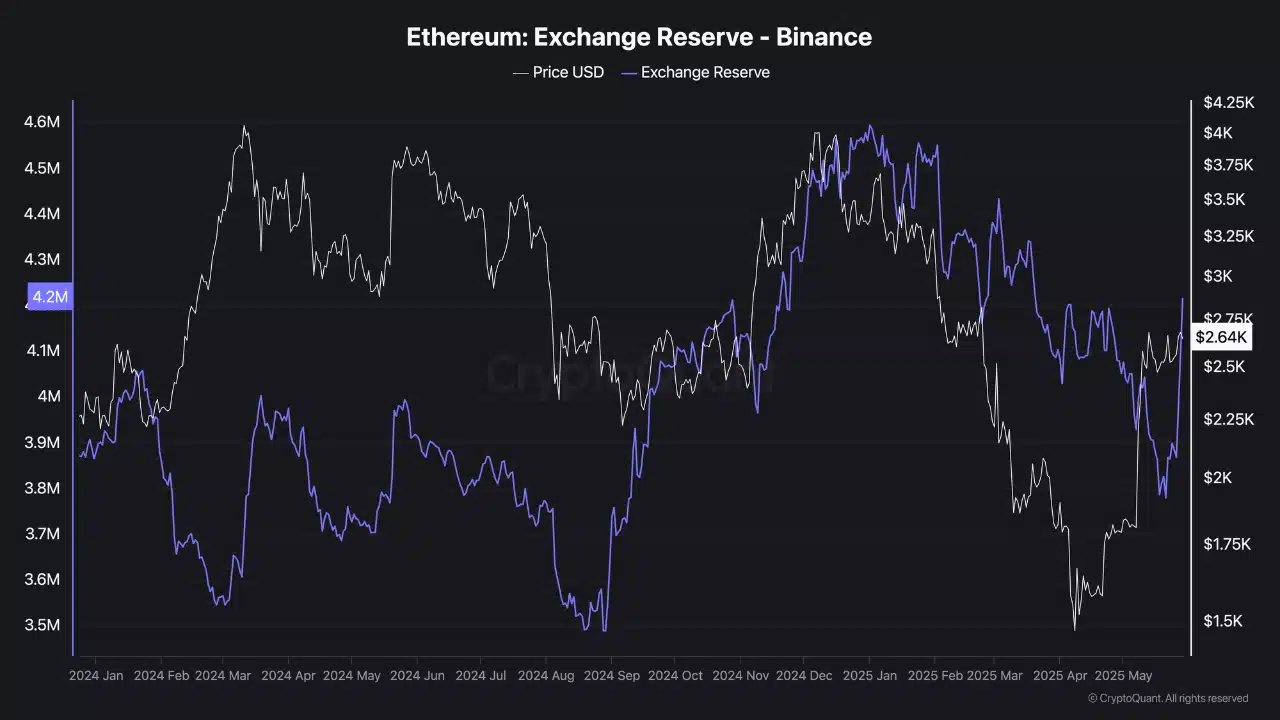

Ah, Ethereum. The crypto rollercoaster that refuses to leave the station. Bounded between $2,400 and $2,700, it’s playing hard to get — or maybe just playing dead. Binance’s reserves just shot up like they’re about to throw a huge, dramatic tantrum, hinting that some traders are panic-selling like it’s hot potatoes. Imagine tokens sneaking over to exchanges faster than your ex running from commitment. Yeah, sell pressure’s building, folks.

Plus, despite ETH briefly flirting above $2,600, it’s now lounging at $2,623 after a modest 3.60% dip. Seems like the market’s just shrugging — “Meh, everything’s fine,” said no one ever. See that picture below? It’s like watching a soap opera — dramatic and slightly cringe-worthy.

Why do negative netflows keep lurking despite the sideways yawn-fest?

Ethereum’s wallets are busy kicking out -248.83K ETH in the past week and -60.9K ETH over the month. Nice. This usually means clever investors are storing it away in their cold vaults or just ghosting the market, but it’s also clear they’ve been scarred by a previous selloff — like a bad breakup that keeps them from trusting future reconciling attempts.

The latest 24-hour netflow? A tiny -4K ETH, as if to say, “We’re just chilling.” But don’t be fooled; these outflows are a steady drip, not a flood. It’s like trying to fill a bathtub with a leaky faucet — patience, my friend, patience. Without fresh money rushing in, ETH’s hopes of climbing higher look shaky, at best.

Trader nerves and liquidation walls: the real party poopers

In the last day, open interest — that fancy measure of how many contracts are out there — plummeted by 8.99%, now resting at $18.14 billion. Looks like traders are clutching their wallets, waiting for the scary storm to blow over. Less conviction means less excitement, which often translates into market lullabies before the next big move.

But hold onto your hats: Binance’s ETH/USDT Liquidation Heatmap reveals walls of liquidation between $2,700 and $2,830. These aren’t your average speed bumps — they’re massive, unyielding barriers that make bulls feel like they’re trying to push a boulder uphill. Every failed breakout attempt sparks a quick reverse, like a boomerang that just won’t come back. Check the picture below for the full dramatic effect.

If ETH doesn’t suddenly blast through these walls with volume and fireworks, the bulls are stuck like a bad joke — giggling nervously but getting nowhere. These resistance zones? They’re the ceiling until market confidence decides to grow legs and break free.

The truth? ETH’s sideways move isn’t just laziness. It’s hiding deeper weakness: declining OI, persistent outflows, and looming liquidation walls. If ETH can’t convincingly punch through $2,700, watch out for the next support at $2,480 — it might be more like a trampoline than a safety net.

So, stay cautious, folks. ETH’s current vibe is like a sluggish hangover — limping through a narrow range with limited punch. Cheers to the crypto drama — it never gets old 🍸🤪.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- KPop Demon Hunters: Real Ages Revealed?!

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-30 14:17