Ethereum’s Gamble: Will $300M from Consensys Trigger a Breakout? 🤔💸

In the dim corridors of the financial abyss, Ethereum has lingered, shackled beneath the stubborn resistance of $2,681, for what feels like an eternity. The price, a restless ghost, moves with disturbing stability, as if pondering the futility of its own existence. Oh, how the market’s puppeteers orchestrate this tragic dance, invisible strings tugging softly, whispering promises of salvation or ruin.

Yet, amidst this gloom, a flicker of hope emerges—an influx of investors, led by the mighty Consensys, like a band of forlorn souls seeking redemption. These characters, cloaked in greed and ambition, may just be the harbingers of chaos or revival. Perhaps, someday soon, Ethereum’s fate shall be sealed by their daring—[pause for dramatic effect]—a rise, a leap towards the uncertain future.

Investors’ Masquerade: A Demand Woven with Irony

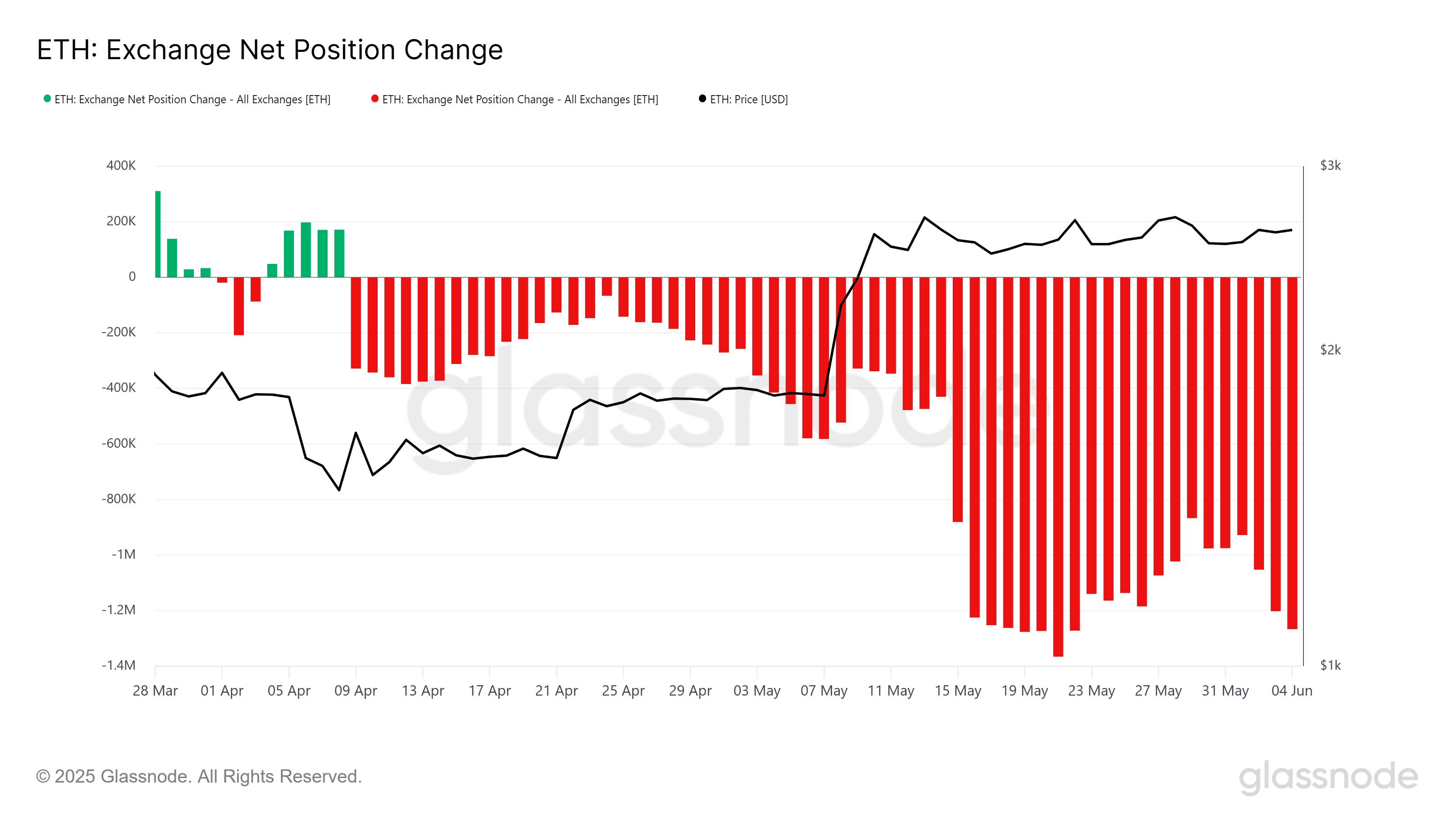

Since the oppressive days of late May, the market’s tide has turned—investors, weary of selling, have bought over 300,000 ETH, amounting to a staggering $778 million since June’s dawn. As if waking from a long nightmare, they cling to Ethereum, their confidence swelling like a ship battling the storm. This growing dance of accumulation whispers promises of hope—or impending doom—to those who listen.

Leading the charge, Consensys—the erstwhile knight—has reportedly hoarded more than $300 million worth of ETH from Galaxy Digital, according to Arkham’s whispering echoes. This act, as if wielded by the gods of finance, signals a resolute belief in Ethereum’s unending saga. Large entities, like crouching predators, continue to stake their claim—each acquiring yet another piece of this fractured dream, perhaps dreaming of riches or oblivion. Trust, after all, is but a fragile illusion, dear reader, until the money starts flowing.

Gazing upon the macro cosmos, the IOMAP indicator gleams—a demand zone between $2,378 and $2,454, where over 65 million ETH, worth nearly $169 billion, huddle in silent anticipation. It is as if the market’s heart beats strongest here, shielding Ethereum from precipitous falls, offering a false sense of stability amid the chaos. The bullish winds whisper, “All is well,” but beware—the storm is always lurking just beyond the horizon.

With these colossal investors supportive, Ethereum’s foundation remains firm, or so it seems. The absence of a wave of selling from these giants suggests a fragile peace—yet, in the shadows, danger lurks. A sudden tremor, and the entire edifice of hope could crumble, plunging ETH into deeper darkness. Still, the pattern persists—a dance of accumulation and restraint, like prisoners pacing in a cell, longing for freedom.

Ethereum’s Delicate Balance: Waiting for the Breakout—or Not

As I write these words, ETH hovers at $2,611, stubbornly below the sacred threshold of $2,681. The question lingers—will momentum, like a restless spirit, finally propel it over this hurdle? Or will it languish in this limbo, the price dancing to the tune of traders’ whims?

If the small fortress of support at $2,583 holds—oh, how sweet the promise!—Ethereum might break free from its chains, soaring toward $2,814, chasing dreams of grandeur. Ah, the optimism! But beware: if the surrounding market turns treacherous or sellers rally with wrath, ETH could retreat to $2,500, plunging back into despair—a reminder that hope is but a flickering candle in the darkness.

And so, dear reader, the saga continues. Ethereum stands at the crossroads—support or collapse, hope or despair. The players are ready, the stage set—a drama of dreams, money, and madness. Will the breakout come, or is this mere illusion, another fleeting mirage in the desert of certainty? Only time shall reveal the tragic comedy of this digital farce.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-06-05 22:46