Ah, Ethereum, that capricious muse of the digital realm, still reeling from its recent tumble, as if it were a poet caught in a tempest of existential dread. The horizon looms dark, and whispers of further descent echo through the ether, promising more of the same in the weeks to come.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Behold the daily chart, a canvas of despair where the price dances like a marionette, crafting lower highs and lows, ever since it was spurned by the lofty resistance at $4,000. Support levels have crumbled like ancient ruins, particularly the revered 200-day moving average, now a ghostly figure haunting the $3,000 threshold.

Though the price has flirted with the $2,200 support and momentarily rebounded, the specter of decline lingers, as long as our dear cryptocurrency remains shackled beneath the 200-day moving average. A tragic romance, indeed.

The 4-Hour Chart

Gaze upon the 4-hour timeframe, where the price has meandered downwards within a grand falling wedge, a tragic play unfolding before our very eyes. On Monday, the market broke free from this pattern, only to reclaim the $2,800 level, like a wayward lover returning home. Yet, the RSI, that fickle friend, still languishes below 50%, whispering tales of bearish momentum.

Thus, if the price does not ascend above the $3,000 mark soon, we may brace ourselves for a deeper correction or a prolonged period of stagnation, a waiting game that tests the patience of even the most stoic souls.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Ethereum Open Interest

As Ethereum spirals into a steep downtrend, market participants ponder the elusive support that may finally cradle its weary price. A dive into the futures market sentiment may yield insights, like a seer peering into a crystal ball.

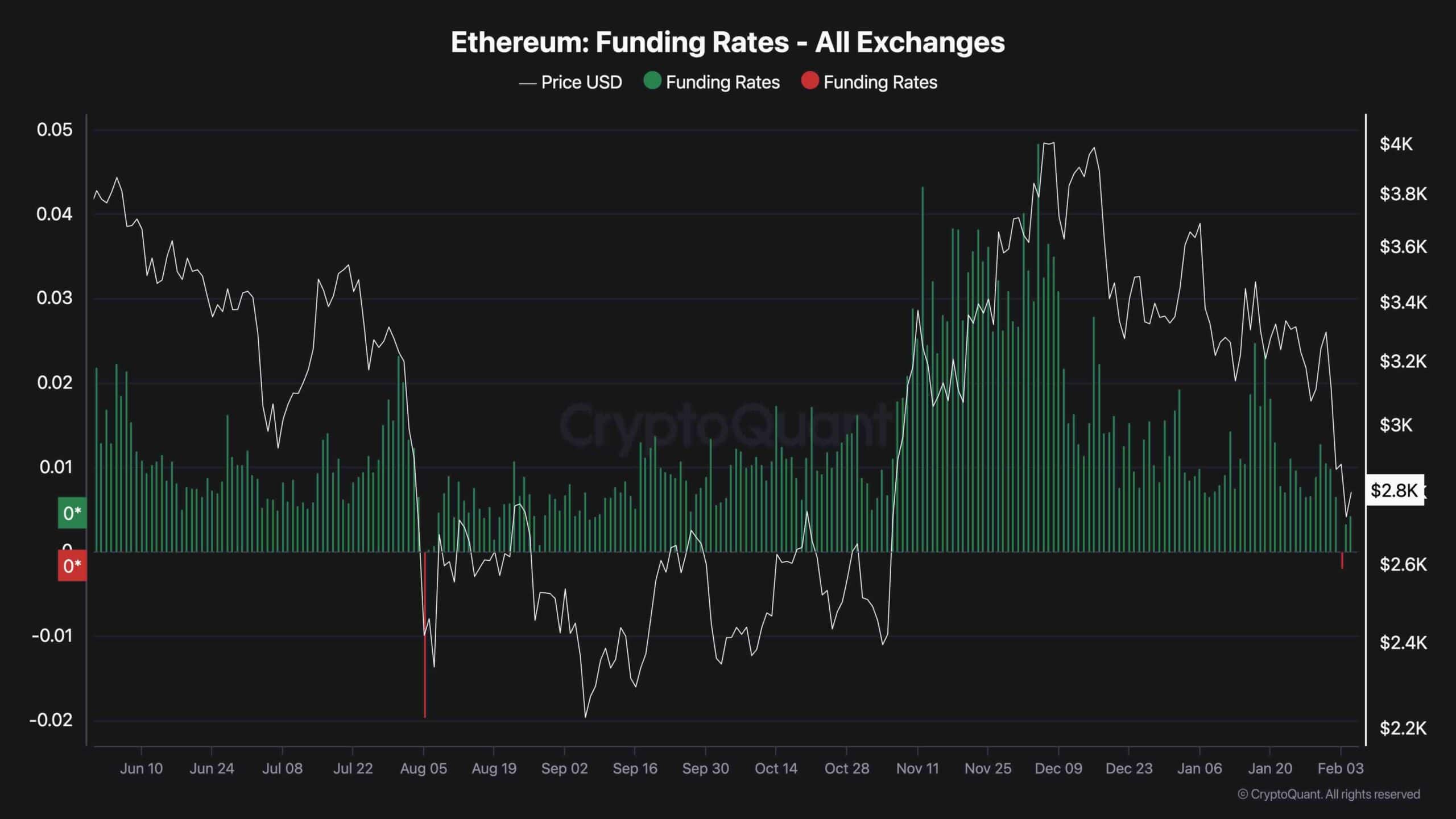

This chart unveils the Ethereum funding rates metric, a measure of the fervor with which buyers and sellers execute their orders. Favorable funding rates sing of bullish sentiment, while negative values croon a bearish ballad.

As the chart reveals, funding rates have plummeted post-crash, a sobering reminder that the futures market is no longer in a fevered frenzy. Yet, without a revival of demand in the spot market, recovery remains a distant dream, like a poet’s unfulfilled longing.

Read More

- Best Crosshair Codes for Fragpunk

- How to Get Seal of Pilgrim in AI Limit

- Wuthering Waves: How to Unlock the Reyes Ruins

- Enigma Of Sepia Tier List & Reroll Guide

- Are We Actually Witnessing a Crunch Time for ADA? 😲📈

- Final Fantasy Pixel Remaster: The Trials of Resurrection and Sleeping Bags

- Lost Records Bloom & Rage Walkthrough – All Dialogue Options & Puzzle Solutions

- Katherine Heigl Says ‘Grey’s Anatomy’ Ghost Sex Was ‘Confusing,’ Reunites With Jeffrey Dean Morgan to Discuss ‘Awkward’ Storyline: ‘She’s F—ing a Dead Guy?’

- Mastering Schedule1: Ultimate Guide to the Management Clipboard

- Shocking NFT Sales Surge! But Where Did Everyone Go? 🤔💸

2025-02-05 21:36