Ah, Ethereum—our beloved digital gold, now sulking beneath the mighty 200-day moving average at $2.6K! One might say it’s just shy of a nervous breakdown, everyone eyeing the same line like a crowd at the kitchen door during dinner time. The smart money whispers of distribution — yes, dear reader, the market folks are busy divvying up the spoils like it’s a picnic, and Ethereum is still standing at the gate, unsure whether to dance or retreat.

What’s the forecast? Well, hold onto your hats because a bearish correction is looming larger than your neighbor’s overgrown lawn. The current price whispers tales of a decline, tiptoeing towards the cozy $2.2K zone—think of it as Ethereum’s midlife crisis. And unless some miraculous bull bursts through that $2.6K barrier, the bearish sentiment will keep working its magic, making everyone’s portfolio groan with despair.

Technical Nonsense — I Mean, Analysis

Thanks to the ever-watchful ShayanMarkets (who probably drinks too much coffee), the daily chart shows Ethereum stubbornly resisting at $2.6K, with bulls still without a leg to stand on. The resistance is tougher than grandma’s meatloaf, and the failure to break through hints that more sellers are sharpening their knives. Adding insult to injury, a bearish divergence between price and RSI makes it clear: beware the impending pullback. The momentum’s as faint as your New Year’s resolutions, hinting at a drop towards the $2.2K support zone. Unless, of course, ETH shatters expectations and rises above $2.6K—then it’s a short squeeze, and who wouldn’t want more drama?

The four-hour chart reveals Ethereum trapped inside a rising wedge—fancy words for “a setup for a fall,” as the wise folks say. After bouncing off the $2.5K floor, it’s wobbling near $2.6K, looking about as confident as a cat on a slippery roof. A downward break from this wedge seems more likely than the profit of the lottery, possibly dropping ETH down to $2.2K. But don’t count out the lurking liquidity monster above $2.7K; it could attract “smart money” (whatever that means), igniting a sudden rally—only for the whole thing to end in tears, as always.

Onchain Mysteriousness and Other Nonsense

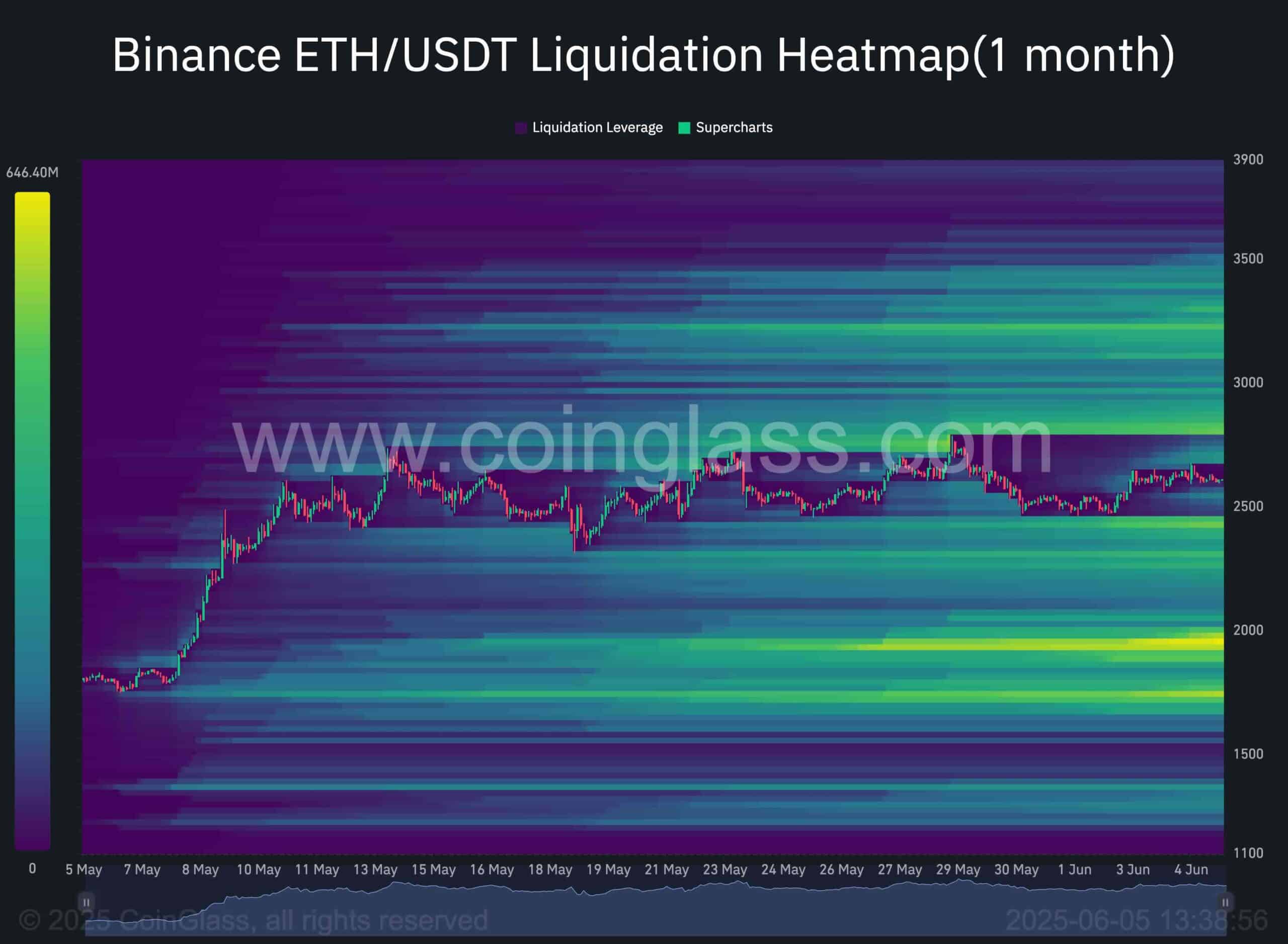

Ethereum, ever the indecisive performer, is now stuck in a wedge pattern—a wonderful metaphor for life, no? The Binance Liquidation Heatmap (which sounds like a fancy weather forecast) shows key liquidity zones near $2.5K and $2.7K. Yes, these are prime spots where whales and day traders line up like kids at an ice cream stand—ready to trigger liquidations or rally in a flash. One good shake, and we’ll see chaos—think of it as a supermarket during a sale, but with more zeros and fewer carts. So, dear survivors, remember: volatility is the name of the game, and risking it all might just leave you with a story to tell at the tavern.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- How to use a Modifier in Wuthering Waves

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-06-05 16:25