- Ethereum is suddenly the belle of the corporate treasury ball, and everyone’s hoping they won’t spill punch on its dress.

- Is this “institutional interest” enough to pump ETH to $3K, or will we all have to keep refreshing those price charts until our fingers cramp?

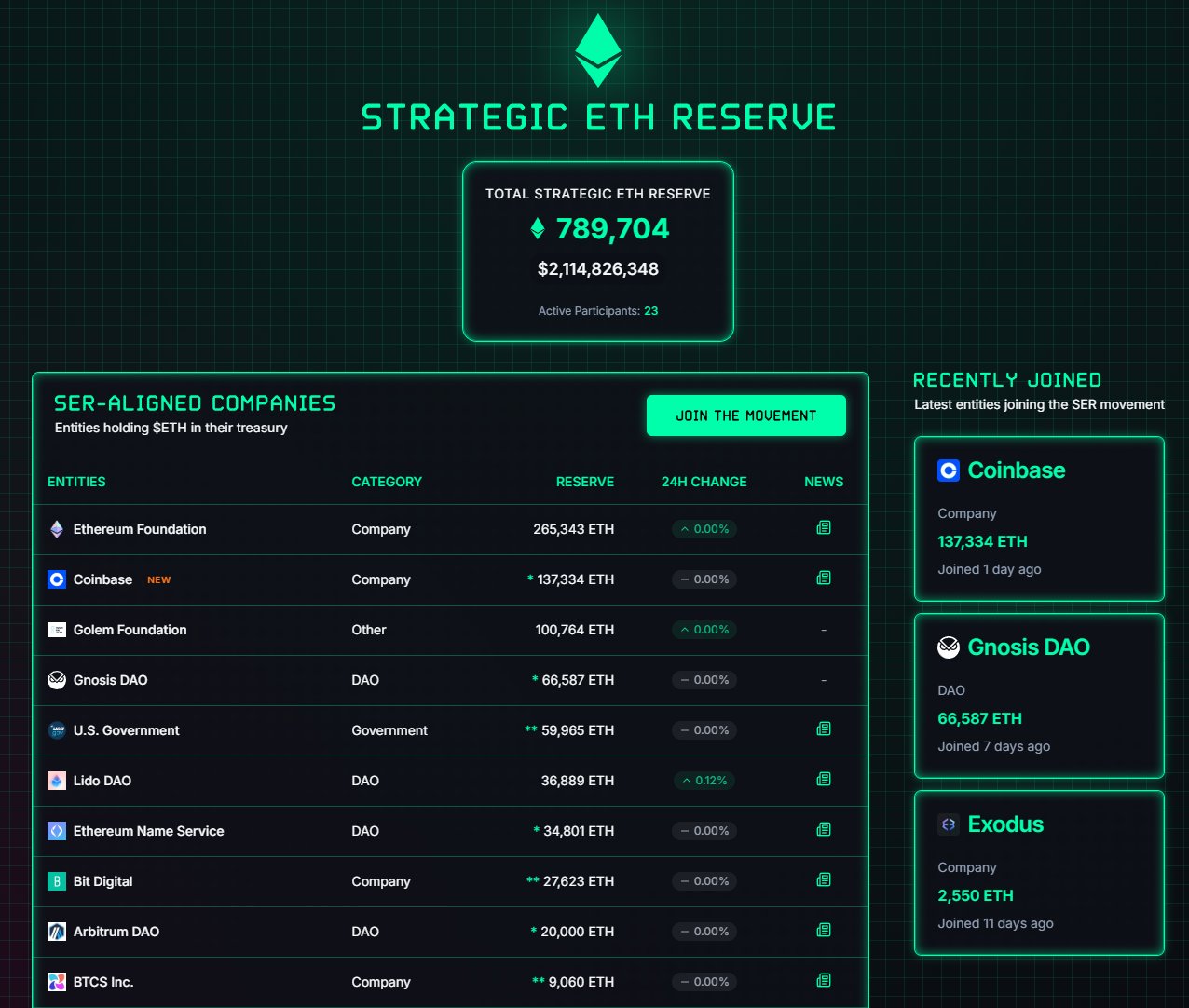

Ethereum’s Strategic Reserve—abbreviated, somewhat optimistically, as SER—has suddenly muscled up, threatening to turn the Bitcoin and Solana boardroom parties into that one dull conference you forgot to RSVP for but, honestly, didn’t really want to attend anyway.

The latest tally: all the institutions you imagine negotiating deals in windowless rooms, plus the actual government of Michigan, now count themselves proud owners of $2.1 billion in ETH (that’s 789,905 coins, and yes, someone had to count).

Ethereum Foundation, Coinbase, and Golem Foundation are leading the pack, which is rather like being first in line for a roller coaster that occasionally catches on fire.

The U.S. government is hoarding 59,965 ETH, presumably hoping the IRS never finds the wallet password. Meanwhile, Michigan—home of lakes and General Motors—has 4,000 ETH. Bhutan, known for mining happiness and Bitcoin, shuffled in with a casual 495 ETH.

Will “Serious Money” Make ETH Moon? 🚀

Whenever a suit buys crypto, you know they’re expecting a return. Just like in Bitcoin, every firm with a boardroom now seems to be playing hot potato with ETH in their treasury. Will it work? Well, according to CryptoQuant, most new demand for Ethereum comes from people with enough in their wallets to buy several small islands (or maybe a moderately sized French château).

These “whales”—because everything in crypto needs an animal, apparently—holding between 10K and 100K ETH (blue) and their slightly less intimidating cousins with 1K-10K ETH (orange) have spent mid-2024 stacking their piles higher.

Between them, these two classes of crypto hoarders have squirreled away 16.7 million and 12.5 million ETH. Meanwhile, retail holders with 100-1K ETH (green—because leprechauns?) got bored and started selling, trimming their stash from 14 million to 9 million ETH.

Translation: giant institutions are now the kid at the birthday party who refuses to share their cake, and the rest of us are left licking the frosting off the knife. Whether the price goes up depends on how long the whale pod stays hungry.

ETH has now popped over 90% from its April low of $1,385, even flirting with $2.7K for the first time since February. Someone credited a successful “Pectra upgrade” for the rally, but personally I suspect it’s just FOMO and everyone’s general terror of missing another crypto run.

So here we are, back in that familiar $2.3K-$2.8K range—the “if you squint it looks bullish” zone. If ETH ever manages to clamber over $3K (cue ominous music and fanfare), perhaps we’ll get a proper rally. Or just another episode of “ETH Trades Sideways: The Series.”

Despite the party hats and confetti, Crypto Twitter (CT) remains unconvinced. Zach Rynes from Chainlink chimed in to say that ETH has picked a fight on three fronts and is losing them all. Presumably, at least one of those is with his own patience.

Other pundits insisted he was wrong, as is tradition. Regardless, the market likes what it sees—for now. CoinGlass shows Binance’s “top traders” increased ETH long positions from 63% in May to 74% in, well, slightly-later May. Because nothing says confidence like doubling down after a 90% rally.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-05-14 20:44