Ah, Ethereum! That enigmatic creature of the crypto world, forever teetering on the edge of glory or despair. For months, the sellers have been huffing and puffing, trying to blow the price below the $3K fortress, but alas, their efforts have been as futile as a bureaucrat’s attempt at efficiency. Recent whispers in the market suggest a bullish rebound, but let’s not get ahead of ourselves, shall we?

ETH remains trapped in a cage, oscillating between the 100-day MA at $3.3K and the 200-day MA at $3K. A breakout from this range? Now that would be a spectacle worthy of a Gogolian tale. Will it soar to the heavens or plummet into the abyss? Only time will tell.

Technical Analysis

By Shayan

The Daily Chart

Ethereum’s price action has been as indecisive as a man choosing between borscht and pelmeni. Following a period of selling pressure, the asset has been consolidating, with sellers repeatedly attempting to breach the $3K support level. But lo and behold, the buyers have been defending this level with the ferocity of a Cossack guarding his vodka stash.

Recently, ETH encountered strong buying pressure near the $3K support zone, leading to a significant rebound. This reaction suggests that the buyers are not to be trifled with. However, for a successful breakout above the $3.5K mark, Ethereum needs more than just a few enthusiastic buyers. It requires a full-blown bullish momentum, the kind that makes bears tremble in their fur coats.

The upcoming price action within this range will be crucial in defining Ethereum’s mid-term trajectory. Both bulls and bears are poised for a potential breakout, and the tension is palpable. Will it be a triumphant march or a humiliating retreat? Stay tuned.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum is consolidating within a descending wedge pattern. The price recently bounced from the wedge’s lower boundary at $3K, aligning with the 0.618 Fibonacci retracement level. This reinforces the area as a strong support zone, much like the foundation of a sturdy Russian izba.

Currently, Ethereum is trading within the tight $3K-$3.3K range, approaching the narrowing end of the wedge pattern. A breakout from this zone is imminent, and the direction will be crucial in determining the market’s next major trend. Given the market conditions, a bullish breakout above this pattern could trigger a rally toward the $4K threshold in the mid-term.

Onchain Analysis

By Shayan

While ETH has shown early signs of recovery, market participants are closely monitoring the likelihood of a breakout above the current price range. The key question remains whether the cryptocurrency can generate enough momentum to breach the critical $3.5K resistance level.

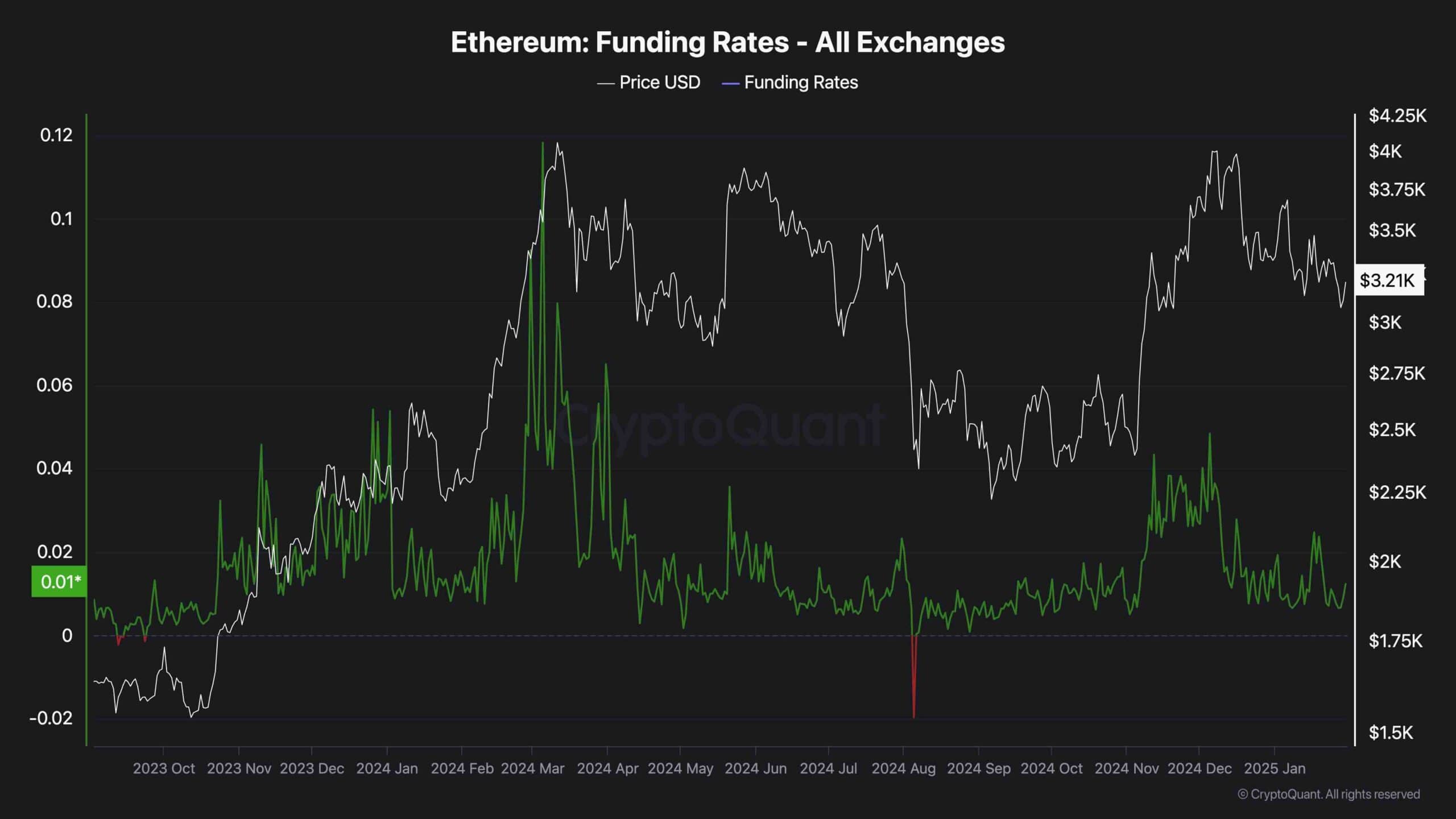

The funding rates metric, a crucial indicator of market sentiment, has recently declined, suggesting that the market is no longer overheated. This cooling-off phase indicates that excessive leverage has been reduced, creating room for a potential sustained rally if demand in the spot market increases.

Notably, funding rates have started to rise slightly alongside Ethereum’s price rebound. This subtle shift hints at growing bullish momentum in the perpetual futures market. However, for a decisive breakout above the $3.5K threshold, the funding rates metric must increase further, signaling heightened optimism and an influx of long positions. If demand continues to grow, ETH could be poised for a significant rally in the coming days.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-30 16:42