TL;DR

- Accumulator wallets are going all-in, adding over 1.13M ETH in two weeks—take that, Netflix binge!

- Ethereum has hit a key liquidity level near $3,750 and traders are eyeing a cozy $3,250–$3,300 as the next cozy little support nook.

- On-chain metrics and MACD signals say, “Keep calm and carry on”—even if ETH/BTC has taken a little detour.

Big Spenders Drop Over $4 Billion in ETH 💸

So, get this: Ethereum wallets belonging to our big-spending friends have collectively dropped more than 1.13 million ETH into their digital piggy banks over the last two weeks. That’s a whopping $4.18 billion! I mean, who needs a yacht when you’ve got crypto, am I right? Analyst Ali Martinez noted that this buying frenzy is “unusually strong,” which is a fancy way of saying these whales are making it rain. 🌧️

Whales have bought more than 1.13 million Ethereum $ETH, worth $4.18 billion, in the last two weeks!

— Ali (@ali_charts) July 24, 2025

At press time, the price of ETH was lingering around $3,6160—quietly hoping to one day be a household name like Oprah. Trading volume? Oh, just a casual $50 billion in the last 24 hours. While things are slightly up today, let’s be real: it’s been wobbling like a toddler on roller skates this past week.

Accumulator Wallet Activity: Making History! 🎉

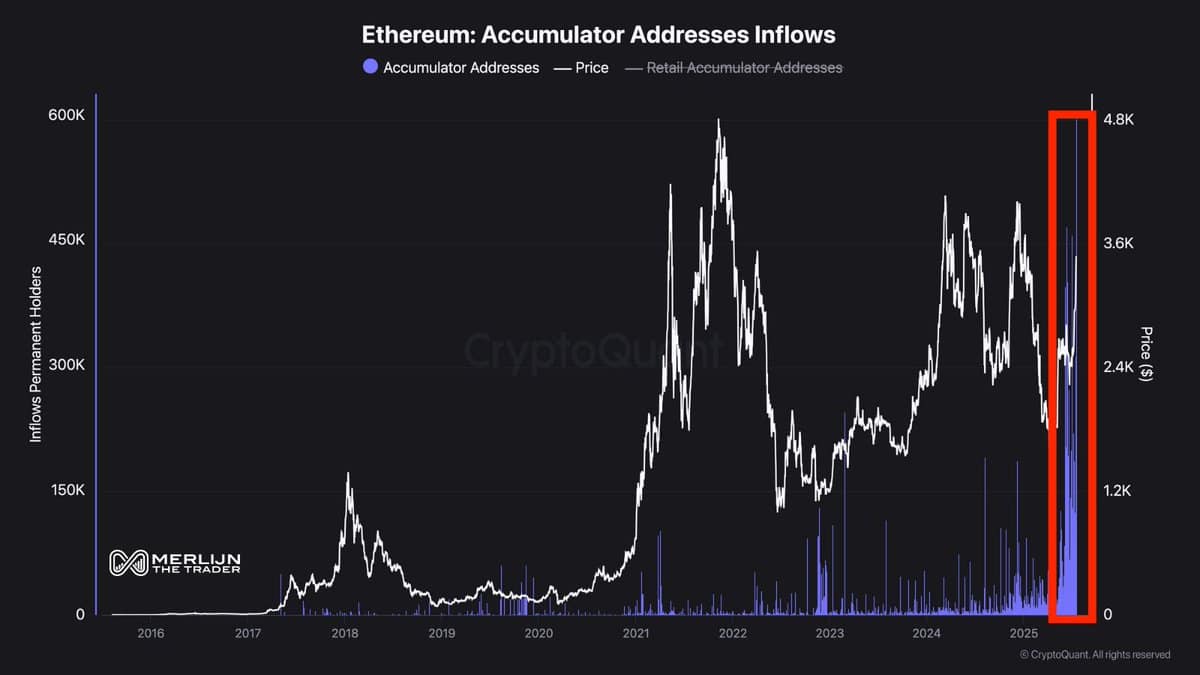

According to CryptoQuant, Ethereum inflows into long-term wallets are breaking all the records, folks! These “accumulator” wallets, which are like the hoarders of the crypto world, just can’t stop, won’t stop. Merlijn The Trader claims we’ve hit levels “greater than any period in 2018, 2020, or 2022.” These folks must either really trust their investments or just really love the thrill of bulking up their digital hoards.

Charts confirm that these inflows are gaining momentum faster than I can forget my gym membership—so don’t sleep on this!

Meanwhile, many are left wondering: what’s fueling this sudden demand? While our day-trading friends might be riding the waves of momentum, these accumulator wallets are quietly positioning themselves for long-term glory.

Price Dips into Liquidity Zone Near $3,750 ⚖️

Ethereum recently dipped its toes into a key buying liquidity area around $3,750. This cheerful little zone also includes a previous order block from late 2021—talk about a throwback! This has led to some short-term selling as traders take their well-deserved profits.

Crypto Eagles are chirping about how a dip between $3,250 and $3,300 might just be on the horizon. If ETH hangs tight above this threshold, we could be gunning for that glorious $4,200 mark! Bring on the confetti!

$ETH just tapped into a major buyside liquidity zone around $3,750, sweeping the old order block from late 2021

– Bullish continuation confirmed but short-term correction into the new FVG at $3,250–$3,300 is likely

– If price respects this FVG, next push could target $4,200+…

— Crypto Eagles (@CryptoProject6) July 24, 2025

The MACD is looking quite happy these days, showing rising momentum. The signal lines are strutting their stuff in positive territory, and the histogram is growing faster than my urge to snack on Halloween candy.

Ethereum has boasted a 50% gain in the past month, even reaching $3,850 before deciding to take a little breather. Meanwhile, the ETH-to-BTC price ratio slipped 5.8% recently as if it was taking short breaks after a sugar rush.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- LINK PREDICTION. LINK cryptocurrency

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

2025-07-25 13:55