In a rather delightful tête-à-tête with the Bankless podcast, our dear Arthur Hayes, the erstwhile BitMEX CEO and now the grand maestro at Maelstrom, has unveiled his rather audacious predictions for Ethereum. He suggests that a leap to $10,000 or even a cheeky $15,000 is not merely a pipe dream, but a plausible outcome as global liquidity pirouettes and capital controls take center stage in this new monetary theatre. 🎭

When quizzed about the recent 50% surge in ETH, Hayes waved away technical mumbo-jumbo and pointed to the fickle nature of sentiment. “The most despised asset tends to rise the quickest in the next act,” he quipped. “It’s simply human nature, darling.” After years of languishing in the shadows of Solana and other high-flying tokens, Hayes believes Ethereum’s grand revival is long overdue. “ETH was practically on life support. Everyone loathed it. The BTC/ETH ratio was plummeting, while Solana was off to the races… it was high time for a comeback!”

Why Ethereum Could Soar To $10,000

Despite not having added to his own Ethereum stash, Hayes remains bullish, unfazed by the current price. “It’s splendid that it’s climbing, but let’s have a proper chat when it hits $10,000 or $15,000. Then we’ll talk turkey!”

Hayes contextualizes Ethereum’s resurgence within what he dubs a global monetary “phase shift”—a dramatic pivot away from the US Treasury as the world’s reserve asset, towards a dual system where value increasingly flows to gold and Bitcoin. In this new paradigm, Ethereum stands to gain not just from speculative frolics, but also from the structural upheavals in capital movement under the tightening grip of financial repression and capital controls.

While he reiterates that gold and Bitcoin are the two neutral reserve assets in this politically fractured world, Hayes sees Ethereum as a thrilling high-beta play in the forthcoming liquidity extravaganza. “They’re printing money like it’s going out of style,” he stated bluntly. “And the result will be gold and Bitcoin soaring to the heavens!”

However, the road for Ethereum won’t be a straight line. Hayes acknowledges ETH’s underwhelming performance against Bitcoin thus far, but he hints that its moment is nigh—especially if regulatory clarity improves or if decentralized finance regains its footing with sustainable cash flows. He pointed to projects like EtherFi and Pendle as potential shining stars that might finally validate their worth through solid fundamentals.

Hayes argues that the potential for Ethereum to dramatically outperform remains, particularly as the market digests what he perceives as the dawn of the end for the 50-year US Treasury-based global financial system. “If you wish to maintain access to capital and spend it as you please, the only assets worth owning are gold and Bitcoin,” he declared. Yet, for the investor with a taste for asymmetry, ETH is “a bit of a slog” at present—albeit still in the early stages of what could be a runaway rally.

Whether Ethereum reaches the coveted $10,000 mark in 2025 or beyond, Hayes is preparing for that eventuality. “Mailstream is about 60% Bitcoin, 20% ETH, and a smattering of other delightful shitcoins and token deals. As for my non-crypto investments, it’s all about physical gold and gold miners, darling. That’s the ticket!”

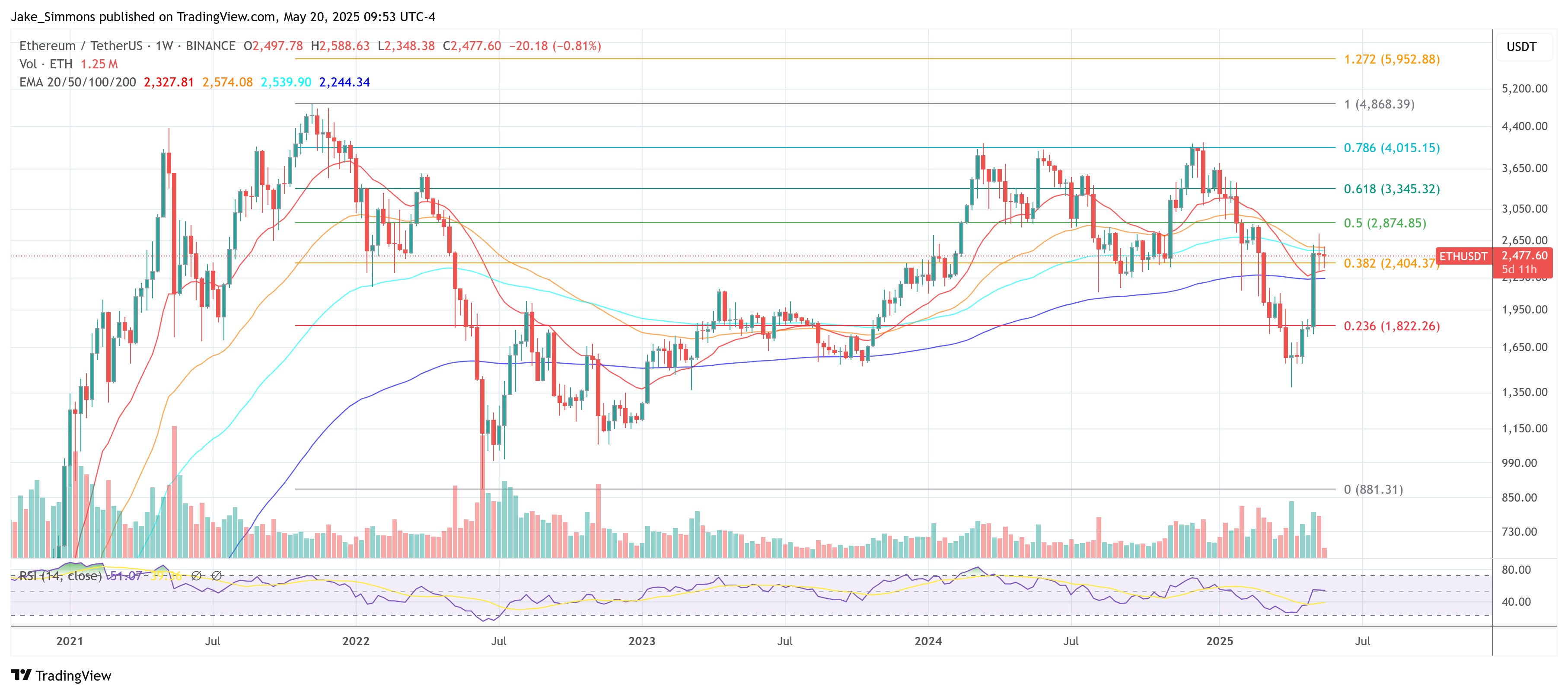

As of the latest gossip, ETH is trading at a modest $2,477. 🤑

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Basketball Zero Boombox & Music ID Codes – Roblox

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-21 05:11