Ethereum’s price has been gradually declining after the rejection from the $4,000 resistance level.

Yet, things might finally change soon as the asset bounced off the $3,000 support.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the recent weeks, the asset’s daily chart shows a trend of forming lower peaks and troughs after it was unable to break through the $4,000 barrier. Additionally, the $3,500 level has been breached as the market has fallen to the $3,000 region, which coincides with the location of the 200-day moving average.

Nevertheless, this stage has bolstered the leading altcoin, propelling it upward to challenge the $3,500 mark once more. Should the market manage to surpass this region, a surge towards the $4,000 resistance point becomes probable.

The 4-Hour Chart

Over the last several weeks, Ethereum (ETH) has been creating a downward-sloping channel on the 4-hour chart. Given that the market has bounced back from the lower trendline of this channel twice already, it seems likely that ETH will soon approach the upper boundary of this pattern.

If the Relative Strength Index (RSI) indicates values exceeding 50%, it points to an upward trend that could extend beyond the current pattern, possibly heading towards the $4,000 region, favoring a bullish outlook.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

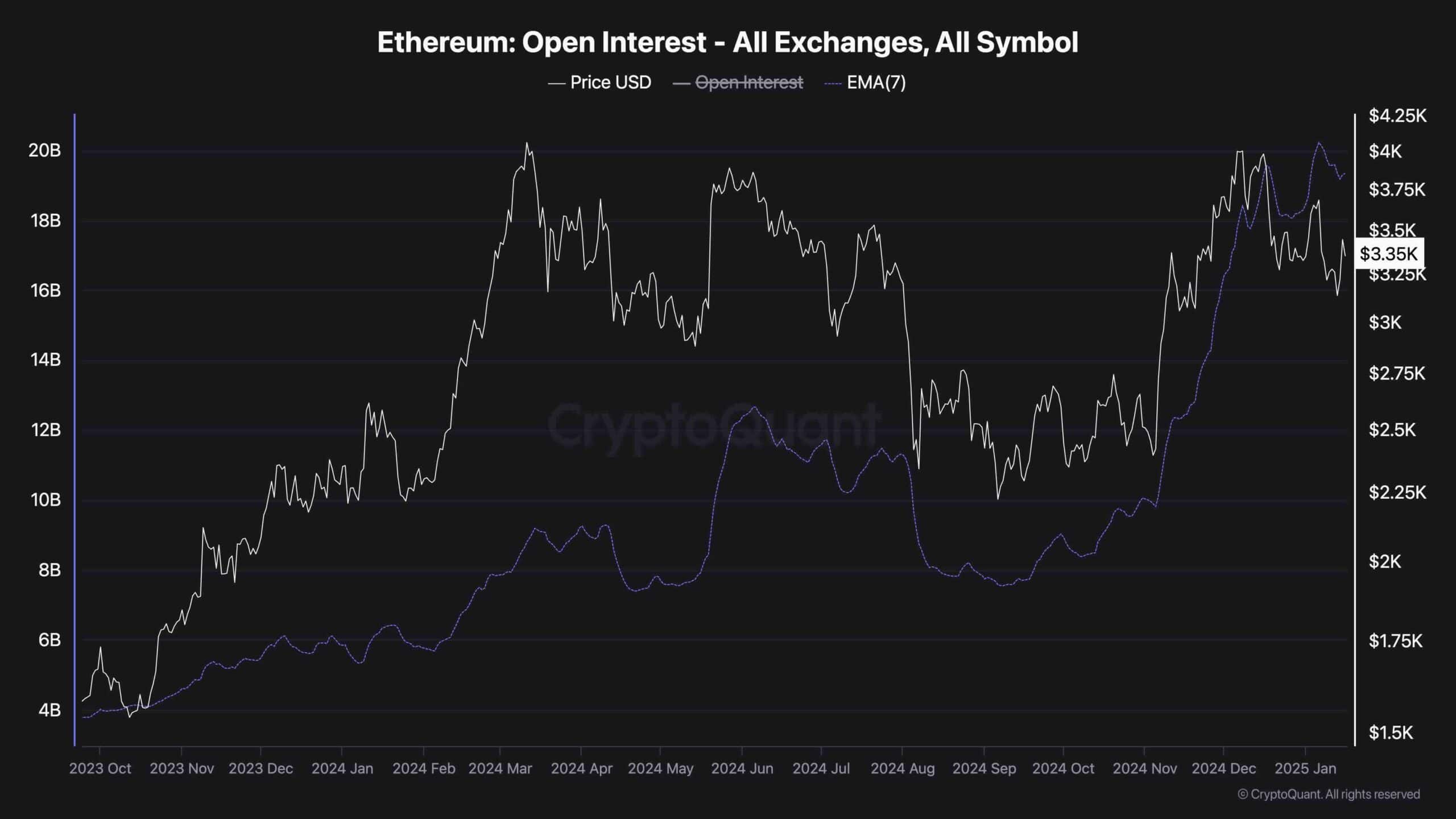

Ethereum Open Interest

Over the past month, Ethereum’s value has experienced a downtrend, leading some investors to ponder if an enduring uptrend is imminent or if further fluctuations and unpredictability might follow instead.

This graph illustrates the open interest indicator, which calculates the total number of outstanding futures agreements across all trading platforms. Generally, larger figures signify greater market volatility because the likelihood of swift margin calls multiplies as risk of mass liquidations rises.

The chart demonstrates that the open interest metric has been rising consistently over the recent weeks. This suggests that more liquidations could still be expected, and the volatility has yet to decrease.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-16 17:20