As a seasoned crypto investor with a decade of experience under my belt, I’ve seen bull runs and bear markets come and go. The current bearish action in Ethereum is causing a bit of unease among market participants, but it’s nothing new to me.

The cost of Ethereum hasn’t managed to reach a fresh all-time peak yet, instead showing signs of downward trend, which has traders concerned that the rally may have concluded.

The asset now remains below $3,500, which has turned into a key resistance line.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Since early November, the daily price trend has shifted towards a bullish phase following its bounce back from the $2,300 support line. Yet, the $4,000 resistance area has thwarted the market’s upward push and even led to a decline, with the $3,500 level also being surrendered.

At present, there’s a strong possibility that the market will trend downwards towards the $3,000 support level and the 200-day moving average, which approximately coincide in price. As Ethereum (ETH) maintains its position above the 200-day moving average, the overall market direction remains optimistic (bullish). However, if ETH falls below this moving average, a more significant drop towards the $2,000 region might occur.

The 4-Hour Chart

Over the course of the last four hours, I’ve noticed an interesting development in the market. It appears we’ve attempted to breach the $4,000 resistance level on two occasions, but each time, we’ve fallen short, creating a distinct double-top pattern. This pattern suggests potential resistance ahead.

With the neckline of the pattern, which is the $3,500 level, broken to the downside and the RSI showing bearish momentum, the market could correct more or even consolidate in the coming weeks before it is able to continue its upward trajectory.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Ethereum Taker Buy Sell Ratio

As a researcher studying the cryptocurrency market, I find myself delving into Ethereum’s current predicament – its struggle to sustain an uptrend and reach another all-time high. Examining sentiments in the futures market could offer valuable insights into the possible factors leading to this correction and whether it might be nearing an end.

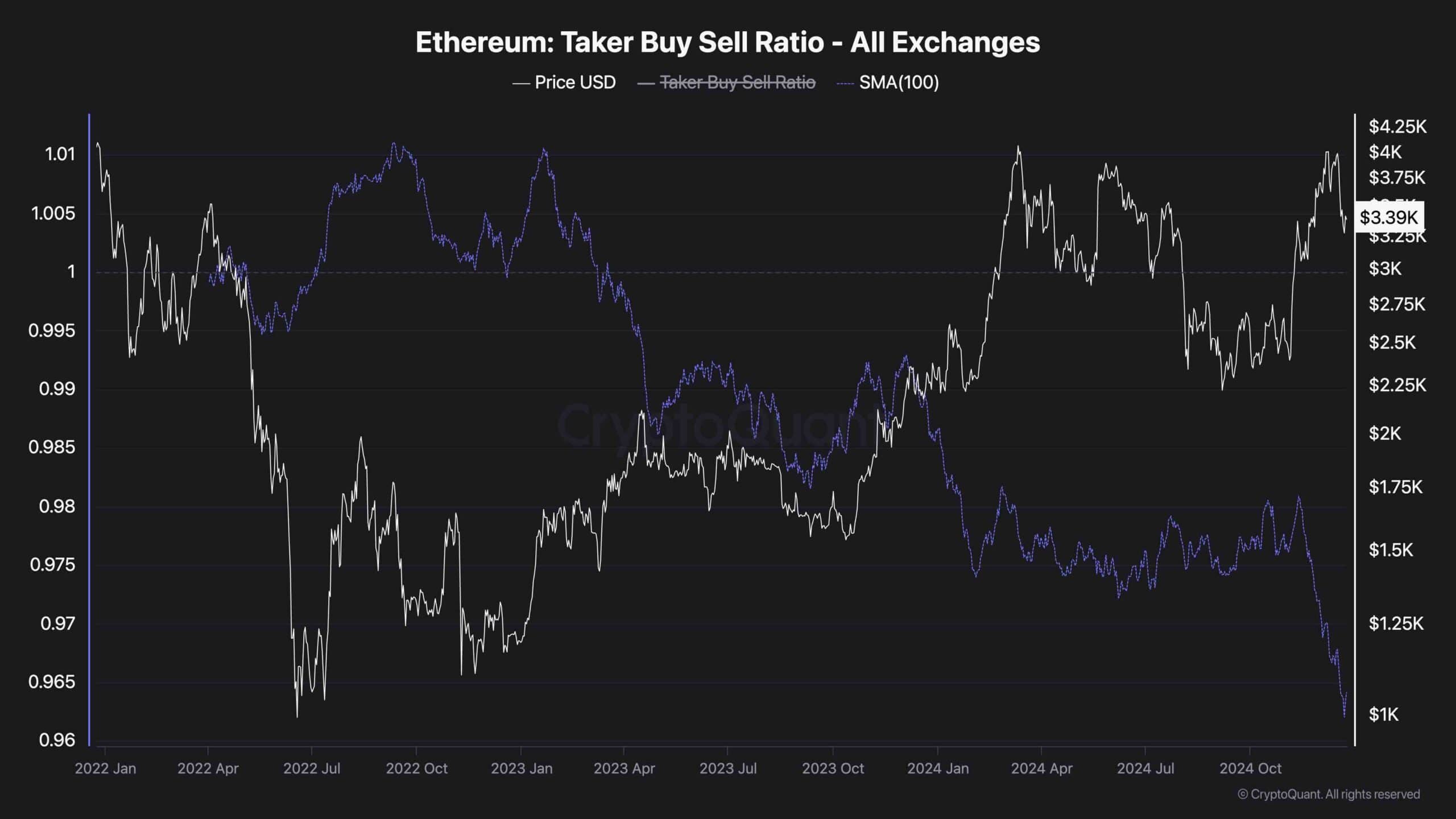

This graph illustrates the Taker Buy Sell Ratio indicator, showing which group – buyers or sellers – is making trades more actively overall, based on market orders.

As the chart suggests, the 100-day moving average of the Taker Buy Sell Ratio has been showing values below one for over a year now, with the metric currently experiencing a massive drop. This indicates that the recent correction might be due to the selling pressure coming from the futures market rather than the spot market, and as long as the metric is trending down, it will be difficult for the market to recover.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- What was the biggest anime of 2024? The popularity of some titles and lack of interest in others may surprise you

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

- ‘We Will Rebuild L.A.’: Rams Players Celebrate First Responders at Relocated NFL Wild Card Game Against Minnesota Vikings

- An American Guide to Robbie Williams

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Michael Schlesinger, Repertory Executive and Classic Film Enthusiast, Dies at 74

- Timothée Chalamet Went Electric and Got Fined

2024-12-25 10:18