As a crypto investor, I’ve noticed some significant fluctuations in Ethereum lately. It experienced a 10% spike, which seems to be connected to heightened market activity coinciding with President Trump’s inauguration.

Despite this, the value of the asset is encountering a crucial obstacle around $3,500. The future market movement should provide insight into its forthcoming direction.

Technical Analysis

By Shayan

The Daily Chart

ETH saw strong buying activity around the $3.2K level that was supported by its 100-day moving average, causing a jump of approximately 10% in price. This increased demand has pushed ETH towards a crucial resistance zone at $3.5K, which coincides with the upper limit of the bullish flag formation.

If the current trend continues, Ethereum could surpass the $3.5K mark, potentially leading to an upward push towards the $4K region that serves as a significant resistance. But keep in mind, near-term price fluctuations will play a crucial role in shaping the market’s direction, and we might witness increased volatility along the way.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s volatility is clear, with its price oscillating around the Fibonacci retracement levels of approximately 0.5 to 0.618. This area, defined by $3,200 as a base and $3,500 as a ceiling, reflects the ongoing struggle between buyers and sellers. The market structure at present suggests optimism, hinting towards a possible bullish breakout gaining strength.

If buyers succeed, Ethereum could embark on a sustained rally toward $4K. However, the increased volatility and potential liquidations necessitate careful risk management, as a rejection at $3.5K could lead to short-term retracements.

Onchain Analysis

By Shayan

During the past period, Ethereum has been confined between the price points of $3,200 and $3,500. Market observers are contemplating the possibility of an upward surge after the inauguration of President Trump, hinting at a bullish trend.

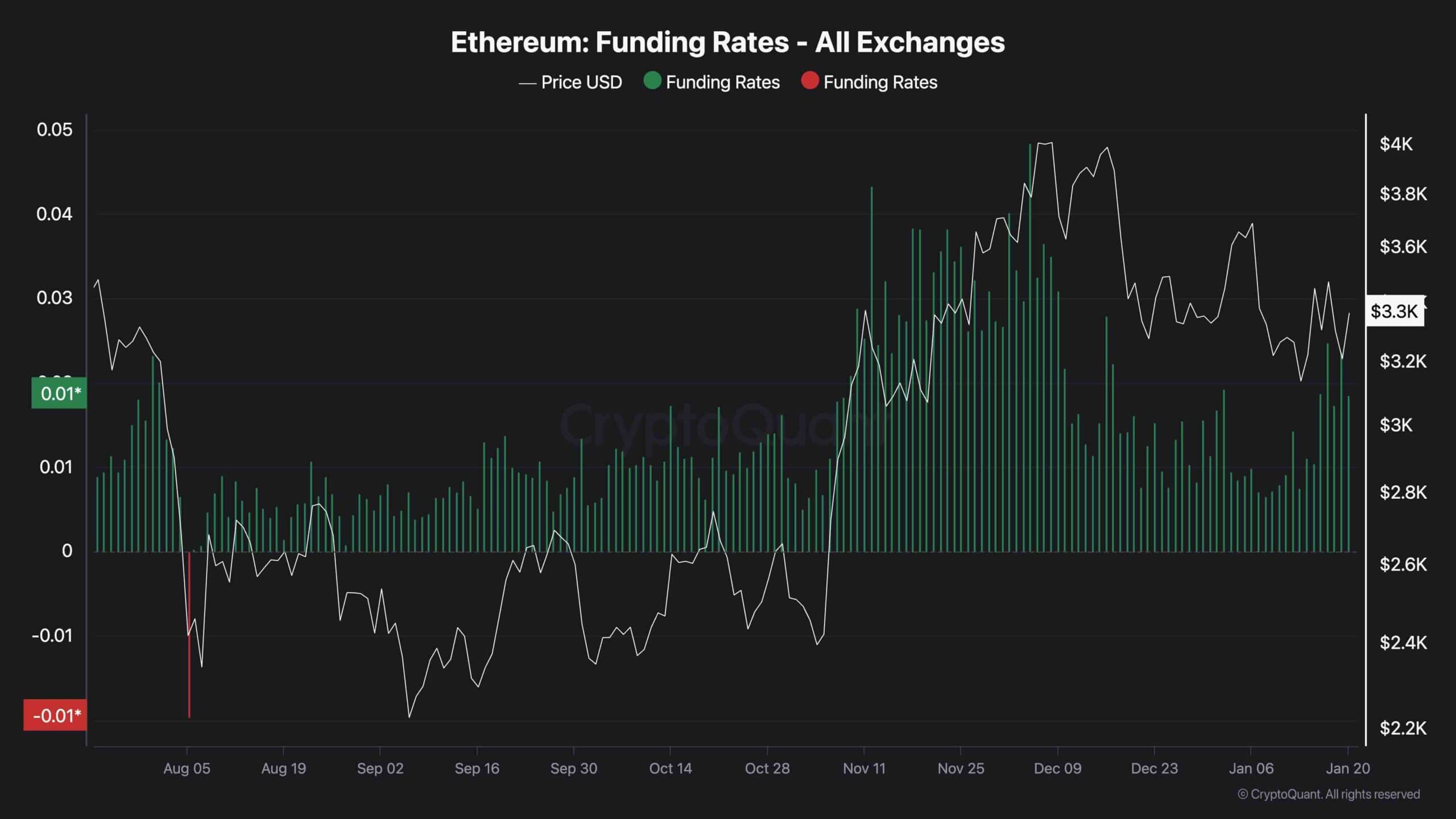

The “funding rates” measure, which reflects the general market attitude, has been decreasing lately, implying fewer long-term investments and a dwindling optimistic outlook. Interestingly, this metric has surged significantly of late, indicating an uptick in positive sentiment within the continuous trading markets.

As Ethereum nears the $3,500 resistance point, the significant amount of supply at this stage emphasizes the importance of continuous bullish energy. In order for a clear breakout to happen, the funding rates indicator needs to increase more, indicating growing market enthusiasm and additional long positions being taken.

A break above $3.5K remains contingent on stronger bullish sentiment in the futures market. The funding rates metric will play a pivotal role in determining whether Ethereum can overcome the $3.5K threshold, making the upcoming market action crucial.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-20 16:59