As a crypto investor, I’ve noticed that the value of Ethereum has taken a significant dip lately, attributed to heightened selling actions. This downtrend led us right to the pivotal 100-day moving average at approximately $3.1K.

At this stage, we find a significant area of stabilization and possible turning point for the cryptocurrency’s upcoming direction change.

Technical Analysis

By Shayan

The Daily Chart

The strong downward trend in Ethereum’s price has pushed it towards the 100-day moving average at $3.1K, a crucial and psychologically important support zone. This area is expected to trigger increased buying interest because it aligns with significant technical signals. Nevertheless, the persistent selling activity highlights the prevailing bearish attitude, leaving the market in a vulnerable state.

If Ethereum stays above its current support, it might lead to an uptrend, alleviating fears of continued drops. On the flip side, falling below the $3.1K support and breaking through the 200-day moving average could initiate a rapid series of sell-offs, with the price possibly aiming for the $2.5K level as the next potential stronghold.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s price movement demonstrates the effects of breaking free from an ascending wedge formation, a bearish pattern that frequently signals upcoming drops. This break has triggered a rapid fall in price, with the cryptocurrency now sitting close to a support zone determined by the 0.5-0.618 Fibonacci retracement zones.

This support range is expected to temporarily stabilize the price, potentially initiating a short-term bullish rebound. However, the market remains on edge, as continued bearish pressure could lead to a breakdown below this support region. In such a scenario, the bearish retracement is likely to extend, further solidifying sellers’ control in the near term.

Onchain Analysis

By Shayan

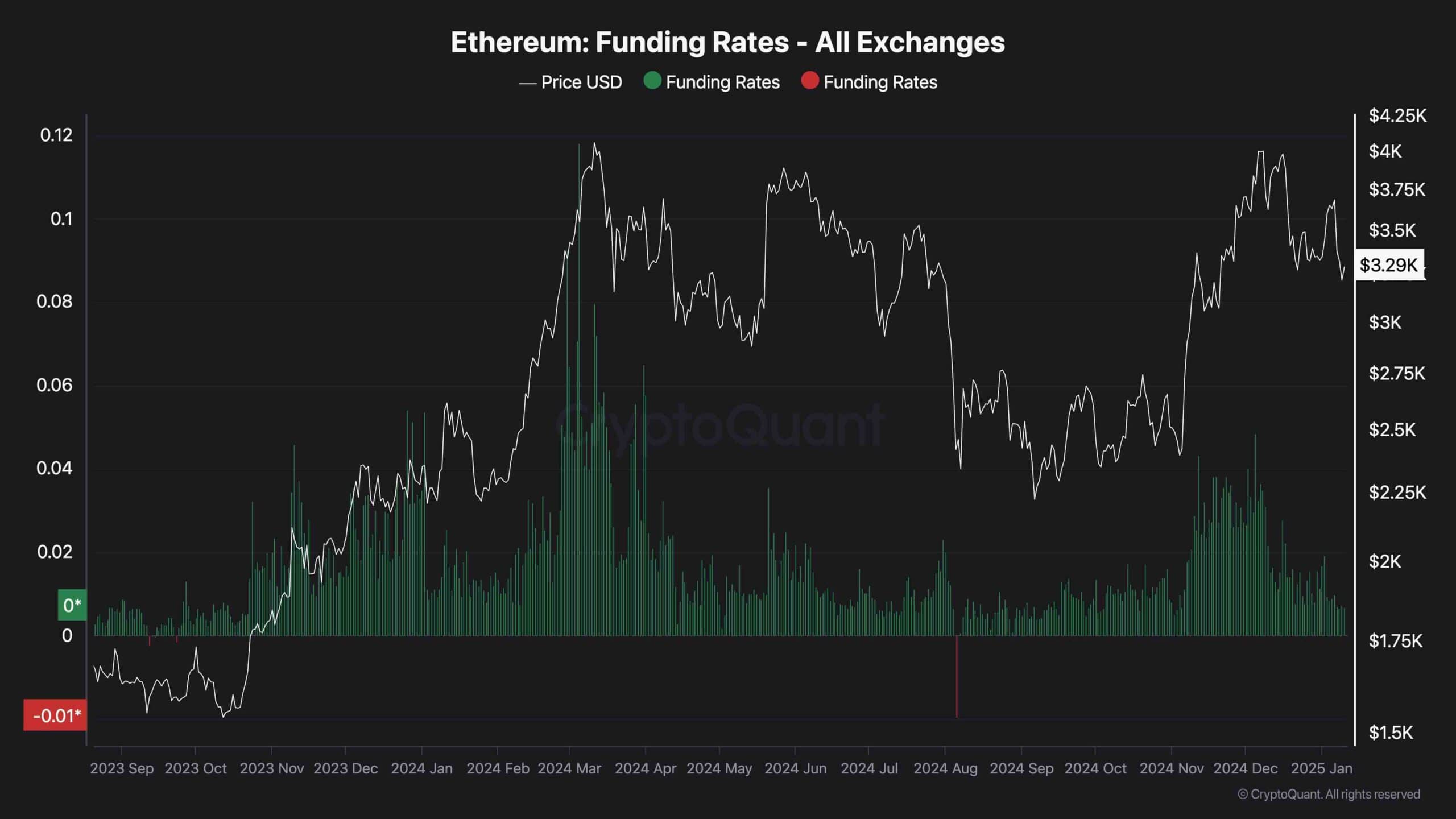

The general upward trajectory of Ethereum might be threatened since Funding Rates, an essential sign of demand in the derivatives market, are delivering ambiguous messages. Although rates surged during the upswing’s peak, their subsequent drop following rejection at the $4K resistance suggests a decrease in traders’ enthusiasm.

At first, Funding Rates increased slightly, showing a cautious optimism. But their significant fall later suggests decreased demand, which weakens Ethereum’s bullish trend. If trader confidence doesn’t recover, maintaining the upward trend could be difficult. The $3K level is crucial; if it’s held above it, the market might stabilize and revive the bullish sentiment. However, if broken, it may trigger increased selling and a more pronounced correction.

Overall, Ethereum’s outlook depends on reclaiming higher Funding Rates and defending $3K. These factors determine whether the market resumes its uptrend or faces further corrections.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-10 17:34