As an analyst with over a decade of experience in the cryptocurrency market, I have witnessed the ebb and flow of digital assets like Ethereum more times than I can count. The latest dip below $4K is reminiscent of a rollercoaster ride that I’ve become all too familiar with.

It seems that Ethereum hasn’t been able to surpass the crucial $4,000 barrier yet, which resulted in a drop in its value. But now, it’s found a key area of support, and experts predict a potential bounce back, followed by some stabilization.

Technical Analysis

By Shayan

The Daily Chart

Over the past year, the $4,000 price level on Ethereum has shown itself as a significant barrier, frequently stopping positive price movements because of intense selling activity.

Lately, I’ve noticed that the price has been met with another rejection at this particular level, leading to a substantial drop in value. This downward trend was amplified by Federal Reserve Chairman Jerome Powell’s remarks hinting at a possible halt in their ongoing policy of reducing crucial interest rates.

Even though ETH experienced a dip, it has managed to regain strength at approximately $3,000 – an essential price point. This recovery has propelled ETH above the $3,500 mark for now. At present, ETH is stabilizing between $3,500 and $4,000, with anticipation of a possible bullish surge to challenge the $4,000 barrier once more after this consolidation period.

The 4-Hour Chart

On the 4-hour Ethereum chart, when it was unable to break through the $4K resistance, it plunged significantly, falling below an ascending wedge formation. This suggests that sellers are in control, causing a strong downward trend that initially pulled back, but then continued its descent.

Currently, Ethereum is being traded around a substantial area of potential support, which is marked by the 0.5 Fibonacci retracement level at approximately $3.2K and the 0.618 Fibonacci retracement level at about $3K.

In simpler terms, this situation should bring some stability over the near and medium term. There might be more consolidation with small pullbacks. If the current support stays strong, traders could start buying again, potentially leading to another effort to break through the $4K ceiling.

Onchain Analysis

By Shayan

The fact that Ethereum didn’t manage to surpass the $4,000 level led to a surge of liquidations in the futures market, which was then followed by a sudden and dramatic drop in price (flash crash), seemingly dampening the overall enthusiasm among investors.

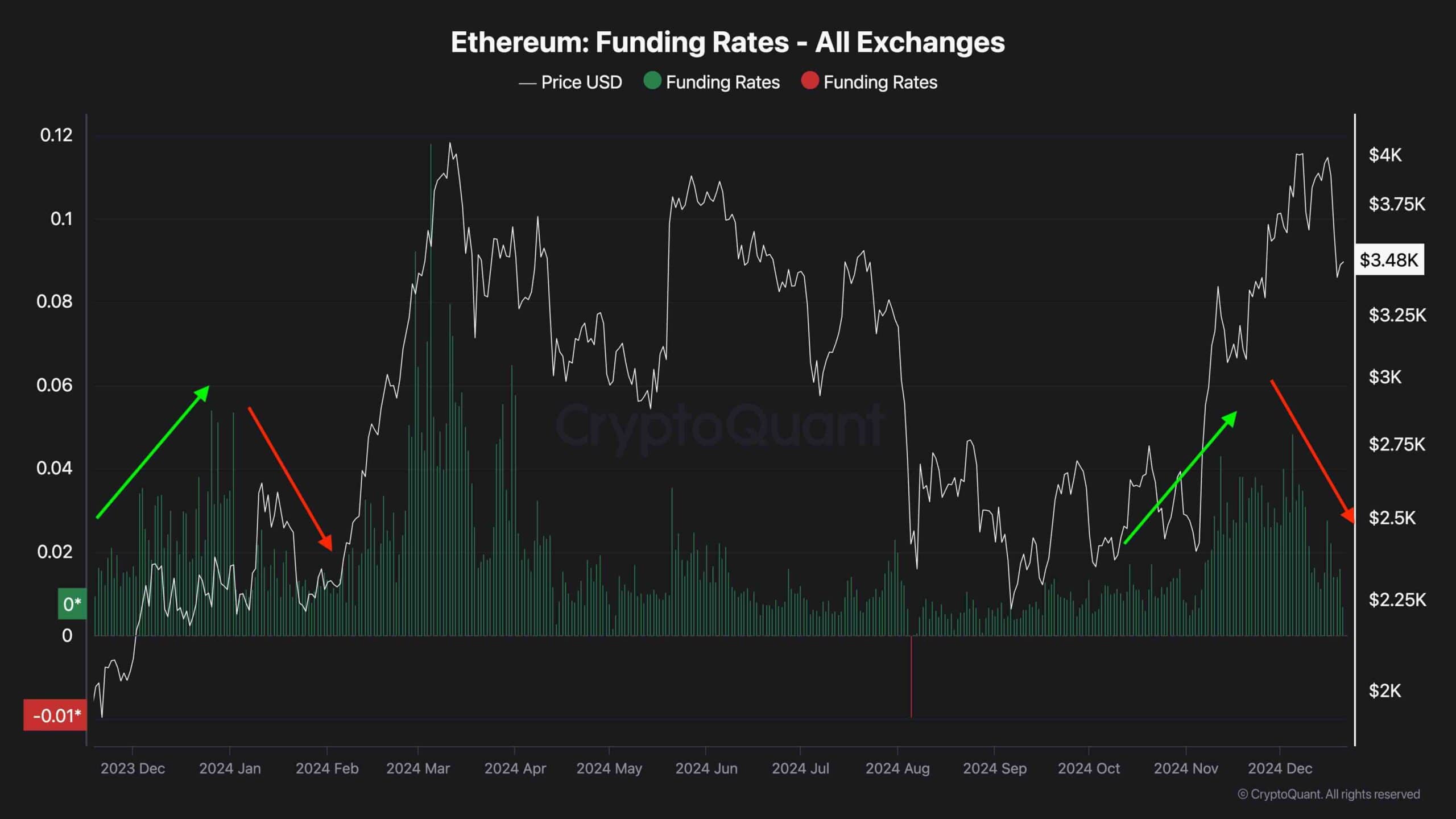

The graph shows the funding rates measurement, which is a trustworthy gauge of the feelings in the futures market about Ethereum. Last week, Ethereum’s overall funding rates experienced a significant increase. However, the rejection at $4K resulted in extensive liquidations, causing the funding rates to return to levels that typically support a bullish trend.

The cooling influence might prepare the ground for a longer-term eco-friendly surge in the upcoming weeks. In a way reminiscent of January 2024, a significant drop in funding rates brought tranquility to the futures market, thereby establishing the conditions for Ethereum’s subsequent strong upward trend. This past occurrence indicates that the current market adjustment could signal the start of another positive cycle.

Read More

- Skull and Bones: Players Demand Nerf for the Overpowered Garuda Ship

- Gaming News: Rocksteady Faces Layoffs After Suicide Squad Game Backlash

- SUI PREDICTION. SUI cryptocurrency

- League of Legends: The Mythmaker Jhin Skin – A Good Start or a Disappointing Trend?

- ‘The Batman 2’ Delayed to 2027, Alejandro G. Iñarritu’s Tom Cruise Movie Gets 2026 Date

- RIF PREDICTION. RIF cryptocurrency

- Destiny 2: The Surprising Stats Behind Slayer’s Fang – A Shotgun Worth Discussing

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Deep Rock Galactic: Shy Dwarfs Unite! Tips for Communicating in the Depths

- The Hilarious Realities of Sim Racing: A Cautionary Tale

2024-12-21 20:12