As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I’ve seen trends come and go, but Ethereum‘s recent surge has certainly piqued my interest. The robust support at $3.5K and subsequent bullish rebound are reminiscent of a phoenix rising from the ashes – a symbol that always brings hope to cryptocurrency enthusiasts like myself.

The $4K resistance looms large, but I believe Ethereum has what it takes to break through this barrier. If history repeats itself, we might just see ETH soaring past this level and setting new highs. However, as they say in the crypto world, “never underestimate the power of a bear market,” so I’ll keep my eyes on that support at $3.5K, just in case.

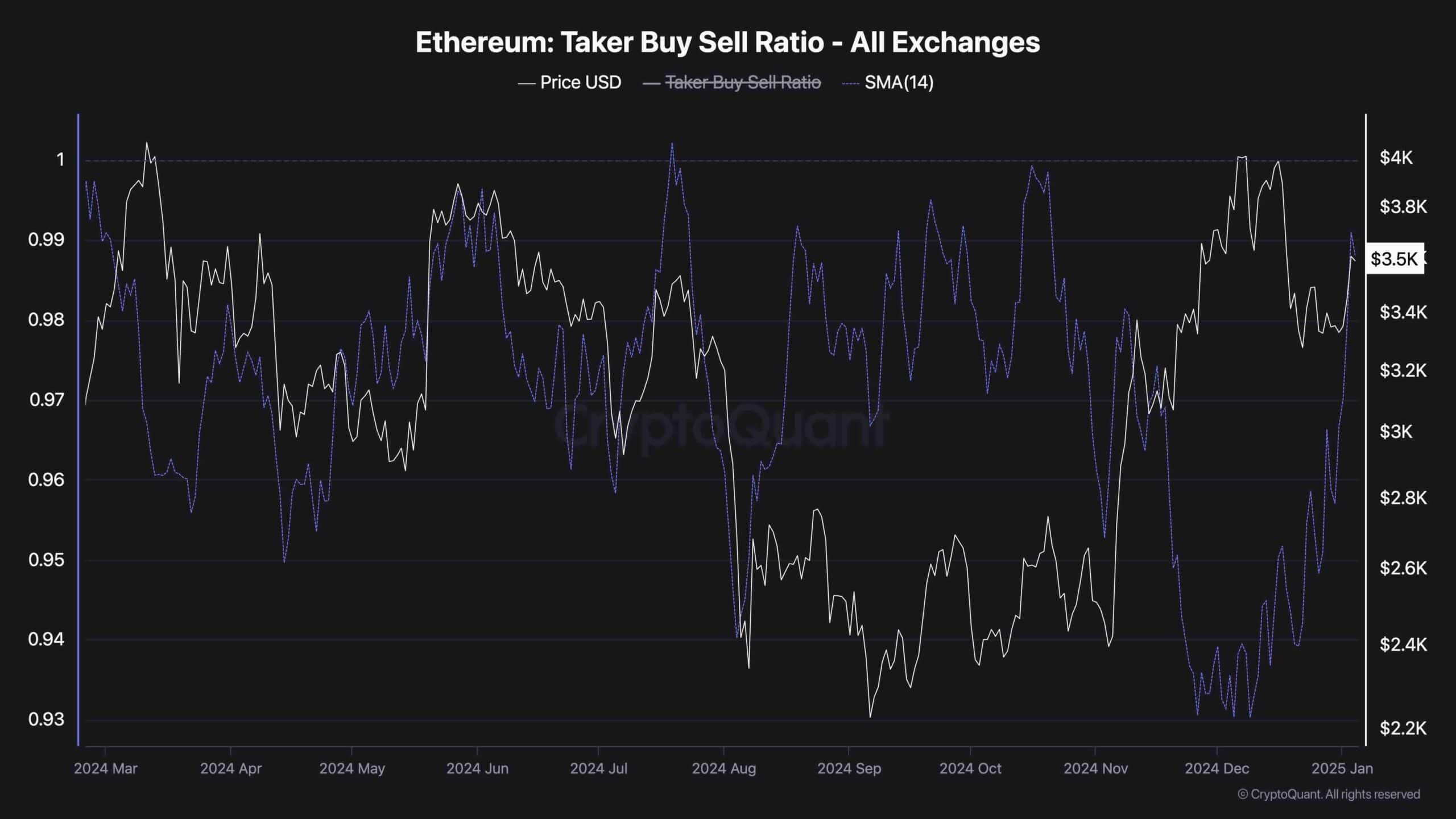

Looking at the Taker Buy Sell Ratio, it appears futures market participants are betting big on ETH. With buyers overwhelmingly dominant, we could be witnessing the early stages of another bull run. So, buckle up, folks – it’s looking like a wild ride ahead!

Oh, and as always, remember: “In crypto, the only constant is change… except for the price of coffee, that seems to always go up!

As a seasoned cryptocurrency investor with over a decade of experience in this dynamic market, I have seen numerous ups and downs. However, the recent surge in buying activity for Ethereum has caught my attention. I have personally witnessed similar patterns before, and when such strong buying pressure is present, it often indicates a potential bullish trend. The fact that Ethereum found robust support at the critical $3.5K level suggests that there are many investors who believe in its long-term potential. This has triggered a bullish rebound, and I am optimistic about Ethereum’s future growth trajectory.

As an analyst, I find myself observing that while Ethereum’s recent recovery is promising, the $4K mark continues to pose a substantial obstacle for potential buyers in the medium term. Overcoming this resistance will be crucial for further growth.

Technical Analysis

By Shayan

The Daily Chart

The price of Ethereum has seen a significant recovery following its encounter with the crucial support at approximately $3,500. This area functioned as a vital gathering point for investors, triggering increased buying interest that subsequently propelled the price upward. As the value continues to rise, the $4,000 mark stands out as a significant hurdle – both psychologically and technically – demanding a strong breakthrough to set the stage for a sustained upward trend.

Right now, Ethereum is holding steady between approximately $3,500 and $4,000. This could signal an impending move upwards or downwards. If Ethereum manages to surpass $4,000, it might initiate a new surge and strengthen the optimistic outlook. Alternatively, if it fails to break through this level, we may see more consolidation or even a dip within the current price range.

The 4-Hour Chart

On shorter timeframes, Ethereum’s downward trend found robust support near significant Fibonacci retracement levels at around $3.2K (0.5) and $3K (0.618). This area of strong support drew considerable buying activity, which halted the decline and initiated a bullish rebound.

After moving from an amassing stage into a surge driven by optimism, Ethereum is currently focusing on breaking through the crucial $4,000 barrier. This level aligns with a prior substantial peak and is anticipated to be a heavy resistance area, where sellers might exert significant pressure.

Ethereum’s price action at the $4K level will determine its future trajectory. A successful breakout above this resistance could lead to a robust rally, while a failure might result in prolonged consolidation or a potential retest of lower support levels near $3.5K.

Onchain Analysis

By Shayan

The Taker-Buyer/Seller-Ratio, a crucial tool for gauging sentiment in the futures market, reveals whether buyers or sellers are making more active trades in the market. Lately, after Ethereum’s bullish recovery close to the $3K support level, this ratio has shown a significant increase, suggesting an upward trend in buy orders within the futures market.

The pattern indicates that traders in the futures market are growing more bullish regarding Ethereum’s near-term price movement, predicting that the asset will approach the $4K resistance level.

Takers’ Buy/Sell Ratio exceeding 1 means buyers are overwhelmingly dominant, often aligning with the onset of a bullish trend. The current data underscores this sentiment shift, reflecting heightened confidence among traders and an expectation of continued upward momentum.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- Tekken Fans Get Creative with Photo Requests for ‘Scientific Research’

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- WLD PREDICTION. WLD cryptocurrency

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

2025-01-04 14:06