Ethereum Near $3,000: The Crypto Rollercoaster Continues 🎢💰

Ethereum (ETH) has decided to throw off its long-term sluggishness and race towards the elusive $3,000 mark, recently reaching a three-month high. Apparently, it’s in a bit of a hurry, but don’t pop the champagne just yet—there are quite a few hurdles on this digital freeway.

While the price has been climbing, long-term holders (LTHs) are busy pocketing their profits faster than you can say “pump and dump,” which might just keep ETH from hitting that sweet $3,000 milestone anytime soon. Because nothing screams stability like a bunch of investors rushing to cash out.

Ethereum Investors Prepare For Surge (or at least, they’re trying to)

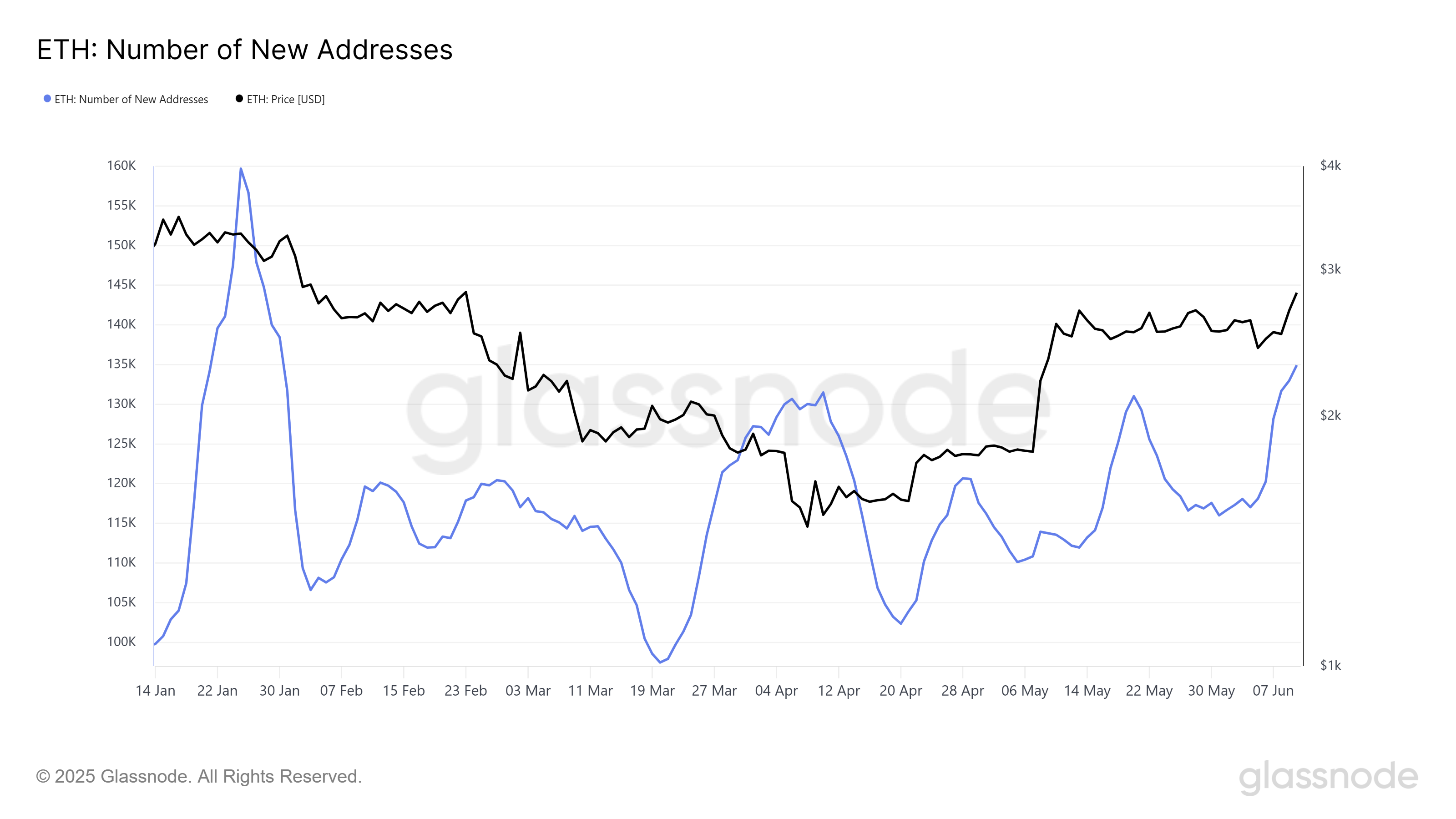

More new wallets are popping up than mushrooms after rain, reaching a four-month high. That’s a certain thumbs-up for Ethereum’s popularity—more investors mean more fun, or chaos, depending on your outlook.

But beware! Some of these new addresses might be suffering from acute FOMO (Fear of Missing Out)—a terrible affliction that causes investors to jump in headfirst and sell at the first whiff of trouble. The risk? Volatility and possibly a market crash faster than you can say “buy high, sell low.”

Yet, the influx of fresh faces is promising. More investors could push ETH’s price skyward—assuming they don’t all panic sell at the first sign of trouble.

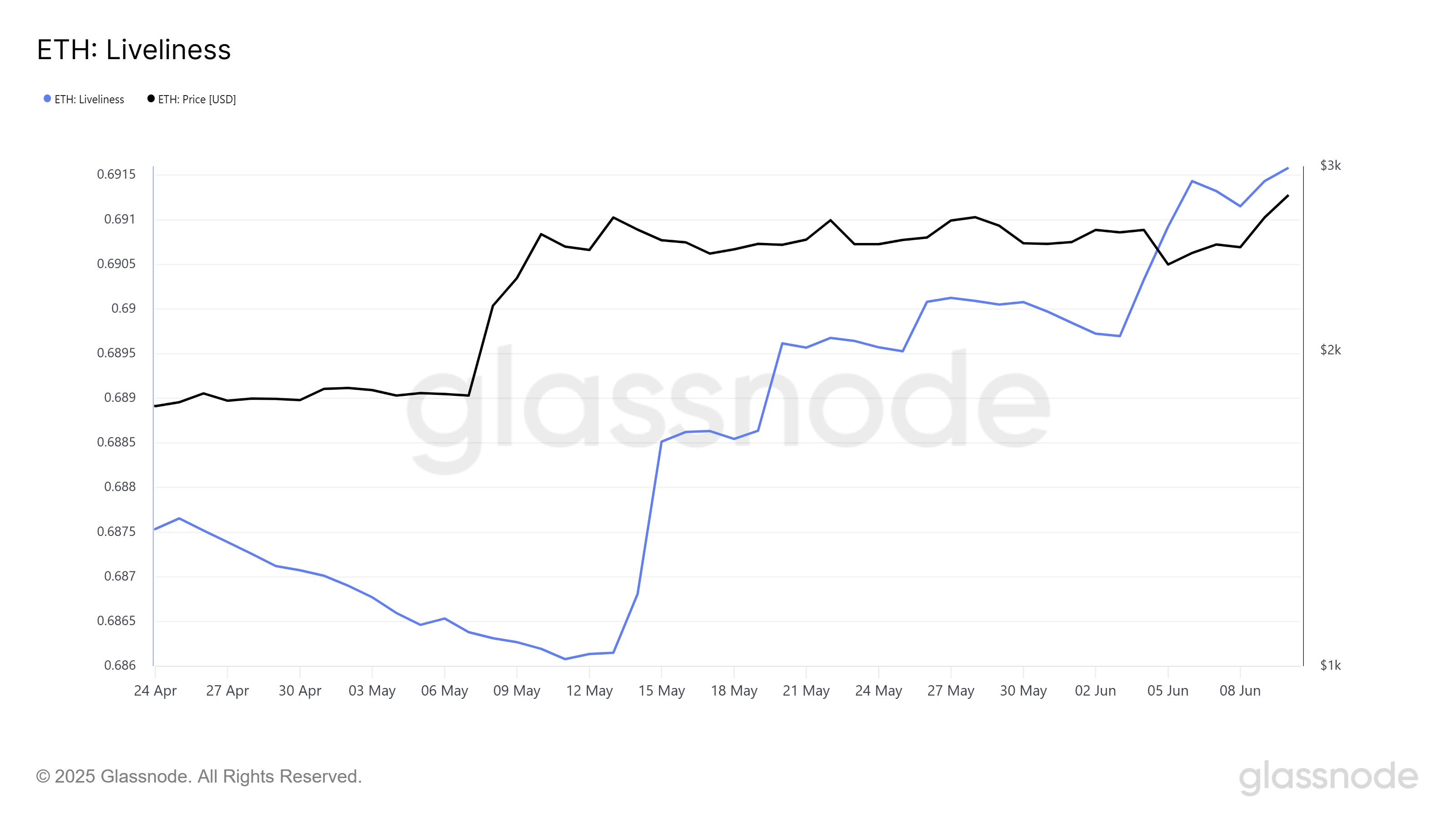

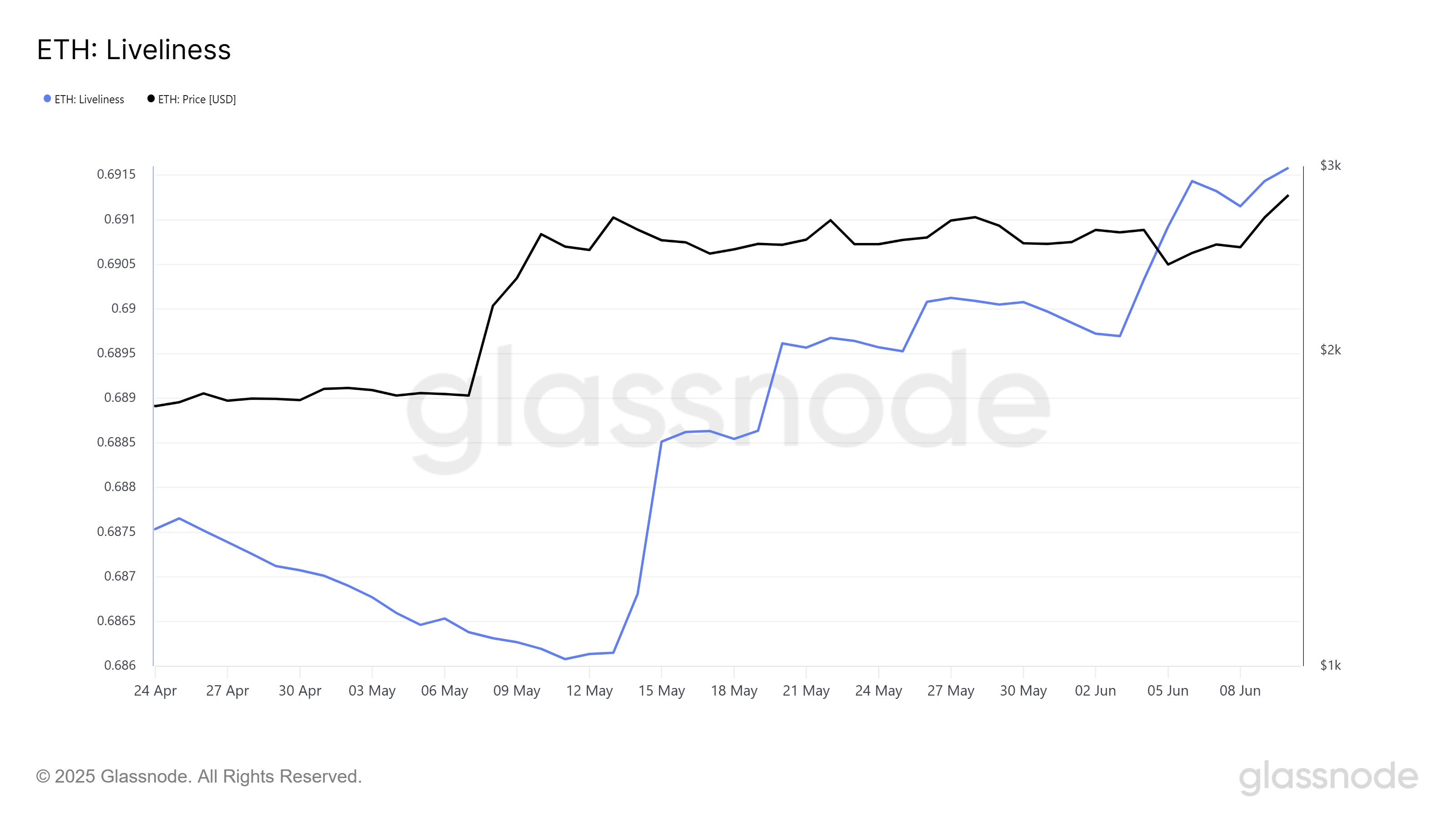

The “Liveliness” metric (because apparently, crypto analytics loves a good euphemism) keeps climbing. This indicates that long-term holders are liquidating their holdings faster than you can say “digital tulip mania.”

As these big players start unloading ethereum, it’s like adding gasoline to a tiny fire—potentially pushing prices down just when everyone thought we’d broken free from the consolidation shackles of May.

Long-term holders, those stalwart investors who usually stick around, are now selling off, which may mean they’re losing confidence faster than a cat in a swimming pool. If they keep this up, Ethereum might struggle to break that pesky $3,000 barrier and revert to its old consolidation ways.

ETH Has a Mountain to Climb (or a Valley to Fall Into)

Right now, Ethereum sits pretty at about $2,769—after a cheerful 14.6% boost this week, ever so slightly escaping a misleadingly long month of limbo beneath $2,681. The big question: can it push past the resistance level at $2,814 and actually make it to $3,000 without throwing a tantrum?

It’s only about 8% away from that magical, mythical $3,000 mark, last seen back in February, which feels like ancient history in crypto-land. If the wise (or lucky) long-term investors stop selling and the market keeps waving bullish pom-poms, ETH could tiptoe upwards to that number.

But beware the double-edged sword. If the LTHs keep bailing faster than guests at a party, Ethereum could tumble back down to its support level at $2,681 or even plummet to $2,476—causing many a crypto enthusiast to swear, cry, and question their life choices.

Lose that support line, and Ethereum might enter a boring, sullen phase of consolidation—like a teenager stuck in detention. So, the hope of reaching that $3K isn’t exactly a guarantee, but hey, in crypto, anything can happen—including flying pigs and market miracles.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- How to watch the South Park Donald Trump PSA free online

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

2025-06-11 19:21