Ethereum (ETH), the number two cryptocurrency (but don’t tell it that, it’s very sensitive), finds itself abruptly thrust into the intergalactic limelight—again. Apparently, institutional investors, fresh from a substantial lunch, have begun herding their capital into Ethereum like particularly optimistic sheep into a field of highly volatile digital grass. Spot ETFs are turning heads, staking numbers are lurching upwards, and somewhere out there, analysts are prophesizing ETH smashing through $3000, probably while waving tiny celebratory flags. Of course, whether this bullish momentum will last or just pop like an overconfident bubble-wrapped unicorn is another question.

Institutions & Bulls: Now with Extra Splash – Ethereum’s Liquidity Geyser

Let’s talk confidence—nothing says “I believe!” quite like a hedge fund moving numbers around so quickly even the decimal places develop vertigo. The latest on-chain reports suggest Ethereum investment barrels have been topped up at an alarming rate. The so-called “whales”—because everything in crypto needs a marine animal nickname—are now gulping down ETH like it’s the last glass of water on Mars. And if you thought the market was quiet, think again: participants are rushing to deposit assets back onto the network as if Ethereum had suddenly promised free coffee.

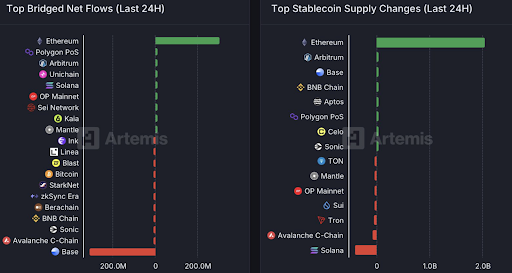

Artemis has spied a deluge of tokens merrily skipping across bridges into Ethereum, while the Base blockchain is apparently taking a well-deserved nap. Stablecoin supply? Significantly chubbier. Meanwhile, Solana is looking suspiciously lighter, perhaps on a digital detox. Crank the hype up another notch: if and when that staking ETF finally gets a green light, we can apparently expect the ETH price to “explode” (not literally, that would be messy), especially as over a million validators and 35 million ETH are already stashed away like interplanetary energy bars.

Will Ethereum Boldly Go Where No Coin Has Gone Before ($10,000)? 🚀

Beneath the frothy speculation, Ethereum’s fundamentals are apparently flexing their muscles. After a tidy parade of new deposits into staking (think: coins sitting about, flexing), Layer-2 scaling like Arbitrum, Optimism, and a less sleepy Base are all bustling with activity. By the time you finish reading this sentence, gas fees may have risen again, and it’s all a not-so-subtle hint at real demand. Since everyone’s now madly locking up their ETH in staking contracts, the classic supply-and-demand equation looks about as balanced as a unicyclist on a tightrope in a hurricane.

Gaze at the next chart long enough, and you’ll notice ETH prices ping-ponging between the 50-day and 200-day moving averages like a nervous squirrel trapped in a cardboard box since May. Apparently, the soothsayers insist this means “strong accumulation.” The Bollinger bands have gone parallel (maybe they’re bored), the MAs could be lining up a Golden Cross (fancy talk for “look excited”), and the RSI—who just wants a nap—might finally bounce. If the planets align, coffee is strong enough, and a Golden Cross really does validate, ETH could finally bust past $2700, tickle $2800, and then—if you believe, really believe—shamble iridescently up to $3000, stopping only for a cup of tea and some congratulatory memes.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 11-year-old boy beats 7-year-old to win 2025 Rubik’s Cube World Championship

2025-06-20 15:40