Oh, darling, Ethereum has been on a rather ghastly rollercoaster ride, losing more than half its value in a few short months. One must wonder, what’s next for our dear ETH? 🤔

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Behold the Ethereum daily chart, a tragic tale of lower highs and lower lows. The poor thing has broken below key support levels, including the 200-day moving average, signaling a rather gloomy market sentiment. 🥀

Recently, our dear ETH has plummeted below the psychological $2,000 mark, now flirting with a significant support zone around $1,900. If the selling pressure continues, we might just see it tumble down to $1,600. How delightful! 😱

The RSI is hovering in oversold territory, suggesting a possible short-term bounce. But let’s not get our hopes up! As long as ETH remains below the key $2,400 level, any recovery could be as fleeting as a summer romance. 💔

The 4-Hour Chart

The 4-hour chart reveals a descending wedge formation, typically a bullish reversal pattern. If the price holds at the $1,900 support zone, it may attempt to rise toward $2,000 and possibly the $2,100 resistance line. But, oh dear, if it fails to rebound, we could be in for a right mess! 😬

On the flip side, a decisive breakout above the wedge with strong volume could confirm a bullish reversal. However, continued consolidation or rejection at resistance may indicate further downside pressure. What a conundrum! 🎭

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Open Interest

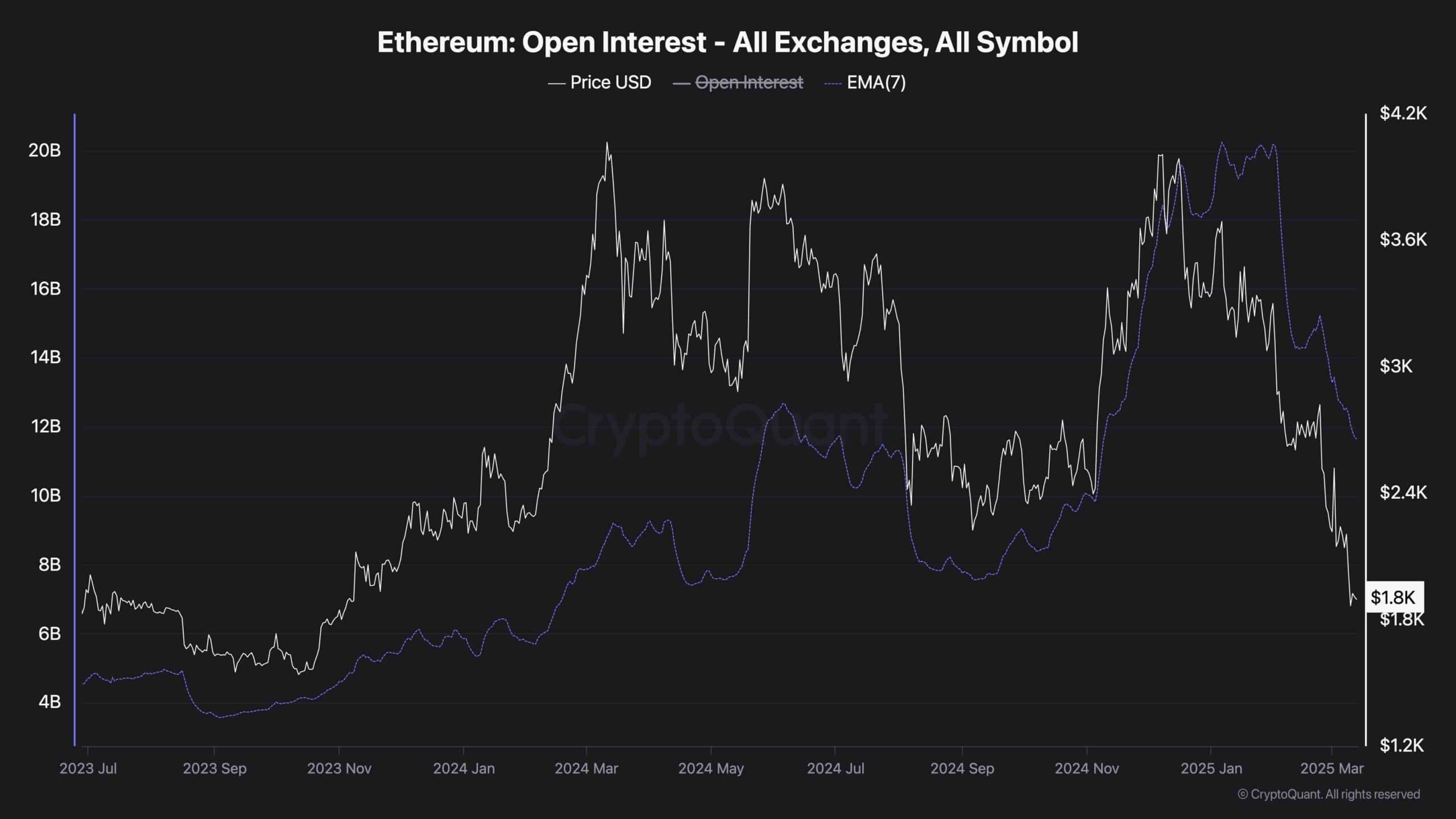

The Ethereum Open Interest (OI) chart offers a glimpse into market positioning and trader sentiment. A significant decline in both price and OI suggests a rather dramatic deleveraging event. How thrilling! 🎢

Historically, spikes in OI followed by rapid drops indicate liquidation cascades, where overleveraged long positions are flushed out, leading to further downward momentum. The recent OI drop aligns with ETH breaking below key support levels around $2,000 and falling toward $1,800. What a spectacle! 🎉

ETH might be in a phase of reduced speculation as traders close positions amid uncertainty. However, a stabilization in OI could indicate that the worst of the sell-off is over, setting up conditions for a potential relief rally. Fingers crossed! 🤞

Yet, for a sustainable recovery, Open Interest must start rising again alongside price, confirming fresh capital entering long positions rather than just short squeezes. Until then, further downside remains possible, especially if ETH fails to hold the $1,800 support zone. How utterly riveting! 🥳

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

2025-03-13 16:39