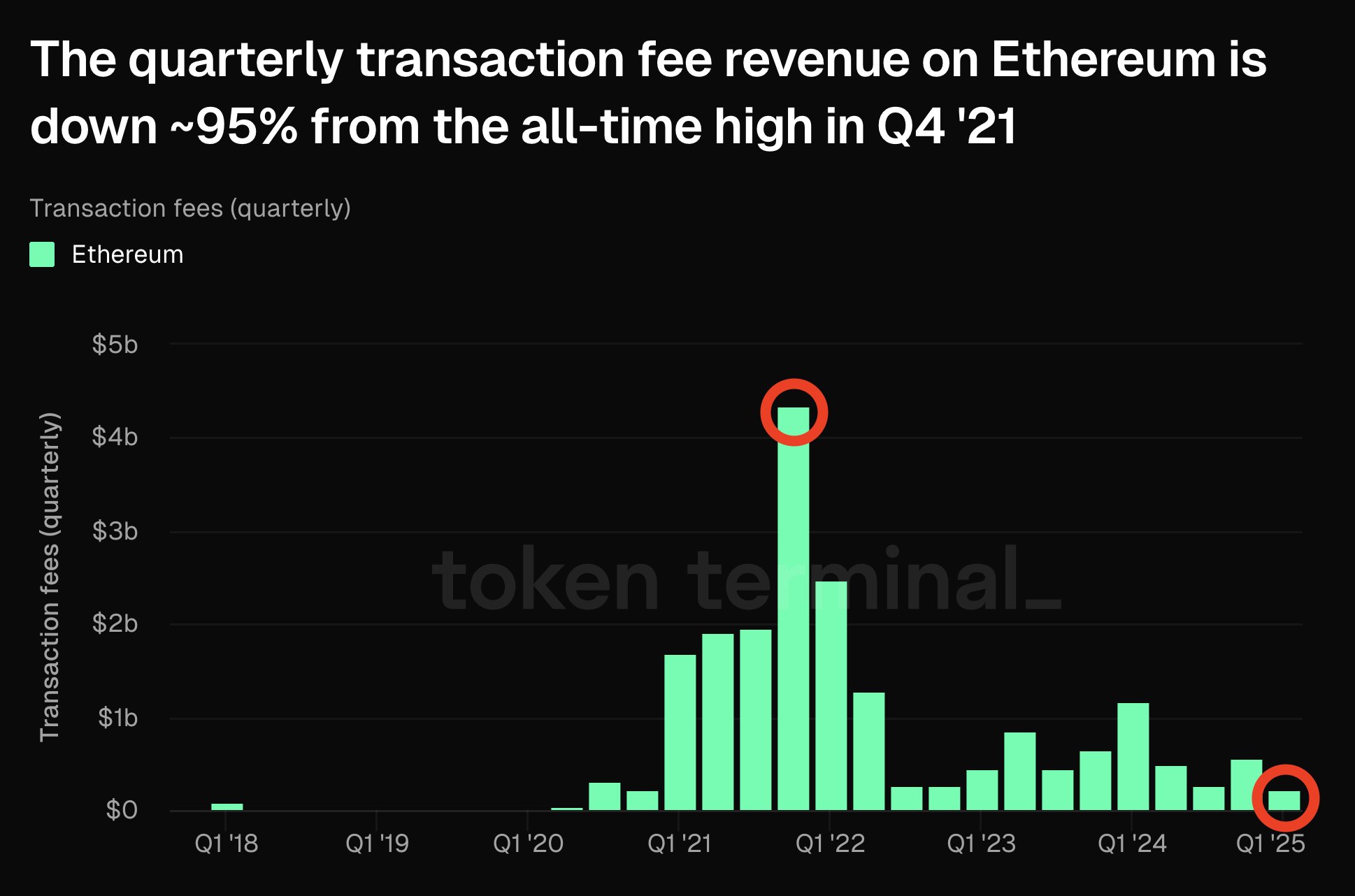

Ethereum (ETH), the world’s second-largest blockchain by market capitalization, has witnessed a dramatic 95% drop in quarterly transaction fee revenue from its peak in Q4 2021, a decline as inevitable as the changing seasons of life.

This precipitous fall can be largely attributed to a significant decrease in Layer 2 contributions and a notable dip in the non-fungible token (NFT) market, as if the once bustling marketplace has suddenly turned into a ghost town.

What’s Driving the-drop-in Ethereum’s Transaction Fee Revenue? 😂

Token Terminal, in a recent X (formerly Twitter) post, highlighted this shift. According to their estimates, Ethereum’s transaction fee revenue for Q1 2025 is projected to reach a mere $217 million, a sum that seems almost quaint compared to the glory days.

This figure represents a staggering 95% reduction from the all-time high of $4.3 billion recorded in Q4 2021. At that time, Ethereum’s revenue soared by 1,777% year-over-year, as if the blockchain had discovered the secret to alchemy, climbing from $231.4 million in Q4 2020 to an astronomical $4.3 billion by the end of 2021.

Moreover, Ethereum’s DeFi ecosystem experienced significant growth in Total Value Locked (TVL), decentralized exchange (DEX) volumes, NFT sales, and Layer 2 TVL. But, of course, all good things must come to an end, and the dynamics have certainly changed since then.

The recent performance of Ethereum is a testament to this. In 2025, monthly revenues have sharply declined, with January recording $150.8 million and February a mere $47.5 million. If the trend of declining transaction fees continues, March may also see similarly low figures, a downward spiral reminiscent of a leaf falling from a tree in autumn.

One of the major contributors to this decline is the shift to Layer 2 solutions. These solutions, known for their ability to process transactions off-chain while settling on Ethereum’s mainnet, have become increasingly popular. The activation of EIP-4844 has significantly reduced the data cost of posting to Ethereum’s chain, further lowering L2 fee contributions. CoinShares, in a report, noted:

“Layer 2-related fees, which were high in 2023 and early 2024, have since declined due to cost savings introduced by EIP-4844.”

The decline in NFT activity has also played a significant role. Q4 2021 was the peak of the NFT craze, with platforms like OpenSea recording billions of dollars in monthly trading volume. Now, however, the interest has waned, leading to a sharp drop in transaction volume and, consequently, fee revenue, much like the fading embers of a once-bright fire.

ETH Suffers its Worst Quarterly Decline Since 2018 🚀💔

This decline extends beyond transaction fee revenue. The price of Ethereum has followed a similar downward trend. After reaching an all-time high (ATH) in November 2021, ETH has dropped substantially, now trading 58.8% below that peak, a fall that has left many investors feeling the cold wind of reality.

Even during the election euphoria, when many cryptocurrencies, including Bitcoin (BTC), saw new highs, Ethereum failed to keep pace, as if it were a horse that had lost its stride in the race.

“ETH has experienced the sharpest decline in Q1, dropping by -40%, marking its biggest quarterly loss since 2018,” an analyst wrote on X.

Over the past month alone, ETH has fallen by 25.1%. As of press time, the altcoin was trading at $1,997, representing a slight gain of 0.45% over the past day, a small glimmer of hope in the midst of darkness.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Former Blizzard president worried about future of Xbox and says changes are needed “fast”

2025-03-24 09:26