What to know:

- Ether, that fickle mistress, flirted with disaster at $1,788 on Monday, nearly causing a cascade of on-chain liquidations. 😱

- One wallet, like a knight in shining armor, swooped in with 2,000 ETH of collateral and $1.5 million in DAI to save the day. 🛡️💰

- Another wallet, possibly the Ethereum Foundation itself, dropped a cool 30,098 ETH ($56.08M) to lower its liquidation price. 🏦💸

An Ethereum user, with the timing of a circus performer, rescued several MakerDAO positions from the jaws of a $360 million liquidation cascade on Tuesday. Just as the price of ETH was tumbling like a drunk acrobat, they added collateral at the final hour. 🎪⏰

One of the positions, with a liquidation price of $1,928, was triggered during a market plunge in U.S. trading hours. The ETH was less than two minutes away from being liquidated and sold at a MakerDAO auction until the wallet owner, like a magician pulling a rabbit out of a hat, deposited 2,000 ETH from Bitfinex as additional collateral. It also paid back $1.5 million worth of the DAI stablecoin. 🎩🐇

The wallet in question, previously as inactive as a hibernating bear since November, surprised everyone by saving the position. 🐻❄️

That particular position is not out of the woods yet; it will be liquidated if ETH drops to $1,781 or until the owner adds more collateral. Ether is currently trading at $1,928, having bounced from Monday’s low of $1,788 like a rubber ball. 🏀📈

Another wallet, which according to X account Lookonchain is suspected of being the Ethereum Foundation, deposited 30,098 ETH ($56.08M) to lower the liquidation price of its position to $1,127. 🏛️💎

Whilst hundreds of millions of dollars worth of liquidations are fairly common across derivatives markets, decentralized finance (DeFi) protocols like MakerDAO use only spot assets. This means that when a liquidation takes place, DeFi liquidity is unable to cope with the skew of spot asset supply. This doesn’t occur on derivative exchanges as there is typically more volume and liquidity driven by leverage. 🎢💧

In this case, just one of nine-figure liquidation on MarkerDAO would likely send the ETH price tumbling, liquidated the other vulnerable position in its path. 🌪️💣

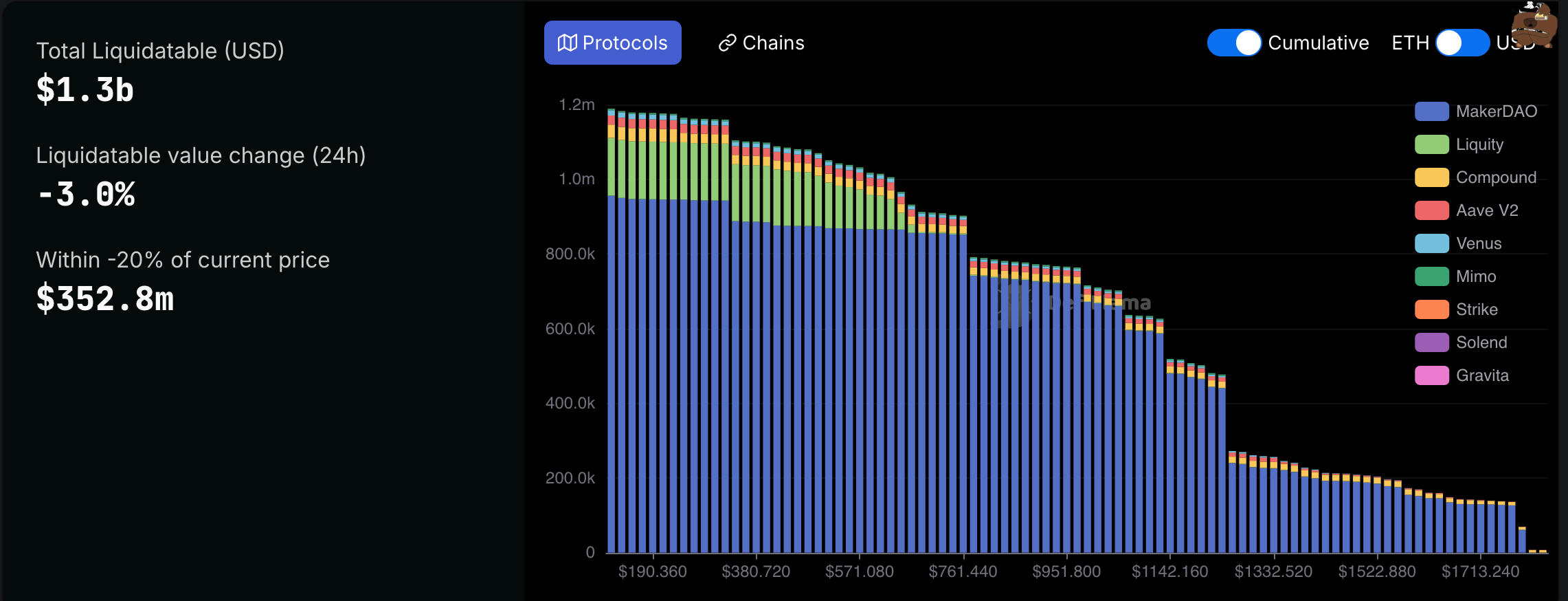

DefiLlama shows that there is $1.3 billion in liquidatable assets on Ethereum, with $352 million of that within 20% of the current price. 🐪💼

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

2025-03-11 17:02