What to know:

As a seasoned crypto investor with a knack for spotting promising projects, I must admit that HyperLiquid has piqued my interest. With its impressive $500 billion perpetuals volume and surging HYPE token market value, it’s hard to ignore this platform that seems to be outshining even Bitcoin in some aspects.

It’s worth noting that Bitcoin isn’t the only digital currency making history. HyperLiquid, a pioneering on-chain perpetual trading system running on its self-developed layer 1 blockchain, is also breaking records. Intriguingly, the platform is witnessing more transactions in Ether (ETH) than Bitcoin.

On the platform, the total amount of perpetual volumes has climbed well over $500 billion, marking an impressive 15-time increase so far this year, as reported by DefiLlama.

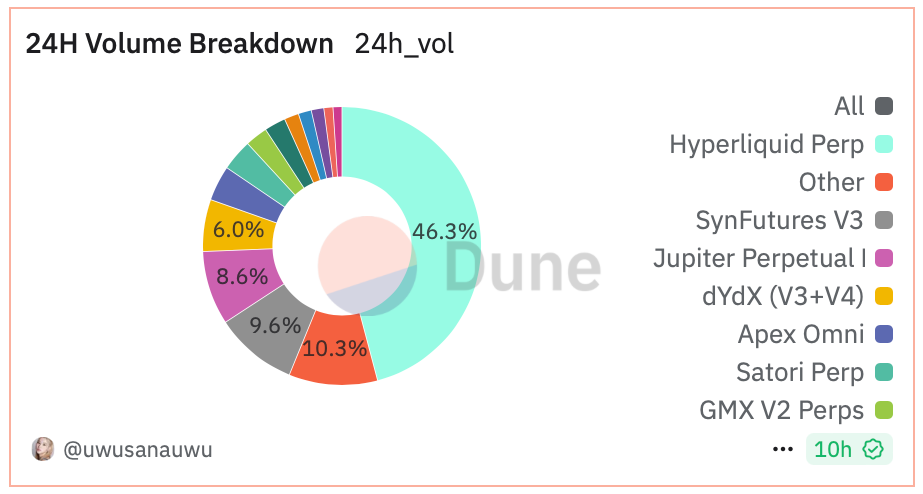

In the last week, the platform’s daily trading volume has consistently exceeded $5 billion, making up more than 45% of the total on-chain perpetual market transactions carried out within the past 24 hours.

It’s quite intriguing that it’s ether, not bitcoin, driving the surge in activity this week. Since Monday alone, the trading volume for ether perpetuals has reached a total of $7 billion. This figure is 18% higher than bitcoin’s weekly volume of $5.94 billion, as reported by stats.hyperliquid.xyz.

Since late November, Ether has been driving the increase in the total value of outstanding contracts (open interest) on the platform. As we speak, over $857.5 million worth of Ether perpetuals are currently active, representing approximately 25% of the overall open interest of $3.49 billion.

The heightened action on HyperLiquid’s ether indicates capital that could propel the growth of the second most valuable cryptocurrency. At present, ETH is being traded at around $3,900, marking a 70% increase since the beginning of the year according to CoinDesk figures.

According to certain onlookers, the reason for its success lies in HyperLiquid being designed for specific purposes instead of being a versatile, all-encompassing chain.

The key to HyperLiquid’s achievement seems to be focusing on matching products with market requirements while combining top-tier performance and DeFi usability, such as waiving KYC procedures. By providing attractive rewards for frequent traders, Hyperliquid aligns well with user preferences, possibly paving the way for future cryptocurrency initiatives, according to notes from Wintermute shared with CoinDesk.

HYPE is bigger than AAVE

Talking about market movements, the HYPE token from HyperLiquid has generated quite a splash in just two weeks. This digital currency has skyrocketed by more than 300% since its launch, reaching a whopping market capitalization of $5.69 billion. Remarkably, this value outstrips that of well-established DeFi players such as Aave, Ethereum‘s leading lending protocol, and Raydium and Jupiter, the decentralized exchanges based on Solana, according to data from Coingecko.

As a researcher, I’ve observed that the prolonged upward trend in the market, particularly after the historic airdrop event, seems to indicate a strong level of investor trust and optimism, as suggested by Wintermute’s analysis.

“Despite the potential for significant sell pressure from the airdrop recipients, the sustained demand for HYPE has consistently outpaced supply, indicating robust market confidence,” Wintermute noted.

On November 29th, HyperLiquid distributed approximately 31% of the nearly one billion HYPE tokens to users who had accumulated trading points. The total value of this airdrop was estimated at around $1.9 billion, eclipsing Arbitrum’s valuation of $1.5 billion for its layer 2 solution.

In simpler terms, HYPE serves multiple purposes within the platform. It functions as collateral for maintaining the stability of the HyperBFT consensus process and also operates like a fuel, enabling smooth transaction processing and the execution of smart contracts.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-13 11:46