In a move that surprised precisely no one (except perhaps those whose heads remain firmly buried in sand), the Federal Reserve—guardians of tedium—resolved on May 7 to leave interest rates untouched at a stately 4.25% to 4.50%. This wholly unremarkable decision had the miraculous effect of making crypto assets suddenly irresistible again. Picture the scene: traders clutching their mobile phones, wide-eyed and giddy as Bitcoin conducted itself with all the decorum of an over-caffeinated debutante, crashing the $100,000 party with Ethereum not far behind. Meanwhile, the so-called “experts” whispered ominously that STHs (short-term holders, for those who refuse to learn their acronyms) would cash in pronto. There’s already a tell-tale whiff of declining on-chain activity—never a splendid sign for those still singing bullish ballads.

ETH’s MVRV Ratio: Or, When Ratios Begin Mischief

The last 24 hours in crypto have been positively Bacchanalian. Bitcoin, with the nonchalance of a lord reclaiming his ancestral seat, breezed back into the $100,000 club, a place it last haunted in February. Not wishing to be upstaged, Ethereum put on its best face and tripped above $2,000, bravely shaking off the lingering vapors of U.S.-China geo-financial melodrama.

The ledger-worshippers at Coinglass report that more than $175 million in Ethereum positions were liquidated during this peacock parade. Buyers, apparently the more prudent tribe, closed $27 million in positions; sellers, tragically optimistic, saw $148 million forcibly seized by the gods of leverage. As Ethereum’s price scaled fresh heights, open interest soared 18%, now tallying an almost satirical $24.8 billion. One wonders if anyone actually understands any of this—or if everyone’s just playing high-stakes baccarat with digital Monopoly money. 🃏

Ethereum’s new vigor can, in part, be traced to an influx of “serious” money, the sort that enjoys bespoke suits and impractical yachts. CoinShares informs us that for two straight weeks, Ether-based ETFs have been positively fragrant with new funds. One can only guess if the recent Pectra upgrade—loftily launched on May 7—helped nudge ETH upward, or if investors simply got bored of waiting for traditional stocks to move.

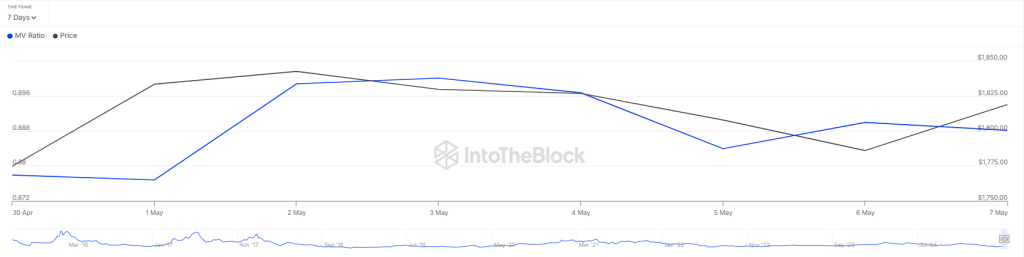

Yet, before one can order the champagne, a cloud looms. IntoTheBlock’s data reveals that the MVRV ratio has slumped to 0.888—a signal, if you ask any proper City cynic, that a horde of investors are selling at a loss even as prices rise. Panic selling, truly the sport of the masses! This, naturally, threatens to trigger yet more selling—a dazzling spiral reminiscent of the last days of Rome, only with fewer togas and even less accountability.

Of course, the upper crust (“smart money” as they dub themselves, with no trace of irony) are buying. Wintermute, reputedly undeterred by such plebeian concerns as “risk,” strutted in to acquire large chunks of ETH, perhaps aiming to harvest market-making fees or simply to stave off boredom. In similar style, Lookonchain announced that Abraxas Capital yanked more than 41,000 ETH (nearly $75M, assuming you enjoy counting monopoly money) from Binance and Kraken. Yet, despite the overnight euphoria, almost half of Ethereum wallets—about 65.5 million or so—are still gallantly holding at a loss. Never let it be said crypto enthusiasts lack optimism, or the taste for exquisite pain. 😅

ETH Price: The Next Plunge or a Ballad of Triumph?

The drama continues. Sellers, finding themselves rather out of sorts, fail spectacularly to tug ETH beneath the moving averages—a damning testament, if you wish to be unkind, to their collective ineptitude. Buyers, meanwhile, are circling the resistance line like well-bred guests eyeing the last canapé. At the time of this writing, ETH stands at a positively giddy $2,048, up 13% in a single day. Is this the beginning of a glorious ascent, or merely the prelude to yet another financial farce?

Optimists—never dissuaded by reality—proclaim that ETH may yet burst beyond resistance ($2,109, for the pedantic) and roar towards $2,500. True, there’s a minor nuisance at the 23.6% Fib level, but what is a Fibonacci barrier to a crowd that thinks in memes and moon emojis? 🚀

Yet, for every optimist, there’s a doom-mongering counterpart. Sellers could, plausibly, drag ETH back beneath those pesky averages. Should they succeed, we may see ETH tumble to $1,734, where (so the thinking goes) brave buyers will attempt a rescue. If that fails, however, the price could slip even further to the stronghold of $1,542. All the while, the RSI—a figure worshipped with almost religious fervor—hovers in the scandalously overbought zone, suggesting a correction is both imminent and, to be frank, overdue.

exuberance, despair, confusion, and the quiet satisfaction of those whose only real aim is to appear cleverer than the next man at dinner parties. Truly, crypto never fails to amuse. 🍸

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- League of Legends MSI 2025: Full schedule, qualified teams & more

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 28 Years Later Fans Go Wild Over Giant Zombie Dongs But The Director’s Comments Will Shock Them

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-05-08 21:19