Now, there’s been a considerable amount of talk ’bout this here “bull market” in the cryptocurrency game, started ’round election time, they say. Some folks reckon the recent stumbles are just a wee hiccup, a “correction” in a grand ol’ bull run. Bless their hearts. 🙄

But does that hold water for every dang digital contraption? Let’s poke around Ethereum, shall we?

Four Months Painted Red

The lay of the land ain’t lookin’ so rosy for Ethereum, I must confess. This here “PoS blockchain” behemoth is seein’ its revenue from fees thinner than a dime novel, and that Pectra update is slower than molasses in January. 🐌

And wouldn’t you know it, network activity’s drier than a desert bone, which, in turn, pumps out more ETH and inflates the critter something fierce. Seems like that “Merge” was supposed to dodge that bullet, but alas… 🤷♂️

Whether ’tis these troubles or some other devilment at play, the cold, hard truth is ETH has been playin’ possum for the past year, and particularly since this so-called bull market commenced. Remember when it stood tall at $2,400? Then, quicker than a snake oil salesman’s pitch, it shot past $4,000 a couple times, only to run out of steam quicker than a Mississippi steamboat low on coal.

It not only failed to carve a new high-water mark, unlike its rowdy cousin Solana, or even Bitcoin, but this subsequent “correction” (or the end of the world, if you like theatrics) sent it southward faster than a greased pig at a county fair, plumb below $2,000. Now it wallows around $1,800. Meaning ETH has lost all them post-election gains and then some, tradin’ 25% lower than it did on November 5th. 😭

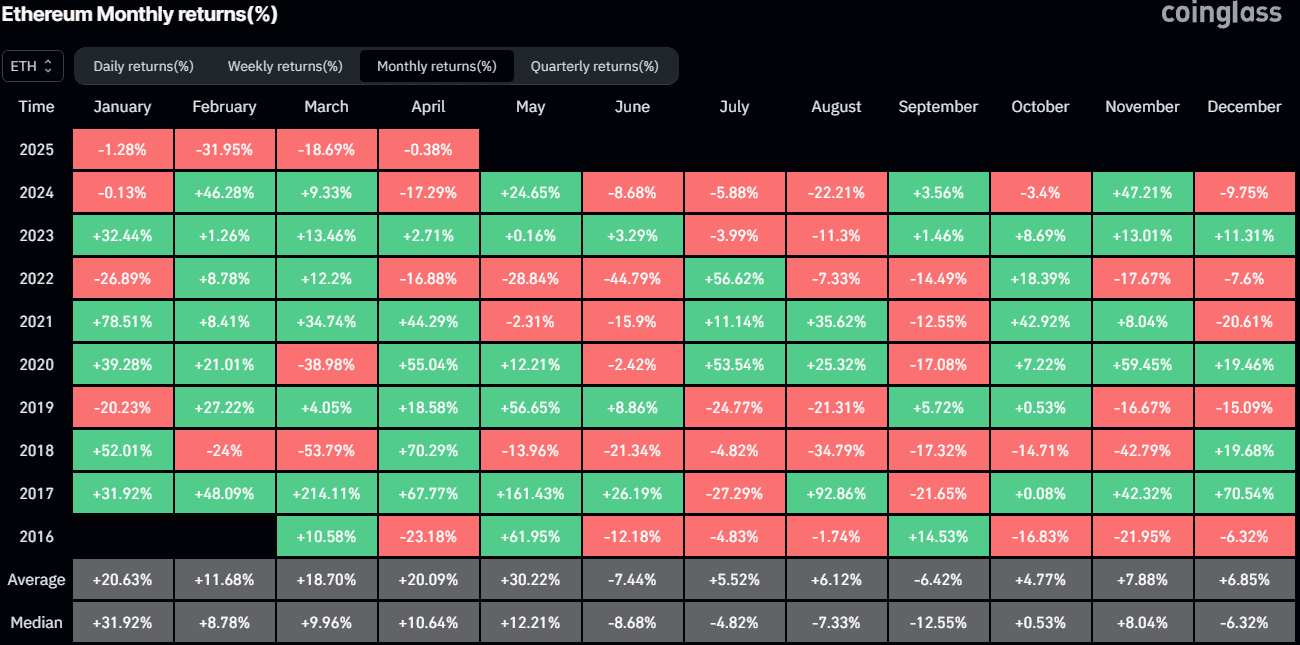

The monthly charts tell a sorry tale. After that rip-roaring November, when ETH closed up a hefty 47%, the next four months bled redder than a politician’s promises. February and March were particularly nasty, droppin’ 32% and 18.7%, respectively.

As this here graph from CoinGlass shows, ETH’s monthly closings have been in the red nine times out of the past twelve months. Makes you wonder if it’s caught the consumption, don’t it?

What’s on the Horizon?

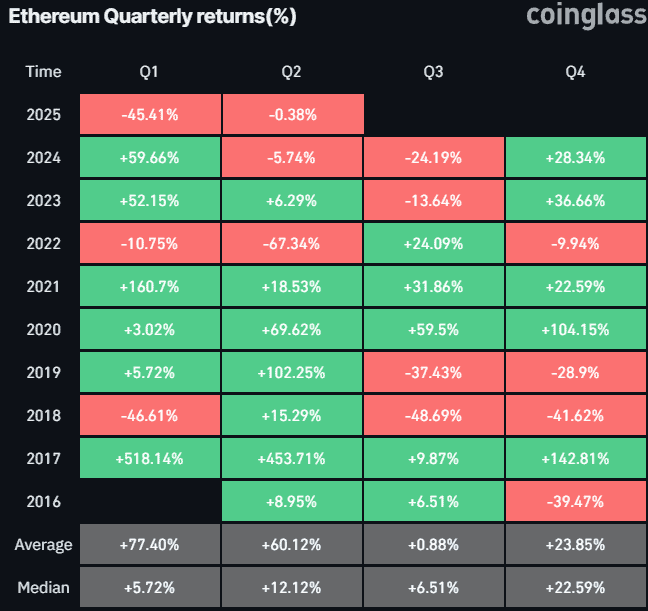

With ETH also markin’ its worst quarterly performance since 2018 at the close of Q1, the big question is: what’s next? Now, predictin’ the future of anythin’ these days is pure guesswork, but we can always peek at what history’s told us. Seems like the smart thing to do, at least.

While some claim current ETH prices are a gift for the long-term stakers, ETH’s Q2s seem to back up this claim, with one huge exception. The critter registered gains in all but two second quarters since 2016. Why, it was on a roll of six consecutive ones ’til that streak screeched to a halt in 2022 with a whopping 67% plunge. 😮

Q2 2023 was back in the green, while last year ended with a slight decline. So, yes, history ain’t no guarantee, but desperate ETH bulls are surely hopin’ to reignite that 2016-2021 streak, especially given that triple-digit surge back in 2017. A fella can dream, can’t he?

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-04-05 16:57