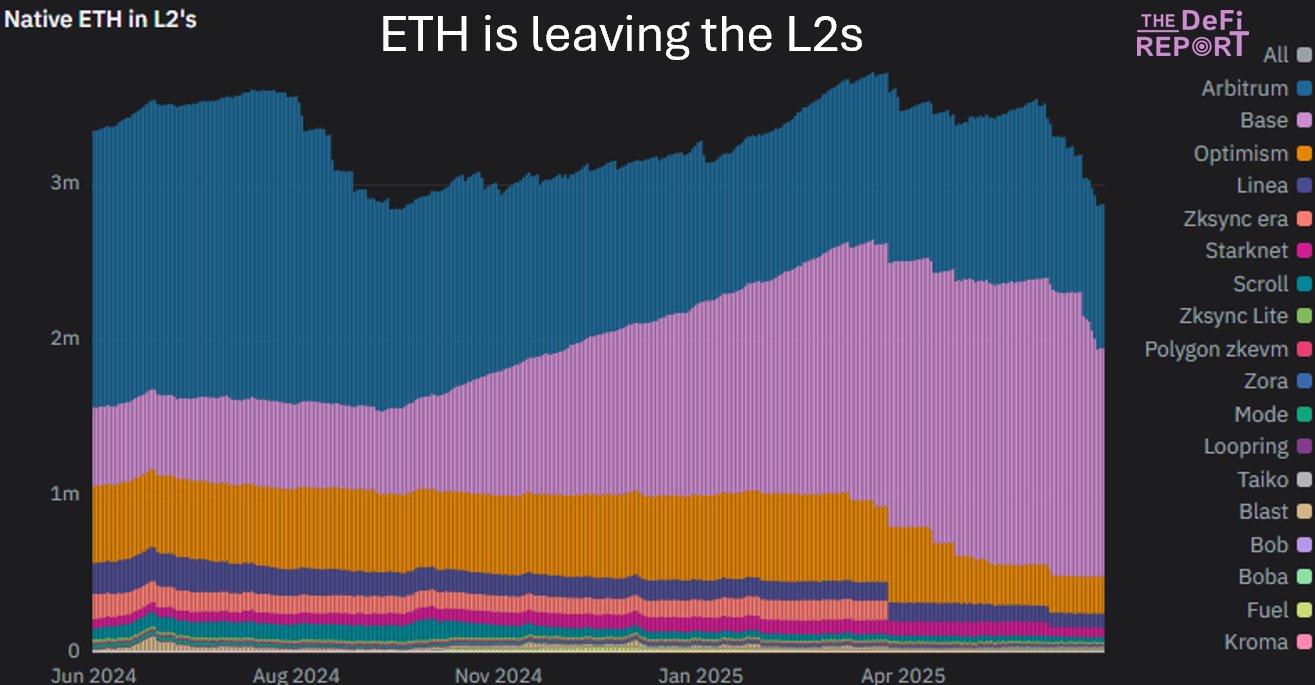

Oh dear, it seems our dear Ethereum (ETH) reserves on Layer 2 (L2) networks have taken quite the nosedive, plummeting by a staggering 25%. How utterly tragic! 🎢

Optimism, bless its heart, has seen a drop of 54% since March, while Arbitrum and Base are not far behind with declines of 17% and 14%, respectively. One might say it’s a veritable exodus! 🚪

What is driving this decline?

The chart from The DeFi Report paints a rather gloomy picture, particularly since early 2025, when our beloved L2 networks like Optimism and Base have been the scene of significant ETH withdrawals. It appears the weakening prices of native Ethereum L2 tokens are the culprits here. How shocking! 😱

Tokens such as OP from Optimism have plummeted by over 38% in the last 90 days. Meanwhile, ARB from Arbitrum has gracefully declined by 21%. This downturn has made investors flee to other platforms like it’s a fire drill! 🔥

Meanwhile, a portion of ETH is making a grand return to the Ethereum mainnet, which is considered the safe haven due to its high security. How quaint! 🏰

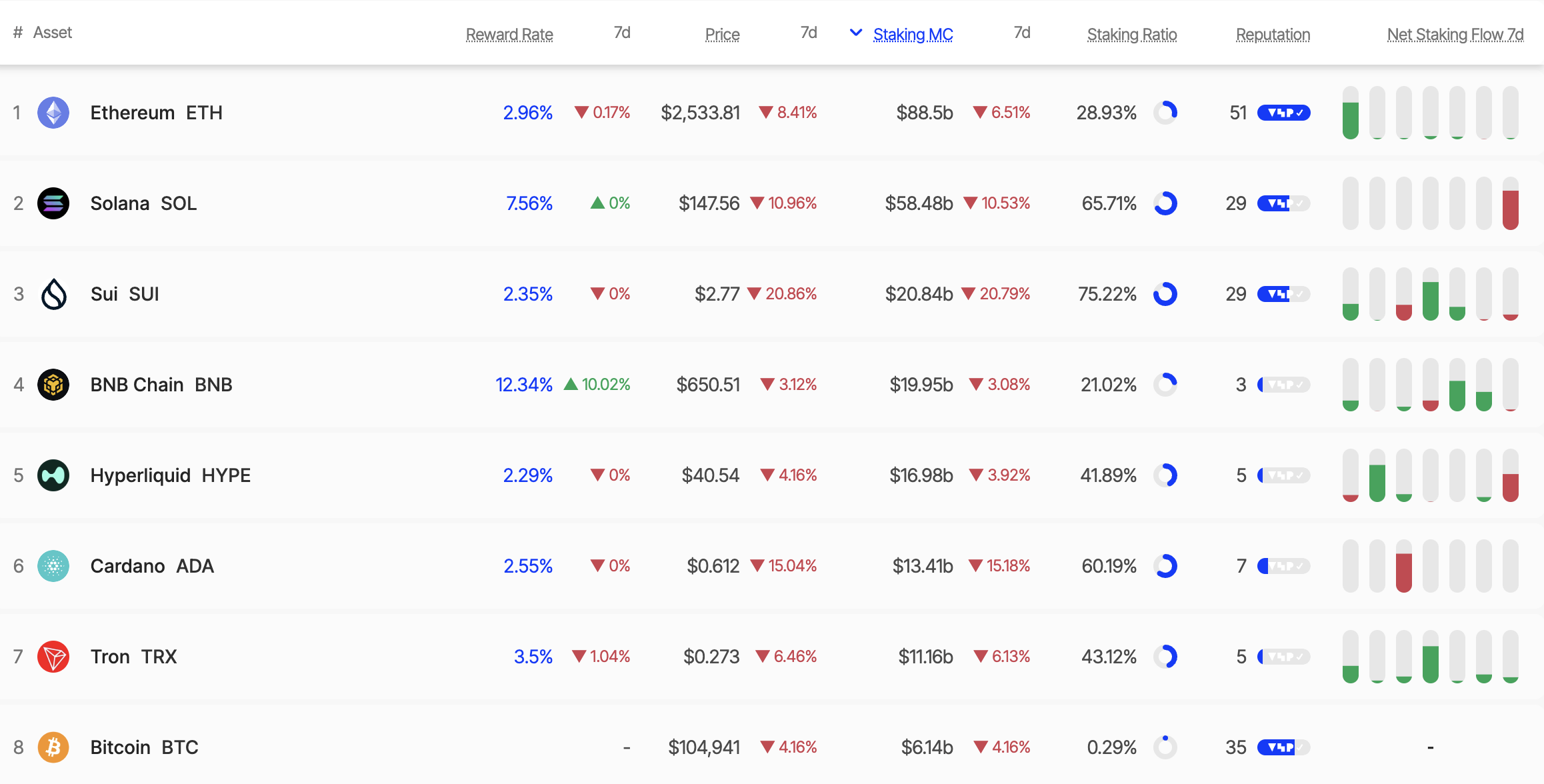

Additionally, the amount of ETH being staked and the number of long-term holding addresses have reached new heights, indicating that investors are prioritizing value-preservation strategies over the wild trading on Ethereum L2. How sensible! 🧐

Another potential factor is the movement of ETH from Accumulation Addresses. Data from CryptoQuant suggests that large wallets are reallocating assets, increasing selling pressure on L2. Oh, the drama! 🎭

Accumulation Addresses (those holders with no history of selling) have reached an all-time high, now clutching 22.8 million ETH. Many public companies are also including ETH as a reserve asset. How very modern! 💼

“In just the first half of June, more than 500,000 ETH have been staked, pushing the total locked amount to a new all-time high of over 35 million ETH. This growth signals rising confidence and a continued drop in liquid supply,” a CryptoQuant analyst stated. How positively optimistic! 🌟

Impact on the Ethereum Ecosystem

This decline marks a rather dramatic shift from 2024, when L2s were seen as the darlings of the crypto world, threatening the mainnet with their ability to attract users and transaction fees. However, the tables have turned, and the mainnet is now basking in increased activity. How delightful! 🎉

This could bolster Ethereum’s position, especially following the successful Pectra upgrade last month, which enhanced performance and reduced costs. However, L2s like Optimism and Base must polish their act to regain trust; otherwise, they risk losing their critical role in scaling the network. How tragic! 😔

ETH’s departure from L2s may linger until this month’s successful Pectra upgrade or strategy adjustments amid market volatility. However, to recover, L2s must focus on improving liquidity and reducing reliance on easily manipulated tokens. How very necessary! 🔧

Developers could consider implementing more transparent incentive mechanisms while collaborating closely with centralized exchanges to stabilize capital flows. A splendid idea, if I do say so! 💡

Moreover, the growth of ETH staking—now accounting for nearly 29% of the total supply—reflects long-term confidence in Ethereum. If L2s fail to adapt promptly, they may lose their competitive edge while the mainnet solidifies its leading position. How utterly riveting! 🎭

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

2025-06-18 16:13