What to know:

- The dollar and bitcoin both surged after November’s U.S. presidential election.

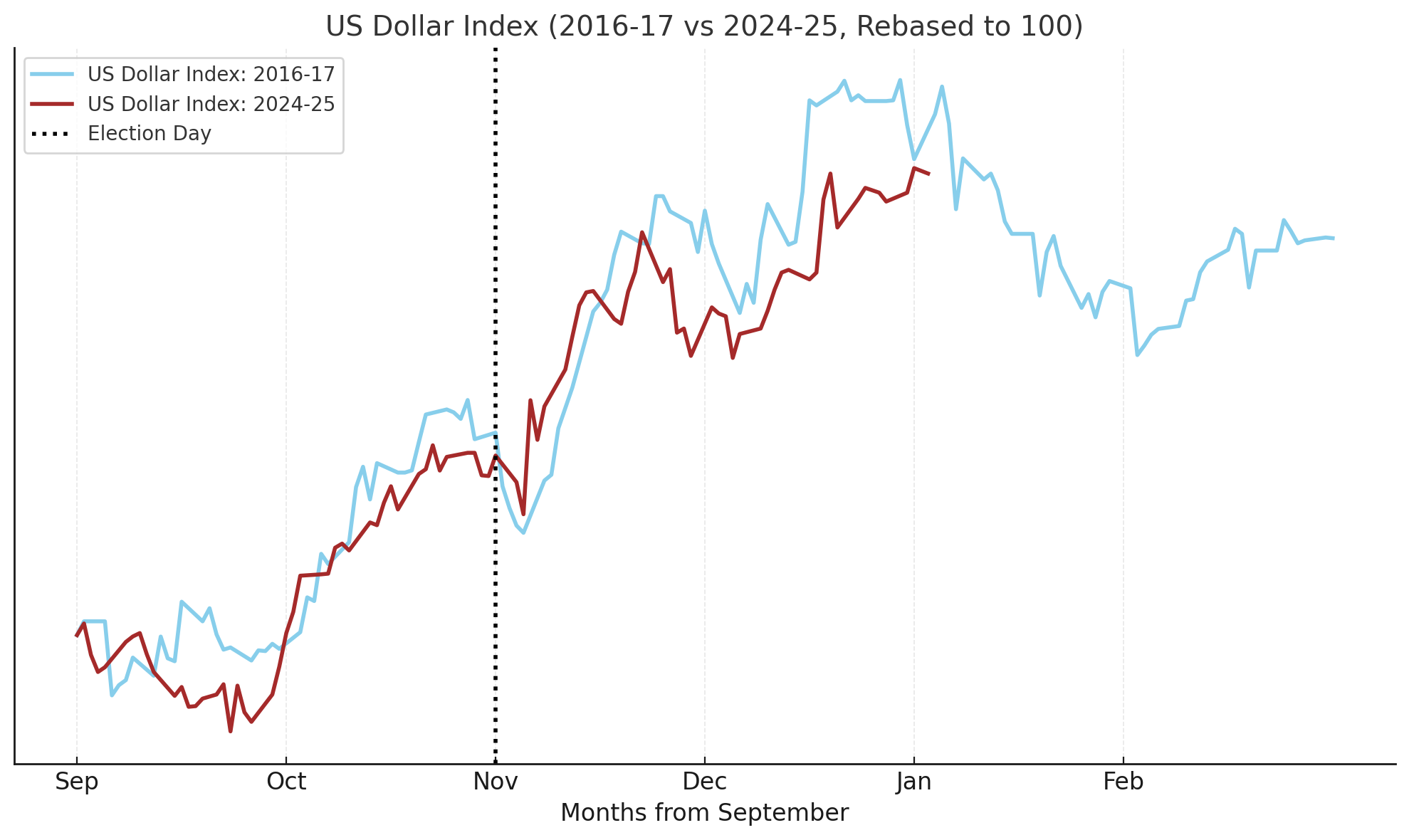

- The dollar’s rally matched that following President-elect Donald Trump’s previous victory, in 2016.

- Continued strength in the currency, which is likely given Trump’s policies and the Fed’s expected interest-rate stance, may weigh on bitcoin in the months ahead.

As a seasoned crypto investor with over a decade of experience navigating market cycles, I have seen my fair share of ups and downs. The recent surge in both the U.S. dollar and bitcoin following the U.S. presidential election has piqued my interest, as it seems to mirror the trends we witnessed after President-elect Donald Trump’s 2016 victory.

However, I am cautiously optimistic about the future of bitcoin, despite the continued strength of the dollar, which is likely due to Trump’s economic policies and the Federal Reserve’s interest-rate stance. While a strong dollar can be negative for risk assets like bitcoin, it has not deterred me from investing in the cryptocurrency in the past, and I believe that its potential as a revolutionary financial instrument outweighs short-term market fluctuations.

That being said, I am well aware of the risks involved with investing in crypto, especially given the volatile nature of the market. The Fed’s current predicament between combating inflation and avoiding a U.S. recession is a concern, as it could potentially impact bitcoin’s performance. However, Trump’s expressed support for bitcoin and the cryptocurrency’s resilience in the face of geopolitical uncertainty give me hope that it will continue to thrive.

In terms of my personal investment strategy, I am planning on holding onto my bitcoin for the long term and taking advantage of any potential dips in the market as opportunities to increase my holdings. As always, I will remain vigilant and keep a close eye on both the broader economic landscape and the cryptocurrency market.

To lighten the mood, I would like to add that investing in crypto is like playing a game of chicken with the stock market – you have to be brave, but not too brave, to make it out alive!

After Donald Trump’s clear victory in the U.S. presidential election two months ago, the U.S. dollar has grown stronger by over 3% compared to other currencies, following a similar pattern as it did after his election in 2016.

Previously, the DXY Index, which compares a currency’s value to a group of the U.S.’ significant trading allies, reached its highest point in December. Over the subsequent eleven months, it declined, mirroring the surge in bitcoin’s (BTC) prices during its 2017 bull market.

This time, it seems the tale might change given the current circumstances. The indicators suggest a consistent trend, while Trump’s economic strategies and the Federal Reserve’s maneuvers could strengthen the dollar’s surge.

Despite a robust dollar often being seen as unfavorable for risk assets, the incoming president has shown enthusiasm towards bitcoin. As a result, bitcoin, the largest cryptocurrency, has surged since his election. However, Andre Dragosch, Bitwise’s head of research in Europe, suggests that this growth, which reached multiple record highs, might not maintain its current pace. Currently, BTC is approximately 10% below its peak of around $108,300 achieved in mid-December.

In a recent interview, Dragosch stated, “The Federal Reserve is currently faced with a challenging dilemma: act now and potentially trigger an economic downturn in the U.S., or risk fueling inflation again by delaying action.

Trump has pledged to levy tariffs on significant trade allies, a move that could heighten international political tension and, in turn, boost the appeal of the U.S. dollar as it’s seen as a safe investment during turbulent periods.

In contrast to other global economies, the U.S. is demonstrating robust economic expansion, boasting a GDP growth exceeding 3% and an inflation rate higher than anticipated. This results in sustained federal funds rates and predictions of merely two interest-rate reductions by 2025.

According to Dragosch, the Federal Reserve has signaled that they will make only two interest rate reductions in 2025, which is much lower than earlier expectations. This news has caused the U.S. dollar to strengthen and bond yields to rise. It seems this trend may also be affecting Bitcoin, as macroeconomic factors currently present a challenge.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- What was the biggest anime of 2024? The popularity of some titles and lack of interest in others may surprise you

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- Deep Rock Galactic: The Synergy of Drillers and Scouts – Can They Cover Each Other’s Backs?

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

- Final Fantasy 1: The MP Mystery Unraveled – Spell Slots Explained

- Influencer dies from cardiac arrest while getting tattoo on hospital operating table

- Smite’s New Gods: Balancing Act or Just a Rush Job?

- Twitch CEO explains why they sometimes get bans wrong

2025-01-02 15:19