Ah, Dogecoin! That mischievous little rascal of the crypto world. Seems the esteemed traders of Binance Futures have, once again, fallen under its spell. Long positions, you say? A veritable avalanche of them! Are they mad? Perhaps… delightfully so. 😂

- Futures traders are heavily long on DOGE, showing short-term bullish conviction. A bullish conviction, you say? More like a fever dream fueled by memes and hopium, wouldn’t you agree? 😉

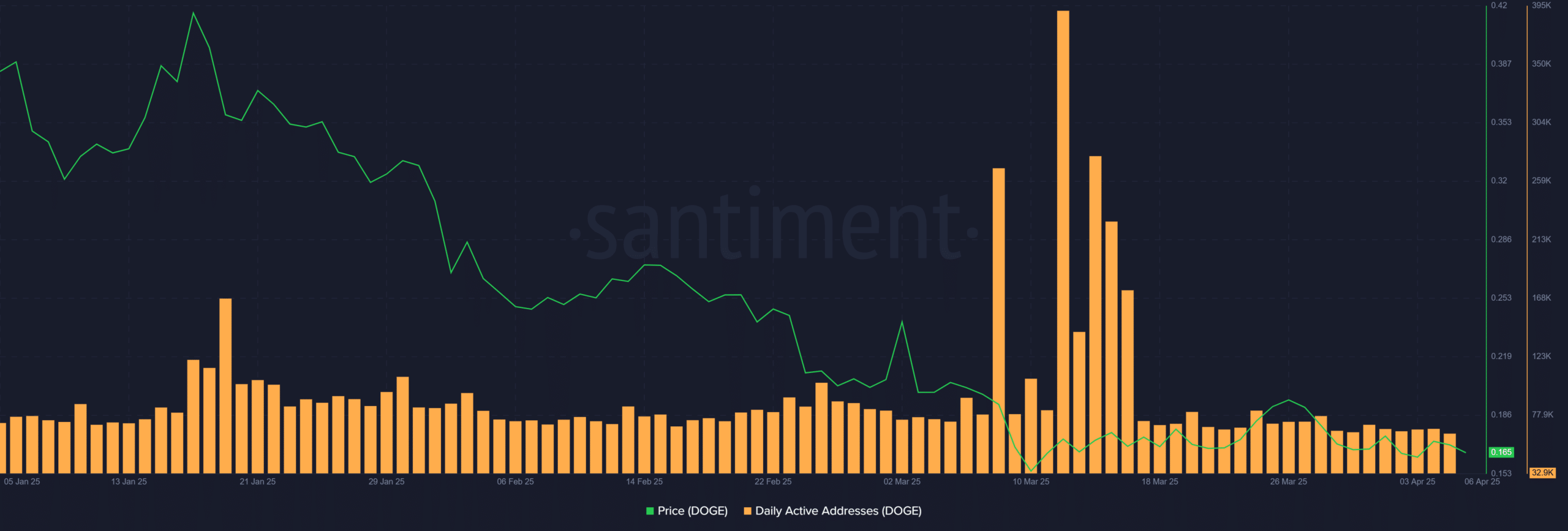

- No strong correlation between DAA spikes and price gains, hinting at speculative activity. Speculative activity? My dear reader, this is the Bolshoi Ballet of financial tomfoolery! 🎭

Binance Futures traders, those brave souls, appear overwhelmingly confident in Dogecoin [DOGE]. Long positions outpacing shorts? It’s like a pack of wolves chasing a single, bewildered sheep! 🐺🐑

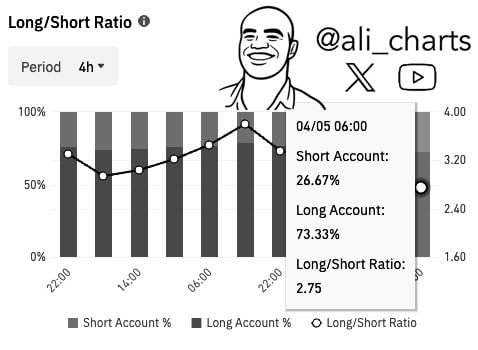

As per a chart shared by the venerable Ali Martinez, long accounts peaked at a staggering 73.33% with a Long/Short Ratio of 2.75 on the 5th of April. A ratio that screams, “To the moon!”… or perhaps, “Straight into the abyss!” 🤷♂️

Earlier data sets show an even stronger sentiment. Stronger? One might need a shot of vodka to stomach such exuberance! 🍸

For instance, on the 3rd of April, long positions surged to a truly preposterous 80.23%, with a Long/Short Ratio of 4.06. Meanwhile, short accounts fell sharply to just 19.77%. A veritable bloodbath for the bears! 🐻🩸

By the 6th of April, long interest had decreased slightly, but still accounted for 77.98% of open positions. The fever, it seems, is slowly abating… or is it merely biding its time? 🤔

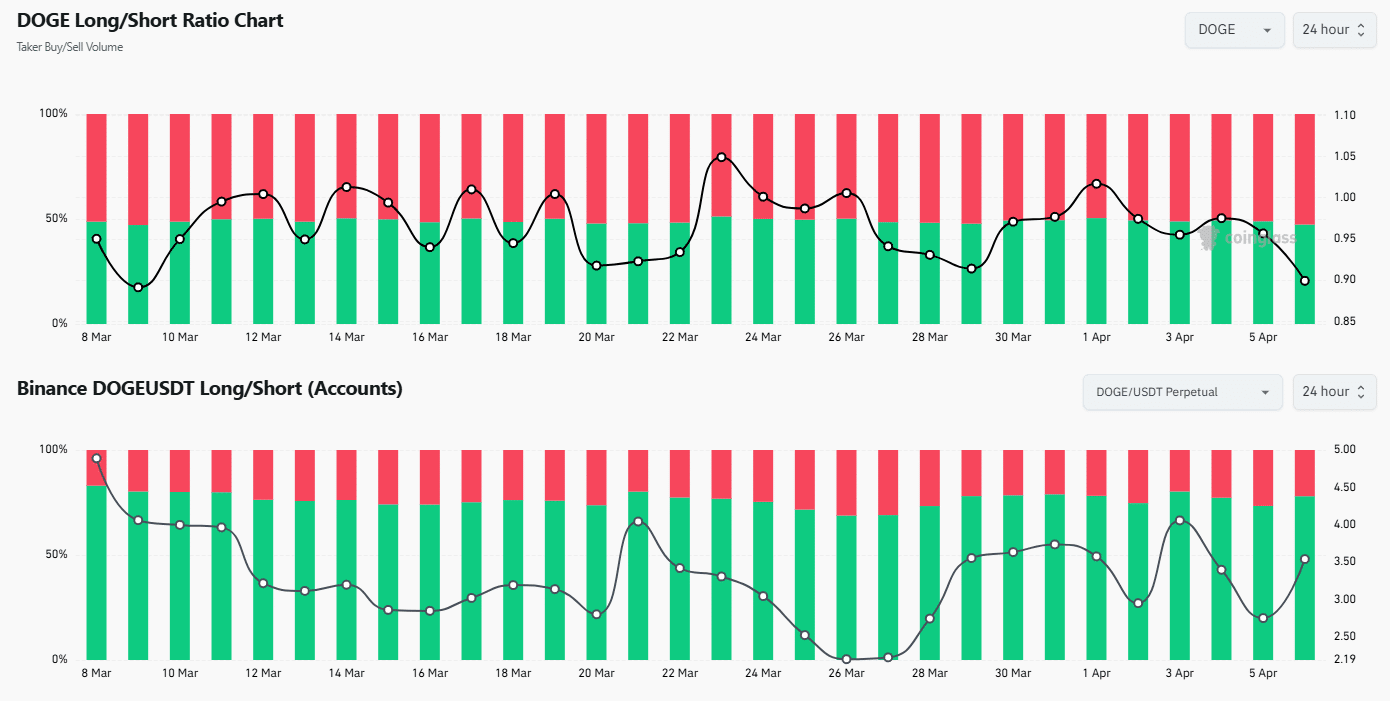

Data from Binance Futures’ Long/Short Ratio between the 30th of March and the 6th of April reveals a stark shift in sentiment. A shift, you say? As dramatic as a samovar falling off a table during a tense family dinner! 💥

Of course, the futures book leaned long at the start, but by April, short positions crept up to 52.66%, while long interest dipped to 47.34%, pulling the Long/Short Ratio down to 0.899—its lowest reading of that week. The tide is turning, comrades! Or is it just a ripple in the vast ocean of crypto madness? 🌊

The impact is even clearer in DOGE futures liquidations

Moreover, this divergence grows clearer when spot price and liquidation figures come into play. Ah, liquidations! The sweet music of failed dreams and shattered hopes! 🎶

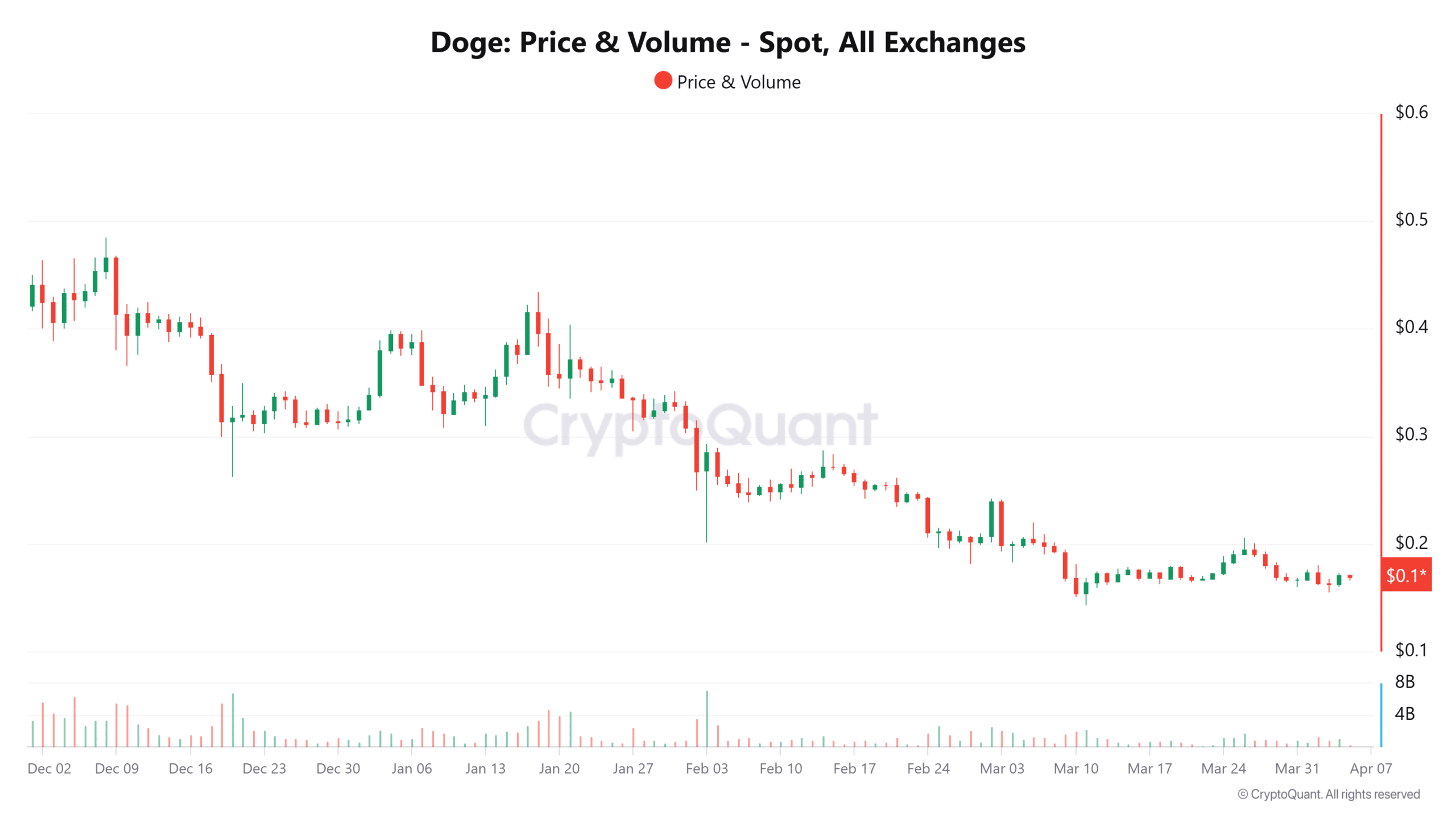

Between February and April, Dogecoin’s price sank nearly 32%, sliding from $0.248 to $0.169, as aggregated spot data shows. A plummet worthy of Icarus himself! 📉

On top of that, volume imploded from 7.18 billion tokens traded to just 353 million. This staggering 95% plunge hinted at waning conviction in the spot market. Waning conviction? More like a complete and utter rout! 👻

More revealing is the decline in whale activity. The whales, those leviathans of the crypto deep, are abandoning ship! 🐳💨

On the 21st of January, when DOGE hovered near $0.42, there were 466 transactions over $100,000. By the 5th of April, that figure plummeted to just 19, even as price held around $0.169. A mass exodus, I tell you! Like rats fleeing a sinking ship… or perhaps, a sinking meme? 🐀🚢

Of course, such a steep fall in large trades strongly implies that institutions or high-net-worth participants have been offloading. Or simply avoiding DOGE amid receding prices. Moreover, on-chain data projects caution. Caution? A wise sentiment in these turbulent times! 🤔

Dogecoin metrics suggest network health is also deteriorating

Daily Active Addresses (DAA) peaked at 81,861 on the 11th of March. By the 5th of April, that number slid to 63,736, a 22% drop. The vital signs are weakening, my friends! 💔

Interestingly, strong Daily Active Addresses (DAA) did not always align with price increases. A curious anomaly! As perplexing as a cat wearing a monocle! 🧐🐱

In early April, despite futures traders showing a strong preference for long positions, other indicators painted a different picture. Whale transactions decreased, spot volumes declined, and network activity weakened. A symphony of bearish signals! 🐻🎵

This reveals a gap between short-term speculative excitement and broader market hesitation. A chasm, perhaps? A bottomless pit of regret? Only time will tell! ⏳

Moreover, while bullish sentiment temporarily boosted optimism among DOGE traders, the advantage remains fragile. Spot market and on-chain data highlight waning interest, lower participation from key stakeholders, and ongoing price declines. Fragile, indeed! Like a house of cards in a hurricane! 🌪️🏠

The data depicts a market in conflict. Brief euphoria in futures trading contrasts sharply with a longer-term cautious outlook. A battle between hope and reality! A clash of titans! Or… perhaps just a minor skirmish in the grand theater of the crypto market. 🎭

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- Umamusume: Pretty Derby Support Card Tier List [Release]

- KPop Demon Hunters: Real Ages Revealed?!

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-04-06 19:08