Crypto looking positively verdant this week, as if spring has sprung right out of blockchain land. Cue wild optimism, champagne popping — and, of course, endless catastrophic warnings. Is this the long-awaited beginning of an epic bullish saga or just the universe’s latest trick to lure us in before pulling the rug?

On one side, hopeful types are dusting off their “To the Moon 🚀” memes as Bitcoin slips coyly over a key psychological milestone (no, not buying you dinner first). But on the other, seasoned skeptics are rolling their eyes and muttering something about “temporary factors” — as if crypto hasn’t been dramatically unpredictable since Satoshi was in diapers.

Bitcoin: Hero’s Comeback or Just Another Reality TV Spin-off?

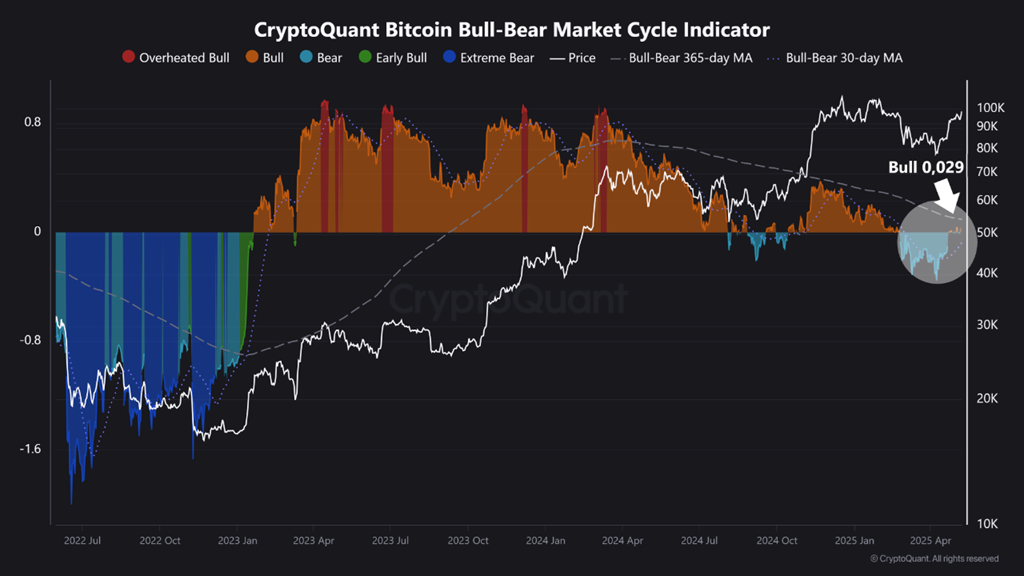

Let’s talk toys: CryptoQuant’s Bull-Bear Market Cycle Indicator, which claims to spot when crypto is ready to rip, has suddenly twitched from bear to bull. Perhaps it’s been inspired by spring cleaning, or maybe it’s just as confused as the rest of us.

Since late February, the indicator was a total mood-killer, insisting on bear market gloom. Yet in recent days — miraculously — it’s showing glimmers of hope. Of course, as with all things crypto, hope is advisory only; enthusiasm not guaranteed.

Before you dash out to buy Lambo-shaped balloons, a reminder: this same magical indicator did us dirty in mid-2024, turning bullish, then refusing to leave the horizontal friend zone for months. Commitment issues? You decide.

Analyst Burakkesmeci, who sounds like someone you’d trust with your passwords, added more charts to the mix—specifically, the 30-day and 365-day moving averages. This bundle of statistical joy, if crossed at just the right angle, could unleash the next meme-riddled, parabolic Bitcoin rally (with extra FOMO) according to Burakkesmeci.

“The Bull-Bear 30DMA has turned upward. If it crosses above the 365DMA, history says parabolic rallies loom,” he predicts. Presumably, so does his dog, and his Uber driver.

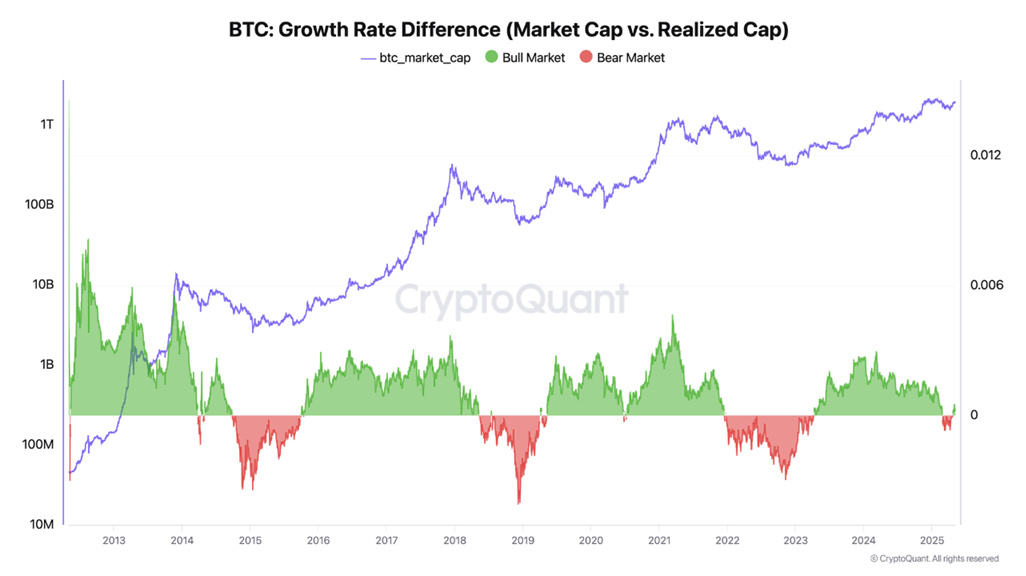

But now, cue the voice of caution: analyst Darkfost, probably reading charts by candlelight, reviewed the Growth Rate Indicator — essentially, Bitcoin’s personal therapist. It weighs Bitcoin’s Market Cap versus Realized Cap, and just when it looked like Bitcoin’s self-esteem was fixed ($BTC strutting above $100,000), Darkfost reminded everyone not to fall for the glow-up just yet.

Instead of a clean break with bearish misery, Darkfost warns this might just be another sneaky “false recovery” (surely the scam coin of human emotions). Blame it on last week’s plot twist: Trump signed a trade deal with the UK, soothing tariff trauma, while the Fed put on its best poker face and left interest rates untouched.

“Traditional market dynamics may remain weird and unreadable for a while,” Darkfost concluded, probably while hiding under his desk with a Magic 8-Ball.

And as if things weren’t frothy enough: the Crypto Fear & Greed Index just burst into the “Greed” zone at 73 — highest in two months. Investors, previously sensible adults, are now googling “yacht emoji” and “FOMO rash.”

Before you start tattooing laser eyes on your cat, a fair warning: “Extreme Greed” in crypto has historically been a prelude to a price nosedive. So buckle up, refresh the memes, and keep one eyebrow permanently raised — just in case this is all just foreplay before the next major correction. 😉

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- LINK PREDICTION. LINK cryptocurrency

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

2025-05-09 23:12